Download Pintu App

Bitcoin Holds Strong at $83K on April 4 — Institutions Are Scooping Up BTC Like Never Before!

Jakarta, Pintu News – Based on the latest data from Arkham Intelligence, three major Bitcoin (BTC) ETF issuers were recorded as buying large amounts of BTC on April 3, 2025. Yesterday alone, the total net inflows from these ETFs reached $220 million, signaling potential expectations of increased demand in the near future.

Despite sharp fluctuations in the price of Bitcoin in recent days, institutional investors seem to show a higher level of confidence in the largest cryptocurrency than traditional financial markets (TradFi).

Then, how will the Bitcoin price move today?

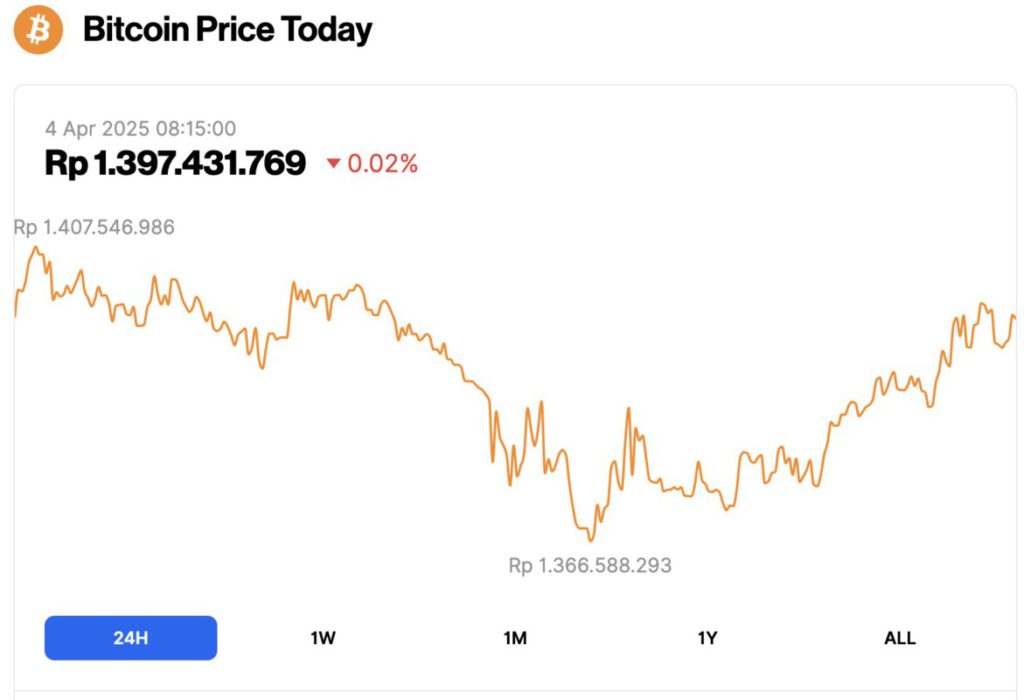

Bitcoin Price Drops 0.02% in 24 Hours

On April 4, 2025, Bitcoin (BTC) was trading at $83,174, or approximately IDR 1,397,431,769. The price saw a slight dip of 0.02% over the past 24 hours. During this period, BTC reached a daily high of IDR 1,407,546,986 and dipped to a low of IDR 1,366,588,293, reflecting mild intraday volatility.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.65 trillion, with trading volume in the last 24 hours also down 27% to $35.72 billion.

Read also: Pi Network Receives Sharp Criticism, Pi Coin Price to Remain at $0.60 Throughout April?

Why are ETF Issuers Buying Up Bitcoin?

The crypto market today experienced a wave of widespread liquidation, amid fears of a global recession looming.

After former President Donald Trump implemented much higher-than-expected import tariffs, the crypto market began to mirror the conditions of the traditional stock market (TradFi) with a notable downward trend.

However, in contrast to the general market conditions, spot Bitcoin ETFs in the US are showing signs of resurgent institutional demand in the short term.

In a social media post, Arkham Intelligence highlighted this phenomenon with a statement:

“Donald Trump just put tariffs on the whole world. So what? Grayscale bought Bitcoin, Fidelity bought Bitcoin, Ark Invest also bought Bitcoin.”

Arkham, as a leading blockchain analysis platform, is not the only one to notice this trend. Although Bitcoin’s price is still highly volatile in the past two days, the asset continues to successfully return to its base price level.

Bitcoin Investors’ Positions Begin to Balance

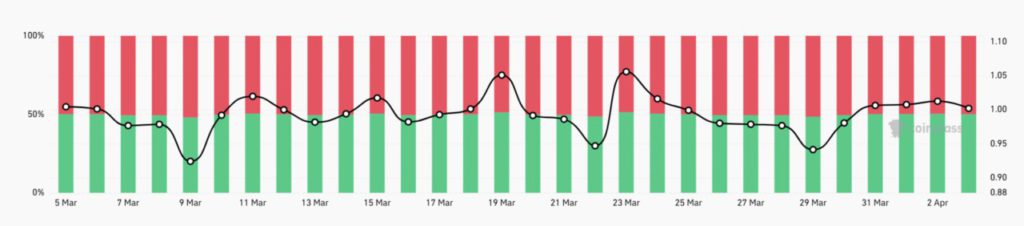

Reporting from BeInCrypto (3/4/25), Bitcoin’ s long-short ratio last week was at 0.94, and has now risen to 1.00 – indicating that investor positions are starting to balance. Previously, with 48.5% long positions and 51.5% short positions, the market tended to be slightly bearish.

Now, the positions are almost balanced, with 50.5% long, indicating that market sentiment is neutral and bearish pressure is easing.

The current balance of long and short positions suggests that market sentiment is stabilizing, reflecting the increasing uncertainty towards Bitcoin’s price movements in the near future.

Read also: Legendary Trader Peter Brandt Predicts Bitcoin Plummeting to $70,000, What Will Happen Next?

Many investors may choose to wait for clearer market signals before taking a position with a firmer direction.

Bitcoin ETF Net Inflows Total $220 Million

Interestingly, Bitcoin ETFs are also performing strongly in other sectors. Based on data from SoSo Value, total net inflows into this asset category reached $220 million in just one day yesterday-a very significant figure.

Although Donald Trump’s tariff announcement came after the stock market closed on Liberation Day, the ETF’s growth remains an impressive highlight.

The direct impact of today’s market turmoil on Bitcoin ETFs is not entirely clear. However, data from Arkham Intelligence shows that ETF issuers are making large BTC purchases.

At the very least, this signals that institutions are anticipating a surge in demand in the near future. While there are still many unanswered questions regarding tariff policies, crypto market conditions, and the overall global economic situation, this trend is worth noting.

If inflows into ETFs continue throughout this week, it will reflect that institutional investors increasingly believe that Bitcoin will remain more stable and sustainable than traditional financial markets (TradFi) amid growing recessionary concerns.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Onchain Data Suggests That Major ETF Issuers Are Buying Bitcoin. Accessed on April 4, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.