Predicting 9 Crypto Trends in 2024

Crypto investors have already had two years filled with chaos and extreme fluctuations. 2022 and 2023 are filled with several historic market-moving events. However, we ended 2023 with many positives such as the potential of Bitcoin ETFs and various new technological developments. Many investors have a positive perspective on the future of crypto in 2024. We will see the potential trends and narratives that will be popular in the crypto market next year.

Article Summary

- 🏦 Bitcoin ETF and Market Reaction: Bitcoin ETF was approved by the SEC on January 10, 2024. Bitcoin stock transaction volume surged on the first day, indicating high investor interest. Galaxy Research forecasts potentially catalytic fund flows for the crypto market in 2024 or 2025.

- 📱 2024 Crypto Technology Trend Predictions: The year 2024 is predicted to be filled with various technological innovation trends in the crypto world. Some of the potentially trending technologies are modular blockchains, L1 sector competition, L3 and appchains development, Zero-Knowledge, and Ethereum’s latest update.

- GameFi: GameFi is transforming, shifting from a play-to-earn model to a play-and-earn, with a more mature infrastructure. Many crypto games will launch in 2024 such as Shrapnel, Parallel TCG, and Illuvium.

- 📡 DePin, AI, and RWA: Other eye-catching trends include DePin, the integration between crypto assets and AI, and the growth of RWAs that will increase institutional investor participation.

BTC Post ETF

The Bitcoin ETF (Exchange-Traded Fund) was approved by the SEC on January 10, 2024, accompanied by Gary Gensler’s negative statement. Many people had expected this approval to happen due to several suspicions.

