Download Pintu App

Shiba Inu (SHIB) on a Downward Trend: Impact of Death Cross Pattern in Late March 2025

Jakarta, Pintu News – Shiba Inu (SHIB) has been on a downward trend in recent weeks, with prices down more than 34% since February 2025. Currently, SHIB is trading at around $0.00001251(Rp204), after previously peaking at $0.00001894(Rp309) last February.

Over the past few weeks, SHIB has failed to maintain a sustained upward trend. Despite experiencing a 26% surge from its weekly low of $0.00001082(IDR176) to $0.0000138(IDR225), this rally was temporary before the price declined again. However, with token reserves on exchanges hitting an all-time low, it is possible that SHIB is gearing up for a recovery in the near future.

Death Cross Pattern and Potential for Further Decline

One technical indicator that triggers investor concerns is the appearance of a Death Cross pattern. This pattern occurs when the50-day moving average falls below the200-day moving average, which is often a bearish signal for an asset.

Currently, SHIB’s price is below both average lines, indicating that selling pressure is still dominating the market. In addition, the Bollinger Bands suggest that the $0.00001123(IDR183) level could be the next price target, reinforcing the bearish outlook in the short term.

Also Read: Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

Whale Activity and Market Sentiment

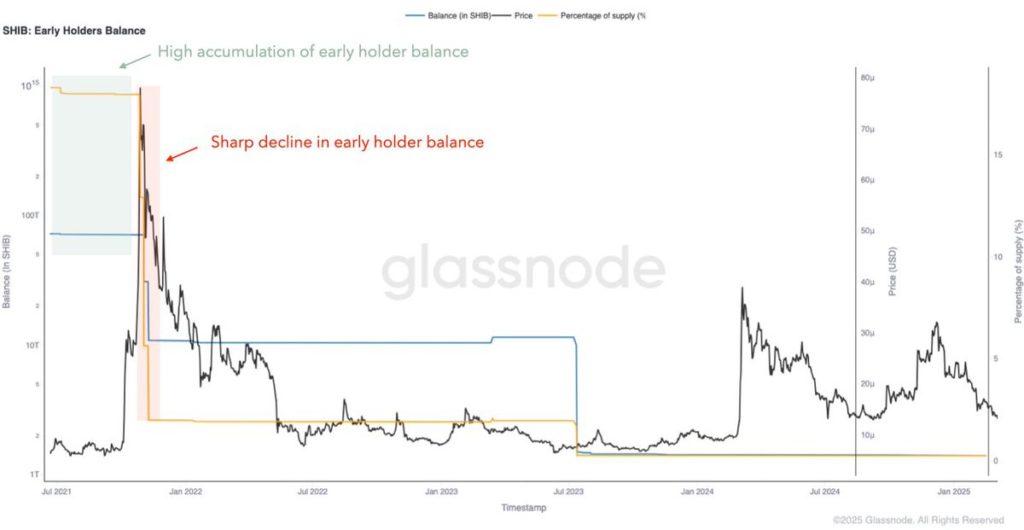

Data analysis from Glassnode shows thatwhales still play an important role in Shiba Inu price movements. Prior to the bullish rally in 2021, whales controlled around 20% of the total SHIB supply, meaning that their decisions to buy or sell in bulk could have a significant impact on the price.

Currently, investors are watching whether the whales will sell more of their holdings, which could further exacerbate the downward trend. However, the price level of $0.00001(IDR163) is considered a key support point for SHIB. Although SHIB has fallen below this level several times in the past month, each time there was a drop, the price quickly rebounded, signaling demand in the range.

In order to reverse this bearish trend, SHIB needs to break the resistance level at $0.000013(IDR212) again. If it fails to cross this boundary, the price is at risk of remaining in a downward range and may re-test its lowest support level.

Conclusion: Shiba Inu’s Future Remains Uncertain

Although technical indicators point to high selling pressure, low SHIB reserves on the exchange and potential whales movement could still change the market direction. For now, investors need to be cautious, especially as the Death Cross pattern suggests the possibility of further declines.

If SHIB can break the key resistance level again, then a bullish outlook could start to emerge. However, without a significant recovery, the asset could remain under bearish pressure for the foreseeable future.

Also Read: Ethereum (ETH) has the potential to surge sharply, analysts reveal similarities with 2020 trends

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Will Shiba Inu Price Decline Continue as Death Cross Pattern Emerges? Accessed March 19, 2025.

- Featured Image: Cryptopotato

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.