Is Investing in Ethereum Layer 2 Worth It? A Deep Dive Into Promising L2 Projects

Investing in the Ethereum Layer 2 (L2) sector is considered a promising opportunity due to the exponential growth of the Ethereum L2 ecosystem and its user base. On one hand, L2 technology is still in active development, implying that there is ample potential for future growth and enhancement of this technology. As a result, many individuals opt to invest in the Ethereum L2 sector. So, what is the potential of investing in the Ethereum L2 sector? Find out the answer in the following article.

Article Summary

- 📈 Ethereum L2 sector investment has promising potential as the protocol ecosystem and users continue to grow.

- 💰 Arbitrum is the Ethereum L2 sector leader with the highest Total Value Locked (TVL) and has the best security.

- ⚡Polygon leads in the number of users and daily transactions, offering the lowest transaction fees but with relatively lower security.

- 💨 Optimism has made significant updates that make it more competitive, although its security system is still under development.

- 🔆 All three L2 platforms offer scalability solutions with better speed and lower transaction fees than Ethereum. However, they had different security trade-offs.

Comparing the Most Popular Ethereum L2 Protocols

Ethereum’s layer 2 (L2) sector is now one of the most rapidly growing sectors in terms of technology and the number of users. L2 developer teams are in fierce competition to offer the most effective Ethereum scalability solutions. Consequently, various L2 projects draw the attention of dApps development teams and, ultimately, attract users.

Inevitably, many believe L2 will be the future of the crypto industry. They are starting to make it as an investment choice. This article will review the Ethereum L2 sector to assess the potential of each L2 project. The following are the three most popular Ethereum L2 networks:

1. Arbitrum

Arbitrum is a Layer 2 blockchain on Ethereum that uses optimistic rollups that allow large numbers of transactions to be processed off-chain. But all of this is done while maintaining the security and decentralization of the Ethereum network. It is the current market leader for Ethereum’s L2 sector.

Pintu Academy has prepared articles on “What is Arbitrum?” and “Arbitrum Ecosystem Development“.

2. Optimism

Like Arbitrum, Optimism is an L2 on Ethereum that uses optimistic rollup technology. Optimism has lagged behind Arbitrum and is now starting to compete again, thanks to the Bedrock update. The update lowers transaction fees on Optimism while increasing compatibility with Ethereum.

You can learn more about Optimism here and the development of its ecosystem here.

3. Polygon

Polygon is one of Ethereum’s most popular L2 projects. Polygon’s primary L2 is Polygon PoS, a unique sidechain with its own consensus mechanism but still utilizes some of Ethereum’s security features. Currently, Polygon is transitioning to the Polygon 2.0 iteration, which is all Zero-Knowledge based. The developer’s team can use Polygon to create their ZK rollup or off-chain technology.

Read more about Polygon’s evolution here and its scalability solutions here.

L2 Sector Competition

In terms of Total Value Locked (TVL), Arbitrum outperformed its competitors with a TVL of US$ 2.06 billion based on data from DeFi Llama on September 6, 2023. Meanwhile, Polygon and Optimism have TVLs of US$ 846.39 million and US$ 696.57 million respectively.

Ringkasan Artikel

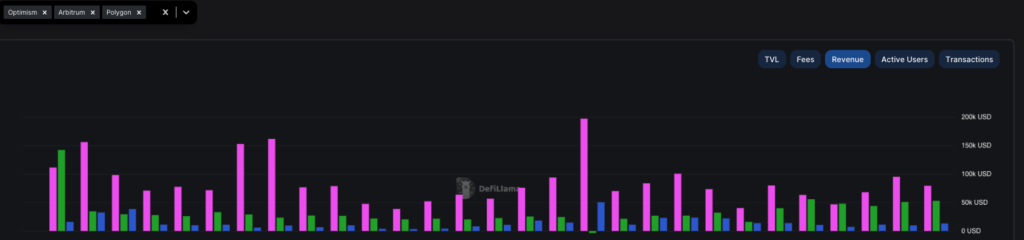

Currently, Arbitrum already has 441 protocols in its network, with GMX being the largest TVL contributor, which is US$ 635.08 million. Then, there are 469 protocols on the Polygon network and 183 protocols on the Optimism network. On September 5, Polygon recorded daily revenue from transaction fees of US$ 32,180. Arbitrum followed this at US$26,600 and Optimism at US$17,690.