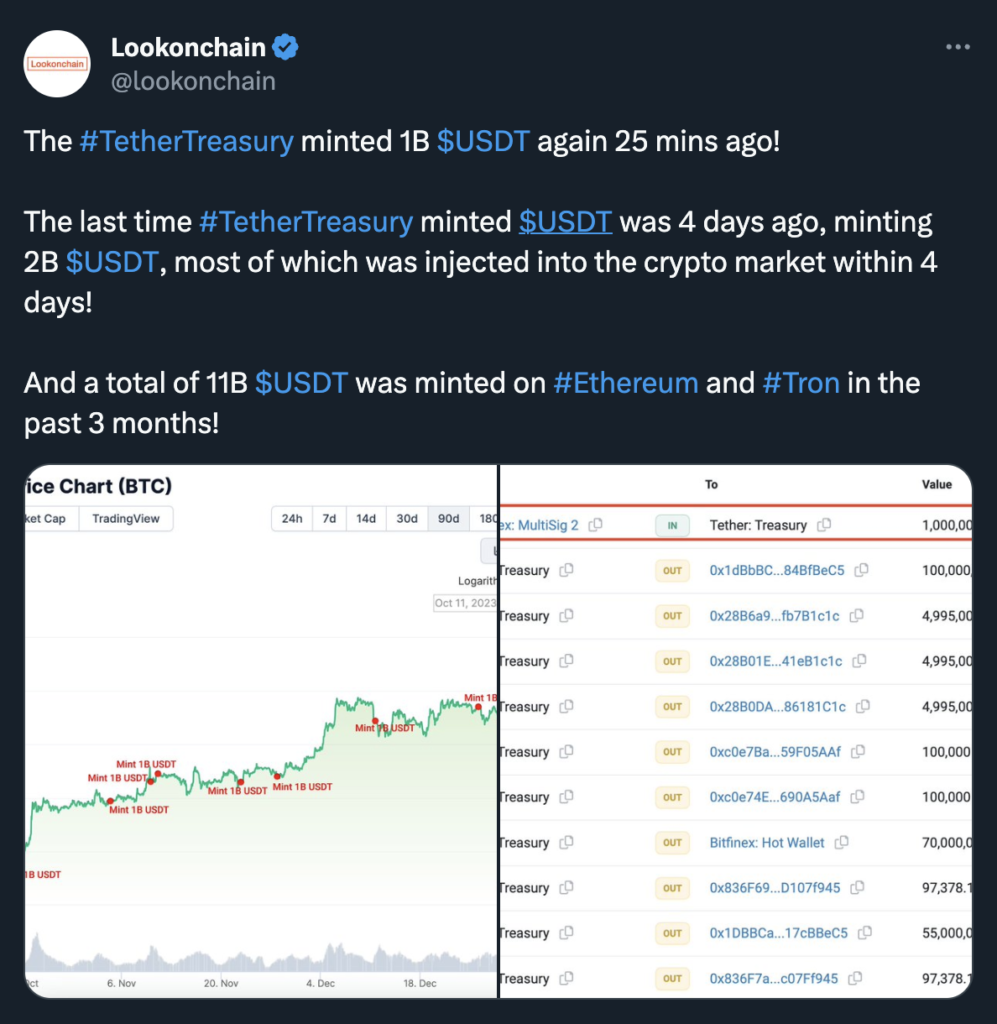

First, Gary Gensler sent several tweets about the dangers of cryptocurrencies, something he rarely does. Then, the multiple printings of USDT reaching $1 billion strengthened rumors of institutional investors preparing to enter the crypto market.

On the first day, the volume of stock transactions related to Bitcoin reached $4.6 billion. The volume on the second day decreased to $3.15 billion. Grayscale (GTBC), BlackRock (IBIT), and Fidelity (FBTC) led in transaction volume.

Galaxy Research predicted the expected inflows into the Spot Bitcoin ETF. Galaxy estimates that about $14.4 billion will flow into BTC in the first year. This figure then increases to $38.6 billion by the third year. However, it can be seen that Galaxy’s figures are quite conservative as it only puts an average of 1% allocation towards BTC.

In addition, the BTC dominance chart can also be an important indicator. At the beginning of the 2019 and 2020-2021 bull market, Bitcoin’s dominance rate increased considerably to 70%. So, will the ETF catalyze the rapid rise of Bitcoin dominance? Or is the ETF a reversal because the next Bitcoin catalyst is still a long time away (Halving on April 24, 2024)?

Regardless of the ETF announcement, the inflows of funds into BTC could potentially be the catalyst for the crypto market to experience a bull run in 2024 or 2025. With that in mind, we will discuss 9 potential crypto trends and narratives in 2024. Some of the trends below already have clear sector leaders and assets we can buy while others do not.

