Download Pintu App

SIMD-228 Proposal: Solana (SOL) to Cut Inflation by 80%!

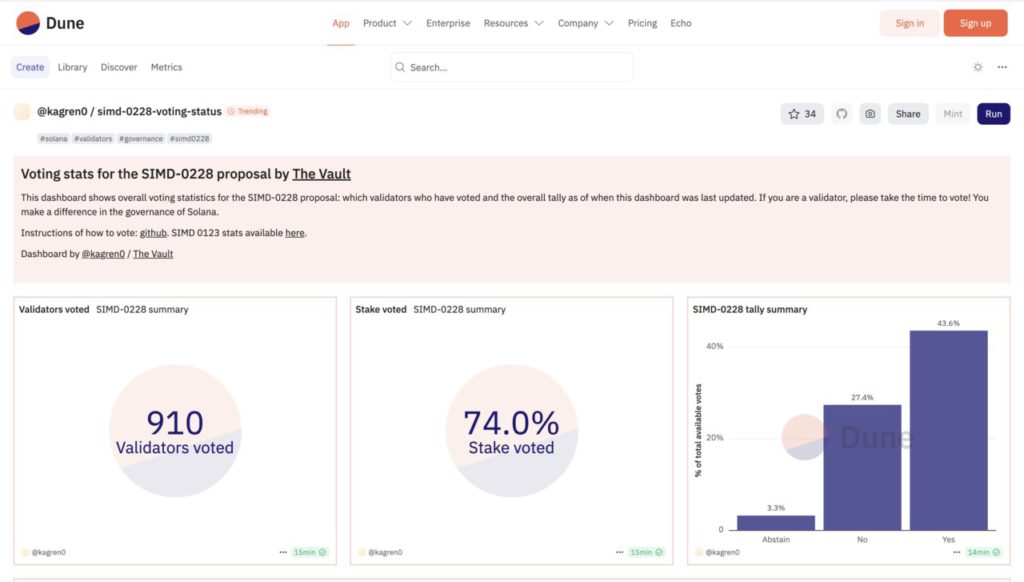

Jakarta, Pintu News SIMD-228’s proposal to cut Solana inflation (SOL) by 80% has received support from 35.7% of Solana validators.

Based on data from Dune Analytics, out of 1,327 active validators, 701 have cast their votes.

With 1.2% abstaining, 17.2% against, and 37.5% in favor, this proposal is a hot topic among the Solana community.

Proposal Details and Current Support

If approved, SIMD-228 will drastically reduce the staking rewards, which will reduce the number of new Solana tokens (SOL) in circulation. This is expected to reduce selling pressure in the market. Solana’s inflation model currently relies on a balance between burning transaction fees and staking rewards.

During periods of high network traffic, more fees are burned, which helps offset inflation. However, fewer tokens are taken out of circulation as transaction fees decrease. Staking incentives continue to add new SOL supply at an inflation rate of 6.8%, which may depress token prices.

Also read: XRP News: Will Ripple (XRP) Price Freefall to $1 or Surge to $3.5?

Impact on Validators and Decentralization

The reduction in staking rewards proposed by SIMD-228 may increase the value of Solana (SOL) by reducing supply. However, small validators with low or zero commission rates may find it difficult to remain profitable and may be forced out of the network.

If enough validators leave the network, Solana’s decentralization could be threatened, raising questions about its long-term sustainability. Before settling on SIMD-228, Solana developers had considered several options, including flat-rate adjustments.

Read also: 3 Memecoins that are the talk of the town ahead of Eid 2025

Market Performance and Future Prospects

Solana’s recent market performance has shown a decline. On March 13, Solana (SOL) was trading at $126, down more than 50% from its peak of $293 in January. Data from DefiLlama shows a decline in decentralized finance activity, with the total value locked on the network falling from $12 billion in January to $7 billion.

With the decrease in network usage, mainly due to the easing of the memecoin trade, monthly fees also dropped significantly, from $250 million in January to $89 million in February.

While the approval of SIMD-228 may alleviate supply pressures, its success depends on increased network demand. Reducing inflation alone may not be enough to drive a strong recovery without increasing users and activity.

Conclusion

The decision on the SIMD-228 proposal will largely determine the future of the Solana ecosystem. Given the challenges, the community and developers must carefully weigh the long-term impact of any decisions made, especially in relation to the health and decentralization of the network.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Solana Validators Vote to Implement SIMD 228, Cut SOL Inflation by 2025. Accessed on March 14, 2025

- Featured Image: Coinmarketcap

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.