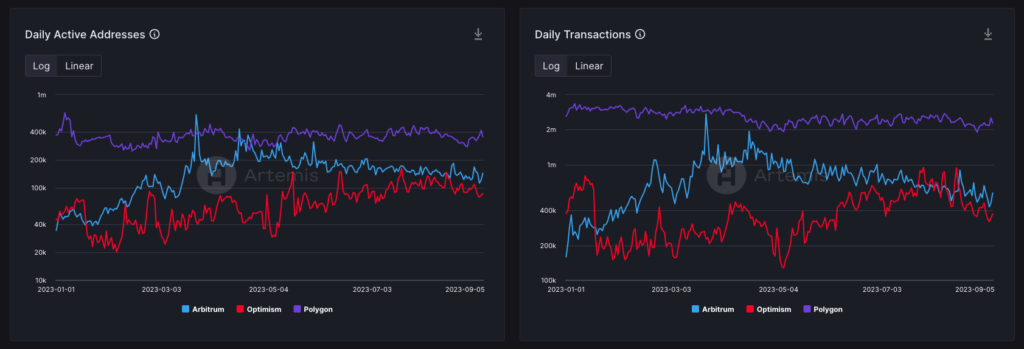

However, as an existing blockchain with a sizable user base, Polygon has performed much better than Arbitrum and Optimism year to date. Both in terms of daily users and daily transactions, Polygon ranks first.

If you look at the Artemis data above, you can see that Polygon has a relatively stable performance. The number of daily users is consistently in the range of 300,000, with the number of daily transactions reaching 2 million.

Meanwhile, Arbitrum started this year in third place. However, it was slowly able to overtake Optimism in terms of the number of daily users and daily transactions. Even in March, the number of active users of Arbitrum had surpassed Polygon and almost equaled the number of daily transactions.

| Network | Daily Users (Per 5 September) | Highest Daily Users | Lowest Daily Users | Daily Transactions (Per 5 September) | Highest Daily Transactions | Lowest Daily Transacations |

| Arbitrum | 143,110 | 611,610 | 34,450 | 569,760 | 2.73 million | 159,470 |

| Optimism | 85,980 | 149,060 | 20,250 | 374,370 | 937,420 | 127,610 |

| Polygon | 352,960 | 638,530 | 252,287 | 2.28 juta | 3.35 million | 1.91 million |

TPS and Transaction Costs Competition in the L2 Sector

As a scalability solution, the L2 project aims to speed up transaction processing but at a fraction of the cost of Ethereum. So, how did it work out? Check out the table below to get the answer.

| Network | Total Users | Total Transactions | Total Volume | Average Fee | TPS (Transaction Per Second) |

| Arbitrum | 4.78 million | 94.36 million | US$ 15.83 billion | US$ 0.13 | 1,092 |

| Optimism | 2.73 million | 48.14 million | US$ 4.33 billion | US$ 0.19 | 557 |

| Polygon | 10.49 million | 216,63 million | US$ 3.16 billion | US$ 0.03 | 2,507 |

It can be seen that all L2 projects managed to outperform the TPS level and with lower gas fees than Ethereum. Based on Ethtps.info data, Ethereum’s current maximum TPS is 111, with an ETH delivery fee of US$0.50 and a token swap of US$2.49.

Similar to the year-to-date data, as an existing network, Polygon is ahead regarding total users and transactions. However, Arbitrum recorded the highest total volume, almost 5x higher than Polygon. This indicates that the transaction volume in Arbitrum has a large value.

Meanwhile, Polygon managed to record more TPS and lower average fees due to using the side-chain mechanism. This technology has a higher transaction speed than optimistic rollup but has a lower security level than optimistic rollup.