Predicted 9 Crypto Trends and Narratives of 2024

1. The Rise of Modular Blockchain

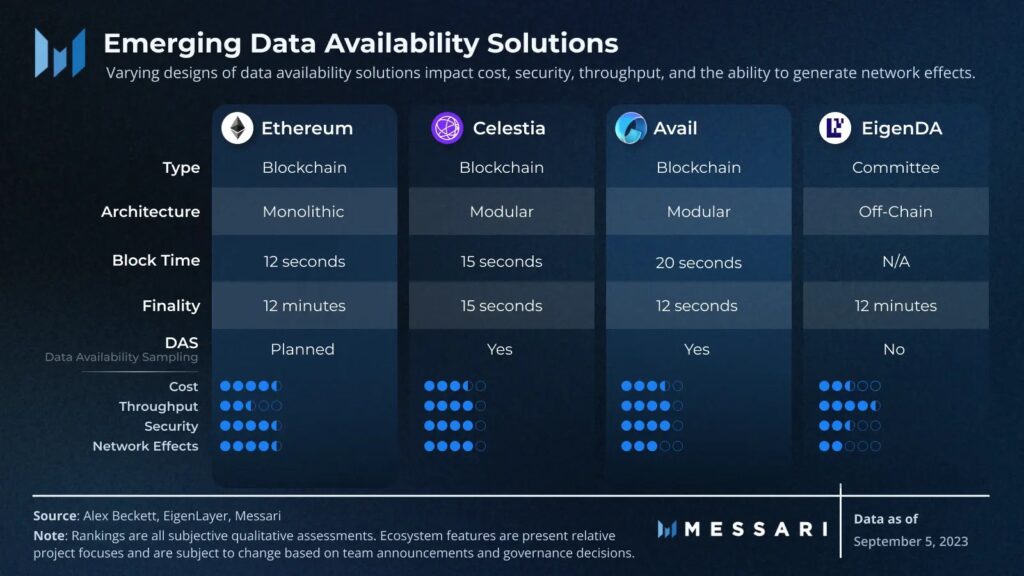

The modular blockchain narrative is evolving rapidly throughout 2023. The need for modular blockchains is increasingly evident with Ethereum’s L2 ecosystem having high transaction speeds and fees. Moving transaction execution to Ethereum’s L2 has not been able to provide sufficient scalability.

Read more: What is Modular Blockchain?

The sector can be divided into various categories based on the layers abstracted. For example, Celestia is a modular project that replaces consensus and settlement while Fuel VM replaces network execution scope. We also haven’t talked about how projects like Risc Zero replace the prover system for a ZK network execution layer.

The modular blockchain trend is just heating up in late 2023 with Celestia as the sector leader (temporarily). However, many projects offering modular stacks will launch in 2024. Avail, Fuel VM, Eclipse, Eigenlayer, Dymension, and Manta Pacific are some of the modular projects that will launch in 2024.

The potential of today’s popular modular blockchain narrative has only touched the outer layer. The year 2024 could open the floodgates on the potential of this sector.

If modular blockchain ecosystems like Dymension and Celestia continue to grow, dozens of independent L2s and Rollapps could produce new crypto apps that could attract thousands of users. The modular blockchain trend releases applications from the clutches of limited ecosystems like Ethereum and Solana and opens up the flexibility to generate independent L2 or sovereign rollups.

Notable modular projects: Celestia, Eigenlayer, Dymension, Fule, Avail, and Near DA.

2. Alt L1 Competition Heating Up

In early to mid-2023, ETH experienced an increase of up to 100%. In that period, Ethereum and the L2 ecosystem in it became the center of attention of the crypto industry from the potential for airdrops to various new applications.

Then, ETH experienced a 25% correction until October and “only” rose 50% in the fourth quarter of 2023. Why “only”? BTC rose 80% while SOL, AVAX, and INJ rose around 500% simultaneously. While many cryptocurrencies rose exponentially, ETH stagnated.

The fourth quarter of 2023 shows that interest in L1 alternatives to Ethereum is still very high. Solana, which was considered dead in early 2023, rose from the grave, recovering from $15 to $120. Avalanche rose 500% in 3 months. Then, the new L1 Injective rose 4,000% in the middle of a bear market. The L1 competition seems to be heating up again.

In addition, several new L1s will be launched in 2024 and are being talked about. One of the most anticipated L1 launches is Monad which has parallel EVM. The ecosystem growth of several new L1s such as Sei, Injective, Mina, and Sui could also potentially bring attention back to the L1 sector in 2024.

Current popular L1 projects: Solana, Avalanche, Injective, and Sei.

3. L3 and Appchains

In conjunction with the modular blockchain trend, Arbitrum , Optimism , and several other projects are racing to create their respective appchain ecosystems. This trend, which was started by Cosmos, has now spread to Ethereum.

Confused with the Layers? Read What is Layer 3 Crypto? – Pintu Academy.

Optimism has the OP Stack, which is a set of software and frameworks to create a new L2 based on Optimism’s code. Meanwhile, Arbitrum’s Orbit Chains can be used by development teams to create new blockchains on top of Arbitrum. Both have visions of creating their own L2 and L3 ecosystems.

Arbitrum tries to differentiate itself from Optimism by implementing Arbitrum Stylus. Through Stylus, Rust, C++, and Wasm developers can directly develop smart contracts in the Arbitrum ecosystem. These three programming languages can run on Arbitrum because Stylus makes it equivalent to Solidity for EVM.

Then, there is Dymension (DYM) which modifies the concept of Appchains with the RollApps ecosystem. The Dymension ecosystem works like a regular web2 application where the Dymension hub acts as a randomized back-end and RollApps is the front-end. Dymension is a mini Cosmos. It creates a small ecosystem within the Cosmos ecosystem and all RollApps can connect with other Cosmos chains via IBC.

