Download Pintu App

Ethereum Devs Confirm Holesky Testnet Shutdown by September 2025 — Here’s Why It Matters

Jakarta, Pintu News – Ethereum core developers have officially announced plans to stop supporting the Holesky testnet in September 2025.

This decision marks the continuation of Ethereum’s testnet transition phase, following the retirement of Kiln, Ropsten, and Rinkeby in 2022, and Goerli in 2023.

Serious Problems in Holesky: Exit Queue Validator and Chain Split

Holesky, which launched in September 2023, was originally designed as a major testnet alongside Sepolia, specifically for staking and infrastructure testing. However, a series of technical issues have made it difficult to use for testing major updates such as the Pectra Upgrade.

Read also: New Breakthrough at Cosmos: EVM Integration that Enhances Interoperability and Innovation!

Some time ago, Pintu News reported that Holesky faced various obstacles during the trial of the Pectra Upgrade, a major protocol update scheduled for release on the Ethereum mainnet in the second quarter of 2025.

One of the main problems is the congested validator exit queue, which can take up to a year for validators who want to leave the network.

In addition, some major execution clients such as Geth, Nethermind, and Besu had used incorrect deposit contract addresses, causing bugs in the execution layer and triggering chain splits that weakened network stability.

This makes Holesky not ideal for full-cycle testing of validator or other community scenarios, although the network still allows deposit testing.

New Testnet “Hoodi” Will Take Over Holesky’s Role

As a solution, the Ethereum Foundation introduced Hoodi, a new testnet that will take over the testing of Pectra updates. This testnet is scheduled to go live on March 26, 2025 at epoch 2048 at 07:37 UTC.

Staking operators and infrastructure providers are encouraged to migrate their tests to Hoodi as soon as possible. Ethereum stated that Hoodi will be used until September 2028, while the Sepolia testnet will be retired in September 2026.

Holesky itself will still be operational until the end of its support period and will likely be used for limited internal testing, such as gas limit improvement experiments and other protocol-level testing.

Impact on Ethereum Ecosystem and Market Sentiment

Ethereum’s move to optimize its testnet infrastructure aims to improve the efficiency and reliability of testing before new features are released on the mainnet. This is important so that major network upgrades like Pectra can be rolled out without a hitch.

Read also: Ethreum Price Down 2% Today (3/21/25): Whale Crypto Withdraws $29 Million ETH!

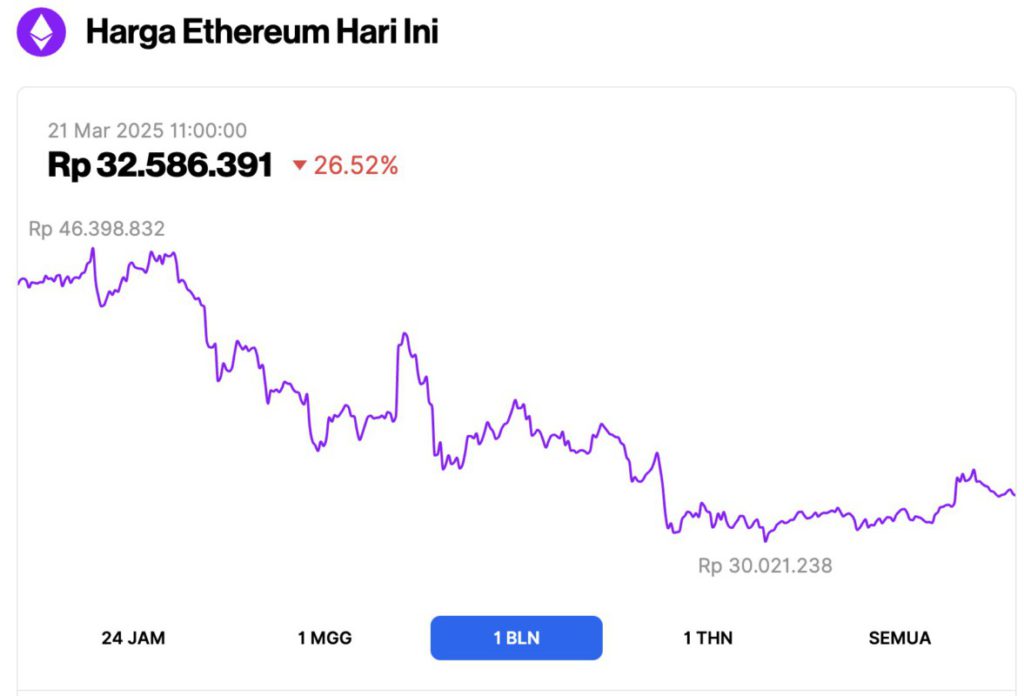

On the other hand, Ethereum (ETH) has been under market pressure, with prices dropping around 26% in the past month, and is currently trading at around IDR 32.5 million (21/3/25).

However, on-chain metrics indicate a positive long-term sentiment. Only 6.38% of total ETH supply remains on centralized exchanges, the lowest since Ethereum’s launch, according to a report by Crypto News (3/20). This suggests that many investors are moving their ETH into cold storage, signaling a desire for long-term holds.

Ethereum Transaction Fees Decrease: A Positive Signal for Adoption

In addition, Ethereum’s transaction fees have also plummeted to an average of just €6.78 ($0.41) per transfer, the lowest level since August last year. This contrasts with peak fees that once reached Rp251,208 ($15.21) in the past two years.

Low fees indicate reduced network congestion, which has historically been a healthy signal for Ethereum’s long-term growth, particularly for application development and institutional adoption.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptonews. Ethereum Core Developers to Phase Out Holesky Testnet by September 2025. Accessed March 21, 2025.

- Crypto Slate. Ethereum to end support for Holesky testnet by September 2025. Accessed March 21, 2025.

- The Block. Ethereum developers to end support for Holesky testnet in September. Accessed March 21, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.