Security Risk Trade-Off at L2 Sector

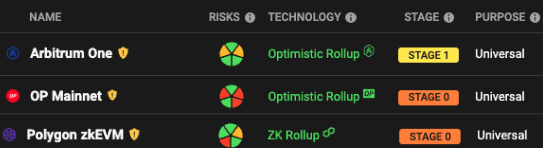

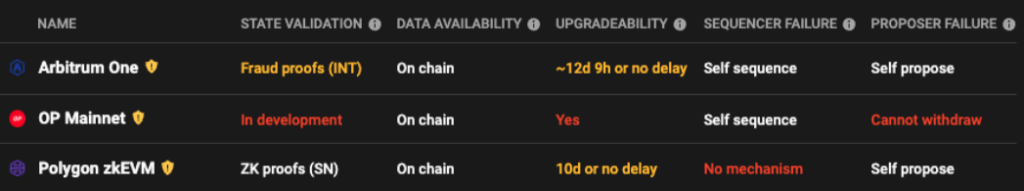

In discussing the risks looming over the existing protocols in L2, the analysis used is the assessment from l2beat.com. It can be seen that Arbitrum is considered to have the lowest level of security risk compared to Optimism and Polygon (used Polygon zkEVM). This is reflected in Arbitrum being declared already at “stage 1.”

Arbitrum gets this label because it has a complete proof system operating on its network. It also has a security council to ensure the security of its network. Another advantage of Arbitrum is that 5 external parties can submit fraud-proof and users can cancel transactions without the help of permissioned operators.

Although Polygon zkEVM has a proof system, it has not yet been labeled as “stage 1”. This is because the permissioned operators can censor users’ withdrawals. Also, Polygon’s security council is not publicly known. In addition, upgrades executed by actors with more centralized control than a Security Council provide less than 7d for users to exit if the permissioned operator is down or censoring. L2beats does not currently show a risk status for Polygon’s main chain, as it is a sidechain L2 technology.

Optimism also has the same assessment as Polygon. However, there is an additional risk in the form of a proof system still under development. The Optimism mechanism is they assume off-chain transactions are valid and don’t publish proofs of validity for transaction batches posted on-chain until proven otherwise. This means that Optimism’s security model relies on social pressure not to steal user funds.

L2 Sector Competition is Heating Up

Each L2 protocol is not just improving its existing technology to increase the number of users and transactions. They are also competing to provide services for development teams to create their own L2 protocols.

So far, Optimism has the upper hand thanks to its OP Stack technology. The technology allows development teams to create their own L2 blockchains using OP Stack as the base. CoinBase’s L2 Base protocol was created using the OP Stack. In addition, Binance’s Zora and OpBNB were also built using OP Stack.

You can read the following article that dives deep into Base and its ecosystem.

Meanwhile, Arbitrum has focused on strengthening its network infrastructure while developing Arbitrum Orbit. The technology allows the developers team to create an L3 network that will connect to Arbitrum One or Arbitrum Nova.

Also, Polygon is currently in a significant update phase by switching to Polygon 2.0. This is a blueprint for a series of updates to make Polygon the “value layer” of the crypto world, a platform for creating, programming, and moving value.

Conclusion

The L2 sector shows promising potential as an option for long-term investment. Existing L2 protocols, such as Polygon, have shown consistency with the number of users and transactions growing steadily. Meanwhile, new L2 protocols such as Arbitrum and Optimism have caught the attention of crypto players with their exponential growth.

The intense competition in the L2 sector will make each protocol continue to innovate to increase the number of users and transactions. This is evident with the introduction of OP Stacks, Arbitrum Orbit, and Polygon 2.0. However, it’s crucial to acknowledge that, given L2’s relatively recent emergence as a technology, there are security risks that need to be taken into account. Failure by development teams to address these issues could potentially diminish the appeal of their protocols.

Buy Crypto Assets on Pintu

Looking to invest in L2 Ethereum Sector? No worries, you can safely and conveniently purchase a L2 token such as ARB, OP, MATIC, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Ally Zach, User Acquisition and Retention Across EVM Chains, Messari, accessed on 5 September 2023.

- Macaulet Peterson, So your layer-2 is ‘secured by Ethereum’ — what does that mean? Blockworks, accessed on 5 September 2023.

- Fransesco, L2s come with their own trade-offs, Twitter, accessed on 5 September 2023.

- Chase Devens, Inside the Arbitrum Ecosystem Boom, Messari, accessed on 5 September 2023.

- Polygon labs, Introducing Polygon 2.0: The Value Layer of the Internet, accessed on 5 September 2023.

- “Welcome to the OP Stack,” OP Stack Docs, accessed on 5 September 2023.

Share