L3 projects and Appchains are popular: Cosmos ecosystem, Arbitrum, Optimism, and Dymension.

4. GameFi

The generation of GameFi built in the middle of a bear market is very different from GameFi projects in previous bull markets. The era of play-to-earn games seems to be over, considering how projects like Axie Infinity proved the model unsustainable. The model has been criticized because many argue that crypto games are not fun to play.

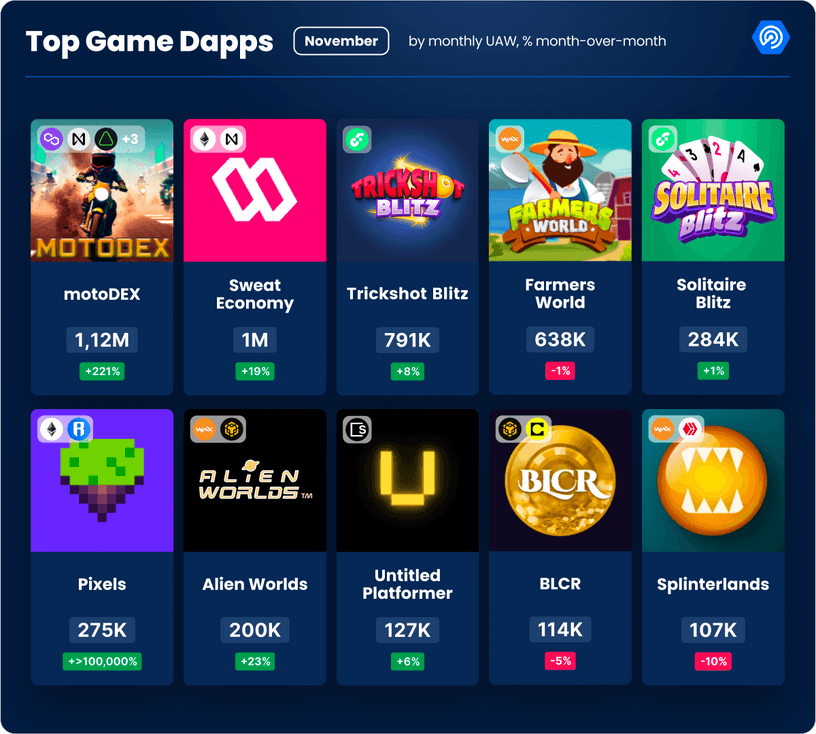

As such, a new generation of projects in the GameFi sector began to focus on creating fun gaming experiences for players and shifted the crypto aspect to play and earn. Currently, games such as Sweat Economy, Splinterlands, Alien Worlds, and Pixel have more than 100K monthly active users.

In addition, GameFi’s infrastructure is quite mature and can support various games with large funding (AAA). TreasureDAO (MAGIC), Beam (BEAM), Immutable X , Echelon Prime (PRIME), Ronin (RON), and Gala are some of the projects with a full game infrastructure.

Read about the new generation of GameFi projects here: The Future and Potential of GameFi Project.

With a much-improved infrastructure, games with big funding are starting to emerge. Many games that were made a few years ago will also only be fully released in 2024. These games will likely compete in the same time frame in 2024.

Notable GameFi projects: Shrapnel, Parallel TCG, DeFi Kingdom, Illuvium, and Star Atlas.

GameFi Infrastructure Projects: Beam, Immutable X, TreasureDAO, Gala, and Ronin Network.

