Download Pintu App

Drastic 19% Drop in Solana Futures – Here’s Solana’s Technical Outlook in March 2025

Jakarta, Pintu News – Solana (SOL) recently experienced a significant drop in its futures value, falling by 19%. This decline raises serious questions about investor confidence in this crypto asset. With critical support in the $125-$110 range, the future of Solana (SOL) seems to depend on its ability to maintain or improve upon that position.

Solana Technical Outlook

Solana (SOL) is currently above the critical support zone between $125 and $110, which crypto analyst Ali Martinez identifies as a bellwether for further movement. If Solana (SOL) manages to hold above this zone, there is potential for a rebound. However, if the price falls below $110, it could trigger a deeper drop, possibly reaching the $95-$100 range.

On the other hand, immediate resistances are at $140 and $150, where sellers often appear. A stronger bullish signal would emerge if Solana (SOL) can reclaim its 50-day Moving Average at $188.74, which could turn the momentum in favor of the bulls. However, the broader trend is still uncertain, with market sentiment trending bearish.

Also Read: MicroStrategy Stock Downside Risk Amid Crypto Market Volatility

Futures Market Sentiment and Declining Interest

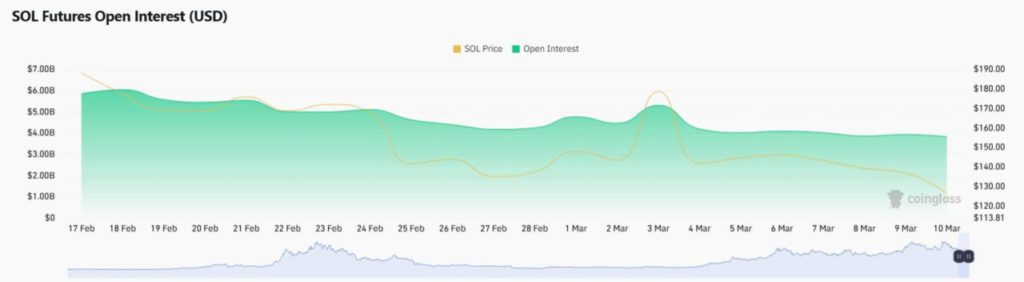

The 19% drop in Solana (SOL) Open Interest (OI) since the beginning of March indicates a decline in speculative interest. This coincided with a sharp price drop, suggesting that traders started to close their positions. Several factors contributed to this decline, including a rejection near $180 that triggered profit-taking.

The disappointing US government crypto reserve plan also triggered massive selling in the market. Additionally, the token’s release from FTX bankruptcy raised concerns about oversupply.

Other major cryptocurrencies such as Ethereum (ETH) and Ripple (XRP) also experienced OI declines, indicating a broader market trend. Solana’s (SOL) OI decline reflects a change in sentiment amid macro and crypto-specific developments.

Navigating Solana’s Uncertainty

If Solana (SOL) manages to hold critical support at $125, it could signal a potential reversal. If Bitcoin (BTC) and Ethereum (ETH) regain momentum, Solana (SOL) could benefit from the positive sentiment, pushing it back to key resistance levels around $150-$160.

On the bearish side, a decisive drop below $110 could trigger further downward pressure, which could lead to increased liquidation. This scenario might be exacerbated by macroeconomic uncertainty, regulatory concerns, or massive altcoin selling.

The key downside levels to watch are $100 and $85, which could test investor confidence. Alternatively, SOL consolidation between $110 and $125 could indicate an accumulation phase. If open interest stabilizes and volumes increase, it may signal preparation for the next big move.

Conclusion

With various factors affecting the market, the future of Solana (SOL) remains uncertain. Investors and traders should pay attention to both key supports and resistances to identify opportunities and risks that may arise. Investment decisions should be based on in-depth analysis and a solid understanding of current market dynamics.

Also Read: Shiba Inu (SHIB) and the Challenges to a Price Rally in the Cryptocurrency Market (11/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana Futures drops 19%, SOL investors losing confidence. Accessed on March 12, 2025

- Featured Image: Decrypt

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.