Download Pintu App

Dogecoin (DOGE) is Back with a Bang, Spike in On-Chain Activity Reaches 400%!

Jakarta, Pintu News – Dogecoin (DOGE) has seen a significant increase in user engagement, with on-chain data showing a 400% spike in active addresses.

This phenomenon has caught the attention of many and raises questions about the factors driving this increase and its impact on the future Dogecoin (DOGE) price.

Check out the full news below!

Causes of Active Address Increase

Data from Santiment, as reported by crypto analyst Ali Charts, shows that the number of active Dogecoin (DOGE) addresses has jumped to nearly 395,000. This signals an increase in the number of users interacting with the network.

While the exact cause of this spike is unclear, it shows a growing interest in Dogecoin (DOGE) despite recent price fluctuations. This spike could also be signaling increased development activity within the Dogecoin (DOGE) network.

The more users involved, the more likely there is to be innovation and development of new features that can attract more users as well as investors.

Also read: PiFest 2025: Over 160 Countries with 950,000 Participants!

Dogecoin (DOGE) Price Performance

According to Coin Edition, from the end of December 2024 to the end of February 2025, the Dogecoin (DOGE) price showed a downward trend, with the number of active addresses decreasing every day. This suggests that the lower price has reduced user engagement.

However, since March 2025, there has been an increase in daily active addresses which has also coincided with a slight recovery in the Dogecoin (DOGE) price.

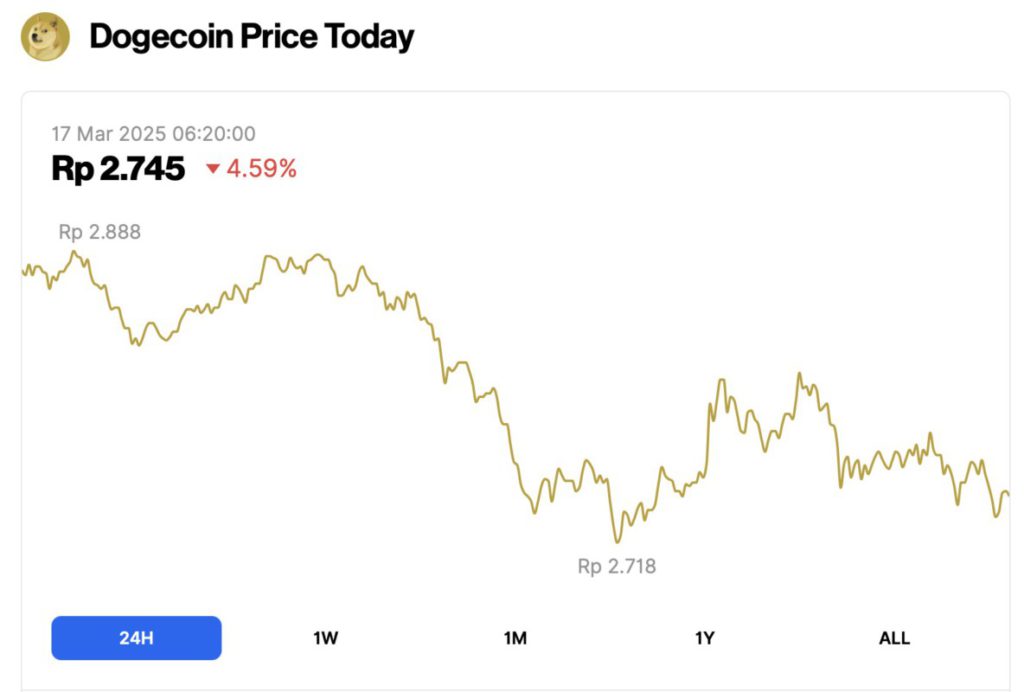

As of March 17, 2025, Dogecoin (DOGE) is trading at IDR2,745, down 4.59% in the last 24 hours and 18.39% over the last week. This recovery, although small, suggests an opportunity for further gains if this positive trend continues.

Also read: Ark Invest’s Huge Investment in Bitcoin, $80 Million Transaction Shocks the Market!

Relationship between Capital Flows and Prices

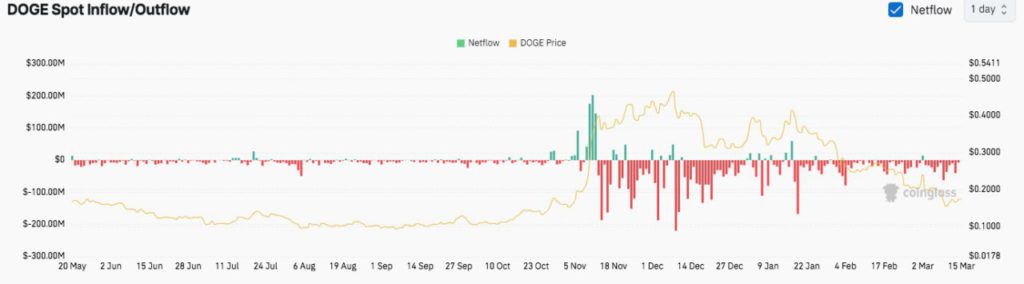

There is a strong correlation between market sentiment and the price of Dogecoin (DOGE). Analysis of capital flows from May 2024 to March 2025 shows that capital inflation during October-November 2024 corresponded with a surge in the Dogecoin (DOGE) price.

Conversely, price declines from December 2024 to March 2025 correlate with capital outflows. Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) also reflect the existing bearish sentiment. The RSI at 37.62 is approaching oversold conditions, which may signal a possible price reversal in the event of a recovery.

Meanwhile, the MACD indicator shows bearish divergence with the MACD line (blue) below the signal line (orange), although the MACD histogram has turned bullish with the formation of green bars.

Conclusion

The surge in user engagement on the Dogecoin (DOGE) network shows interesting market dynamics and growth potential.

While there are some challenges, such as the bearish sentiment shown by technical indicators, there are also signs of recovery that might trigger future price increases.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinEdition. On-Chain Data Shows Dogecoin User Engagement Spiking 400%. Accessed on March 17, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.