5. DePin

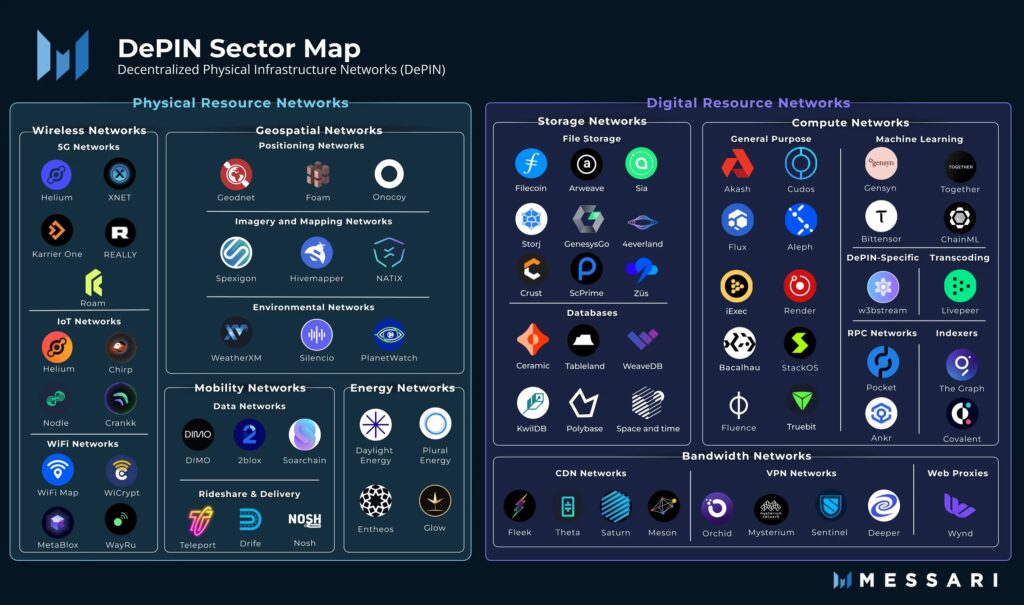

Decentralized Physical Infrastructure or DePin is a new sector in the crypto world. DePin is a network that uses cryptocurrency rewards as an incentive to run and build real-world physical infrastructure. The sector is divided into two types: physical (PRN) and digital (DRN) infrastructure.

Physical infrastructure DePin networks are connectivity networks, geospatial data, mobility networks, and IoT (Internet of Things) technology gadget networks. Meanwhile, examples of digital infrastructure are data storage, computing networks, and bandwidth networks.

What is DePIN? Web3 Physical Infrastructure Narrative.

By sector, there are now more than 600 DePin projects and the sector’s cumulative market capitalization is $200 billion. DePin is one of the sectors in crypto that has clear real-world uses.

For example, Render is a rendering service provider for creating videos and the like. Render itself has successfully collaborated with large companies such as Apple.

Apart from Render (RNDR), there are many other interesting projects such as Hivemapper which provides geospatial data directly from users. Helium (HNT) is also one of the large projects with hundreds of thousands of IoT. Now, Helium is providing 5G services in the US at a much lower cost. DePin also has an important role in providing decentralized infrastructure for the AI industry.

The potential of the DePin sector is clear. DePin incentivizes crypto assets to decentralized service providers. In addition, the services provided by the DePin protocol are much cheaper than services from companies like Amazon. Today, some DePin protocols even provide technologies that centralized service providers do not.

Popular DePin projects: Filecoin, Render, Storj, Helium, Arweave, and Akash.

6. Crypto and the World of AI

Blockchain and crypto technologies provide two important aspects for the AI industry: verification capabilities and decentralized digital currencies. Currently, we are starting to see the integration of cryptocurrencies and AI in sectors such as resource networks for AI, decentralized AI development, and AI utilization in crypto activities.

Several crypto projects are already providing computing services for various services, including AI. Akash and Render are two of the largest decentralized computing protocols that can be used for AI. Akash is testing its Supercloud network for several AI models. Decentralized computing networks like Akash provide alternative services for the growing AI industry.

In addition to the provision of computing services, the development of AI based on decentralization is a hot topic in the crypto world. Not just a concept, decentralized AI is currently in development by protocols such as Olas (OLAS) and Bittensor (TAO). TAO is the first AI crypto asset token to reach $1 billion.

In addition, Bittensor is also a crypto project that offers the first AI Stack. Bittensor is an example of how cryptocurrency incentives can support the creation and development of decentralized AI models. While we are still in the early stages of exploring the integration of crypto and AI, we are already seeing a lot of potential.

