Download Pintu App

Pi Network Soars – Is Pi Coin on Track to Reclaim Its $3 All-Time High?

Jakarta, Pintu News – After experiencing a downturn, Pi Network (PI) is now showing signs of recovery with increased buying momentum. A strong indication that buyers are taking control of the market again, with hopes of reaching the previous all-time high.

Pi Network (PI) Coin Reinforcement Marked by Bullish Indicators

Reporting from BeInCrypto (5/3/25), Pi Network (PI) had reached an all-time high of $3 on February 27, 2025, but there was a massive sale that made the price drop dramatically to $1.51 on March 2.

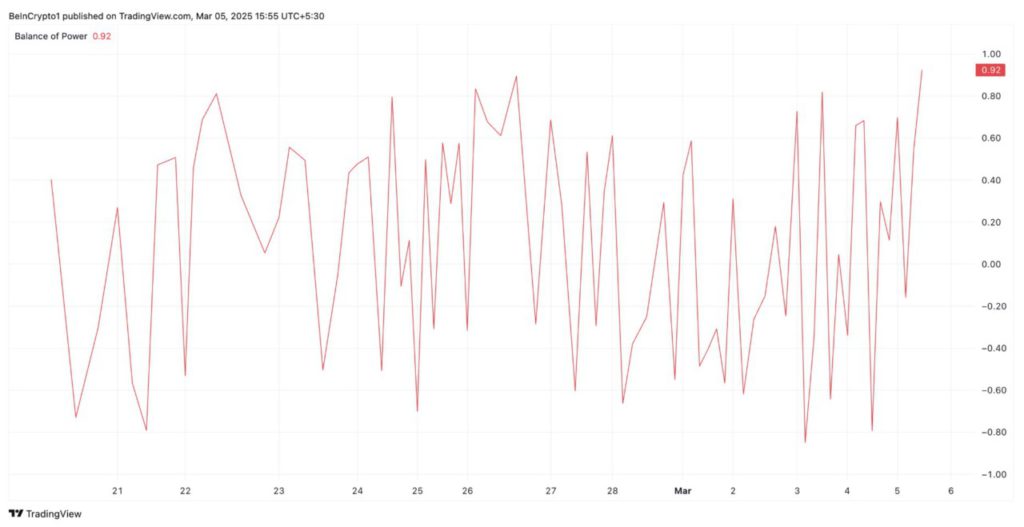

However, the price of PI coin has bounced back, indicating a change in market sentiment. The Balance of Power (BoP) indicator, which measures the strength of buyers and sellers by analyzing price movements in a given period, is currently showing an upward trend with an ATH value of 0.92, signaling buyer dominance.

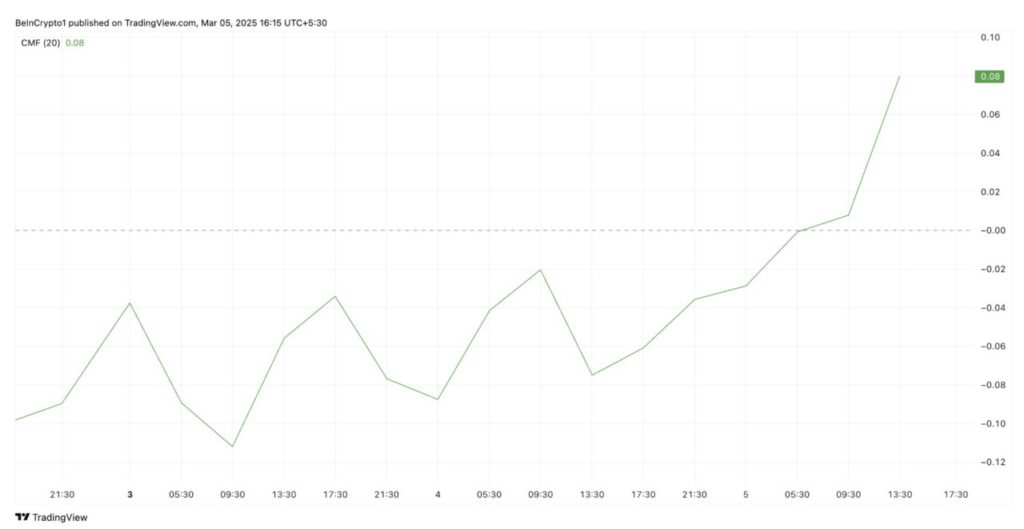

Another indicator, the Chaikin Money Flow (CMF), also shows increased demand for PI Coin. The CMF being above the zero line at 0.08 indicates strong buying pressure.

This shows that capital inflows into PI Coin are greater than outflows, which could be an indication of continued price increases.

PI Network (PI) Faces Critical Resistance

In the four-hour chart (5/3/25), PI Coin was briefly above the $1.97 support. If demand continues to increase, the coin has the potential to break resistance at $2.12 and return to its All Time High of $3.

However, PI Coin is facing challenges due to large distribution, with over 188 million PI having been distributed to over one million Pioneers this month. If demand can’t keep up with the increase in supply, the price of PI Coin might drop back down.

A drop in demand could cause prices to fall below $1.62, possibly even reaching $1.34. This situation calls for careful market monitoring to see if the current bullish trend can hold.

Read also: Is Pi Network on the Verge of a Massive Breakout? 3 Key Reasons Why Pi Coin Could Skyrocket!

Pi Network’s Prospects and Challenges in the Crypto Market

Pi Network continues to show significant potential to return to its peak, especially with favorable technical indicators. However, the challenges of massive distribution and a potential drop in demand should not be overlooked.

Investors and market watchers should pay attention to the dynamics between supply and demand which can greatly affect price movements. Monitoring market indicators such as BoP and CMF will be crucial in determining the future price of PI Coin.

Investment decisions should be based on in-depth analysis and a solid understanding of current market conditions.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Price Rally Targets All-Time High. Accessed on March 6, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.