Download Pintu App

Ethereum Price Increase Potential: Latest Analysis and Predictions Mid-April 2025

Jakarta, Pintu News – In recent months, Ethereum (ETH) has experienced a significant price drop, but analyst Ted Pillows highlighted several major events scheduled for May 2025 that could push Ethereum (ETH) prices back up. From technical improvements to the introduction of new exchange-traded funds (ETFs), these factors are expected to bring a breath of fresh air to Ethereum (ETH).

Pectra Upgrade and Its Impact

The Pectra upgrade scheduled for May 7, 2025, is expected to bring major changes to the staking process, deposit processing, blob capacity, and Ethereum (ETH) account abstraction. These changes will not only improve efficiency but also security in the Ethereum (ETH) network. With these improvements, Ethereum (ETH) is expected to be more attractive to institutional and individual investors.

In addition, the upgrade is also expected to increase transparency and transaction speed, making Ethereum (ETH) more competitive compared to other blockchains. Analysts predict that each event in this upgrade could potentially increase the price of Ethereum (ETH) by $1,000.

Also Read: Solana’s Whale Movement and Selling Pressure: What is the Impact on Crucial Support Levels?

Introduction of Ethereum Staking ETF

The introduction of a staking ETF for Ethereum (ETH) is also an important factor that is expected to boost prices. Since the launch of the spot Ethereum (ETH) ETF last year, it has not performed as well as the spot Bitcoin (BTC) ETF. However, with applications filed by Cboe, Fidelity, and NYSE to allow staking in their ETFs, this situation could change.

This application, if approved, will allow investors to earn returns on staking, adding an attractive passive income stream for ETF holders. This is expected to increase demand and, as a result, the price of Ethereum (ETH) in the market.

Market Optimism and Investor Sentiment

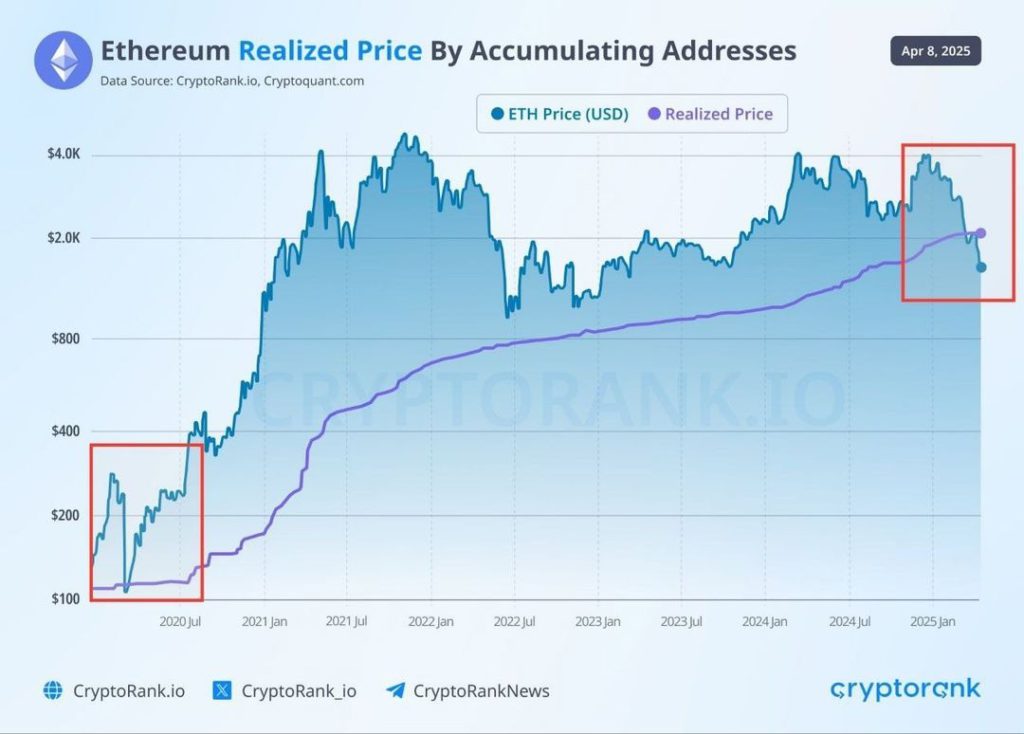

Although Ethereum (ETH) is currently considered a less popular token, many see this as an opportunity to buy. Recent analysis from BeInCrypto shows that Ethereum (ETH) is currently undervalued, based on the MVRV Ratio position being within the “opportunity zone”.

In addition, President Trump’s decision to delay tariffs almost entirely for 90 days has also aided the broader market recovery. This decision, along with the SEC’s approval of options trading on the iShares Ethereum ETF (ETHA) by BlackRock, has driven a significant rise in Ethereum (ETH) prices.

Conclusion

With various key events scheduled and favorable regulatory changes, the future of Ethereum (ETH) looks bright. Investors considering entering or adding to their holdings in Ethereum (ETH) may find that now is a good time to act, given the potential for significant price increases in the future.

Read More: Solana Price Moves Up: Potential Strengthening or Correction in April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Price Recovery Outlook. Accessed on April 11, 2025

- Featured Image: Bitcoin Sistemi

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.