Meanwhile, Olas is a crypto project that focuses on developing AI agents for specialized uses in the crypto industry such as DeFi. Olas envisions AI agents that perform transactions, execute trades, and create profitable DeFi strategies.

2024 could be the year we start to see the results of these developments in AI and crypto integration.

Several AIxCrypto projects to keep an eye on: Bittensor, Olas, Ritual, and Spectral.

7. Parallel EVM, Dencun Upgrade, and Decentralized Sequencer

Ethereum was the center of attention of the crypto community in early 2023 until the completion of Shanghai in April 2023. After that, the community’s attention began to shift to many other projects such as L2, LayerZero, and Solana. Solana Season made many people forget about Ethereum and consider it inferior to the new L1.

Nonetheless, many updates and technological developments are happening in the Ethereum ecosystem. The Dencun update is expected in the first quarter of 2024. With Dencun, L2 transaction fees will be reduced by 90%, the foundation of Ethereum’s compatibility with ZK is being built, and Dencun will be the first step towards DankSharding.

Dencun brings Ethereum’s L2 network transaction fees closer to those on fast L1s like Solana. This update makes L2 even more attractive for crypto users and application developers.

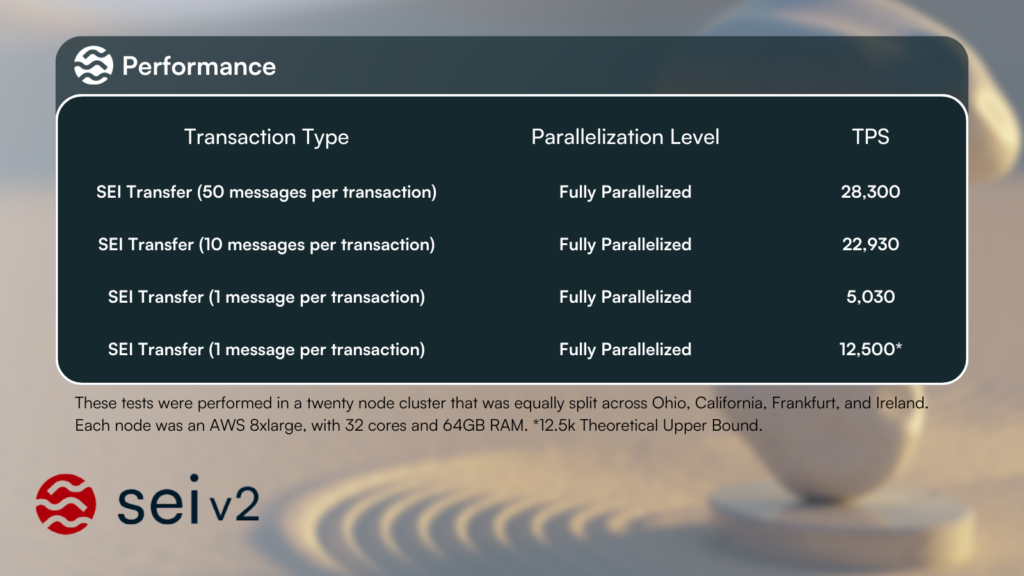

In addition, the development of parallel EVMs, and decentralized sequencers will be a big catalyst to attract users to the EVM ecosystem. Sei (SEI) and Neon EVM (NEON) are protocols that have successfully implemented parallel transaction processing for the EVM space. Neon can achieve 730 transactions per second on its mainnet while a theoretical test of Sei v2 resulted in 28,300 transactions per second.

Finally, the development of decentralized sequencers is getting closer to reality. MetisDAO (METIS) is testing its decentralized sequencer while Espresso is developing one for Arbitrum.

Interesting Ethereum projects with innovative tech: Sei, Neon EVM, Eclipse, MetisDAO, Monad, and Taiko.

8. The Start of Zero Knowledge Era?

Zero-knowledge (ZK) is one of the most used jargon in 2023. Projects that previously had no ZK suddenly have ZK development teams. Polygon, previously an L2 sidechain and PoS, announced plans to become a fully ZK L2.

