Download Pintu App

Canary Capital Pushes for SUI ETF – Will the SEC Approve It?

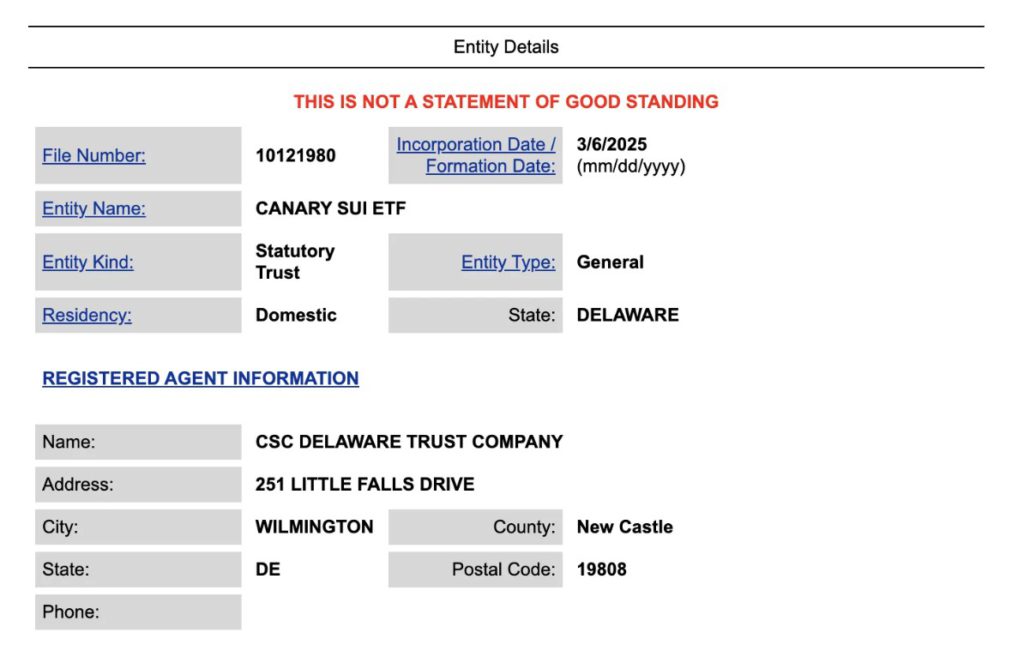

Jakarta, Pintu News – Canary Capital has taken a significant first step by registering a trust entity for its Sui ETF (SUI) in Delaware. The move signals a possible regulatory filing with the SEC to come.

With the planned launch of an investment product focused on SUI crypto assets, Canary Capital could potentially be the first asset manager to propose an SUI-based ETF in the United States.

This is an important development given SUI’s price increase of over 10% following the announcement of the collaboration with World Liberty Financial.

Canary Capital Files for SUI ETF in Delaware

Canary Capital has officially filed a registration to establish a trust entity in Delaware to launch the Canary SUI ETF. The move is a strong signal that the company is preparing to submit a formal application to the US Securities and Exchange Commission (SEC) for regulatory approval.

Read also: Ethereum Network in Turmoil: Holesky Testnet Faces Critical Rescue Mission!

If successful, this will be the first ETF in the US based on Sui (SUI), a blockchain that is increasingly gaining attention in the crypto market.

This registration comes after World Liberty Financial announced its partnership with Sui blockchain. In the announcement, they stated that SUI’s digital assets will be put into a strategic reserve fund called Macro Strategy.

The impact of this news was immediately felt in the market, with SUI prices jumping more than 10% to $3 (7/3/25). However, Canary Capital’s ETF announcement has yet to show a significant price reaction.

Impact and Potential of SUI ETF

If the SUI ETF gains approval, it could be a watershed moment for the adoption of Sui as an institutional investment asset. So far, Canary Capital and Grayscale Investments are the two asset managers most active in pushing for the launch of altcoin-based ETFs.

In addition to SUI, Canary also has plans to launch ETFs based on Litecoin (LTC), XRP (XRP), Solana (SOL), and Hedera (HBAR).

On the other hand, Canary Capital has also just filed an S-1 registration with the SEC to launch the Canary AXL ETF, which focuses on the AXL token of Axelar Network. This move further confirms their ambitions in expanding crypto-based investment options in the US market.

Regulatory Challenges: Will the SEC Approve?

While this SUI-based ETF filing is a big step, the SEC still has a strict track record of approving crypto asset-based ETFs other than Bitcoin (BTC) and Ethereum (ETH).

Read also: BNB Chain Set to Launch Pascal Hardfork – What Does It Mean for Investors?

Many previously submitted altcoin ETF proposals still face regulatory challenges, mainly related to volatility, liquidity and investor safety issues.

However, with the increasing adoption of crypto by large institutions and more countries opening their doors to crypto-based ETFs, the chances of approval for SUI ETFs may be greater than ever.

If the SEC finally gives the green light, this could be a huge catalyst for Sui’s price and ecosystem as a whole.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Canary Capital SUI ETF Files Registration with Delaware. Accessed on March 10, 2025

- Crypto Briefing. Canary Capital SUI ETF Registration. Accessed on March 10, 2025

- Watcher Guru. SUI ETF Filing May Be Nearing Following Canary Registration. Accessed on March 10, 2025

*Featured Image: The Block

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.