In addition, zkEVM is becoming one of the most important ZK implementations because the ZK programming language is very different from Solidity EVM. Therefore, many teams are working on making the ZK language compatible with the EVM engine to make it easier to develop applications in the ZK ecosystem. Some of the teams working on this are Scroll, zkSync, Starkware, and Mina.

So, why are so many projects moving to ZK? ZK provides an ideal scalability solution and privacy compared to the usual optimistic rollup technology. However, the main bottleneck of ZK technology is the complexity of the technology and implementation.

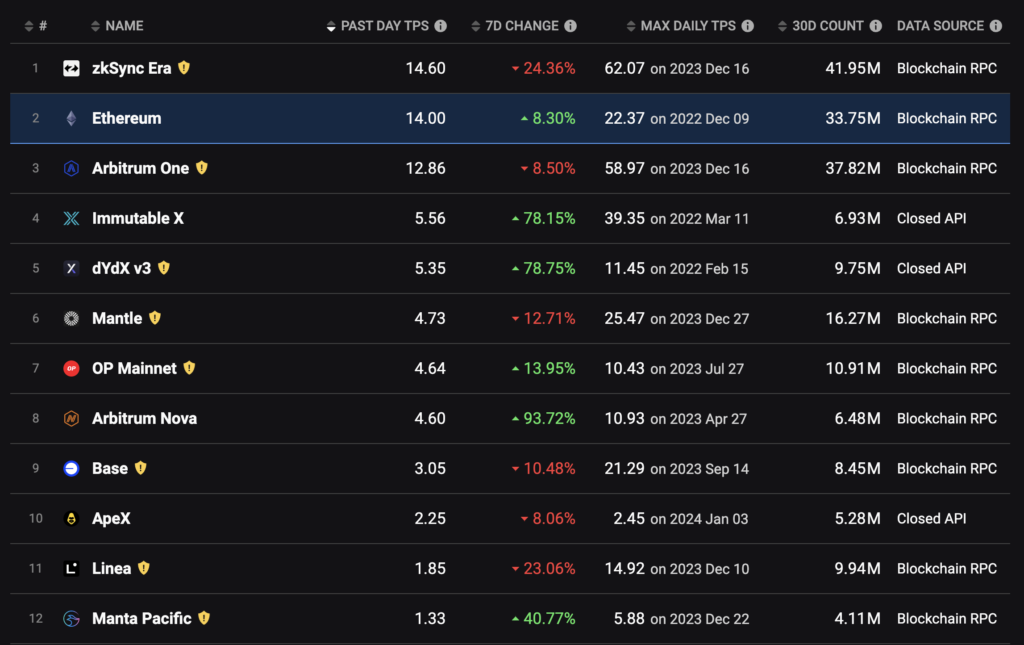

Currently, zkSync is proven to achieve the highest TPS compared to other L2s. 2024 is likely to be the proving ground for ZK technology on Ethereum. ZkSync will face many L2 competitors, with Manta Pacific being the first to launch in 2024.

Several popular ZK-based projects: Manta Pacific, zkSync, Scroll, Polygon, Starknet, Risc Zero, Mina, Taiko, and Avail.

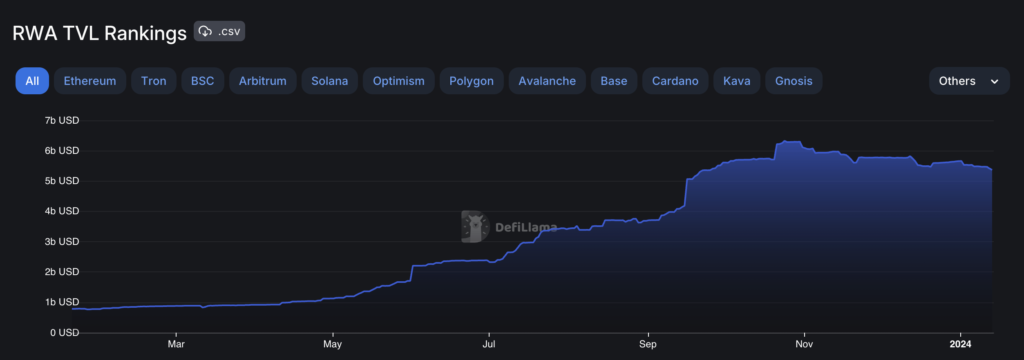

9. RWA and Institutional Investors

The acceptance of Bitcoin ETF signals a new era of institutional investors’ entry into the crypto industry. Now, institutional and retail investors can buy Bitcoin like buying stocks. Bitcoin ETFs lay the foundation for institutional investor participation in blockchain and crypto.

RWA or Real-World Tokenization is a crypto sector that utilizes tokenization or converting real-world assets into assets on the blockchain. With ETFs, concerns about regulation are starting to dissipate and many investors are seeing the potential of RWA. In fact, BlackRock CEO Larry Fink stated that ETFs are a stepping stone towards tokenization of various types of assets.

MakerDAO is the largest DeFi protocol that utilizes RWA. DSR or DAI Savings Rate (DSR) is the interest that Maker gives to users to lock their DAI. Maker can maintain the DSR rate (5%) because it has various interest-generating assets as collateral.

Currently, RWA assets are the largest portion of Maker’s portfolio. RWA assets in Maker mostly consist of short-term bonds that are easy to liquidate. The total number of RWA assets in Maker’s portfolio is $7.92 billion.

Besides Maker, some L1s such as Chainlink and Avalanche have successfully collaborated with institutional investors. Project Guardian is Avalanche’s collaboration project initiated by the Central Bank of Singapore (MAS) with J.P. Morgan and Citi Bank. Project Guardian was launched on Avalanche’s institution-specific subnet Evergreen. Meanwhile, Chainlink is working with Swift to explore the potential for implementing asset tokenization using CCIP.

Essentially, Bitcoin ETFs are becoming a huge catalyst for the RWA sector. Many projects are trying to solve RWA’s biggest problem such as liquidity. Keep an eye on the RWA sector on sites like CoinGecko to monitor its growth this year.

Popular RWA projects: MakerDAO, Centrifuge, Polytrade, Frax, Ondo, and Maple.

Conclusion

The year 2024 looks set to be a landmark year for the crypto industry, driven by the Bitcoin ETF’s endorsement and the emergence of various innovative trends. With the growth of modular blockchains, Ethereum’s L1 alternative, and the development of L3 and appchains, the crypto market is poised for a wave of innovation.

GameFi and DePin are becoming promising sectors, reflecting the maturity and diversification of the industry. The addition of technologies such as Zero Knowledge and AI integration shows that crypto is not just evolving in terms of financial activities. Finally, with the increasing participation of institutional investors and RWAs, 2024 has the potential to be a milestone for crypto acceptance and integration.

How to Buy Crypto on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Aylo, “My Crypto Ideas for 2024“, Substack, accessed on 9 January 2024.

- Paul Veradittakit, “6 Predictions for Crypto in 2024: Pantera’s Paul Veradittakit“, CoinDesk, accessed on 9 January 2024.

- Bradley Keoun, “Blockchain Tech Predictions for 2024, From Experts at Ripple, Coinbase, a16z, Starknet“, CoinDesk, accessed on 10 January 2024.

- Stephanie Dunbar, “The Modular Blockchain Landscape“, Messari, accessed on 10 January 2024.

- Sami Kassab, “Navigating the DePIN Domain“, Messari, accessed on 11 January 2024.

- @Thorhartvigsen, “I spent the past days reading ‘2024 Outlook’ reports from entities like Coinbase, Binance, a16z and more.. Many of these have similar theses on trends like dePIN, AI, Modularity etc.”, Twitter, accessed on 11 January 2024.

- @prithvir12, “13 Predictions for 2024 Written in collaboration with @yoshi_eth2 Trust me“, Twitter, accessed on 12 January 2024.

Share

Related Article

See Assets in This Article

GALA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-