Download Pintu App

Why Did Alpaca Finance (ALPACA) Surge 1,000% Despite Being Delisted?

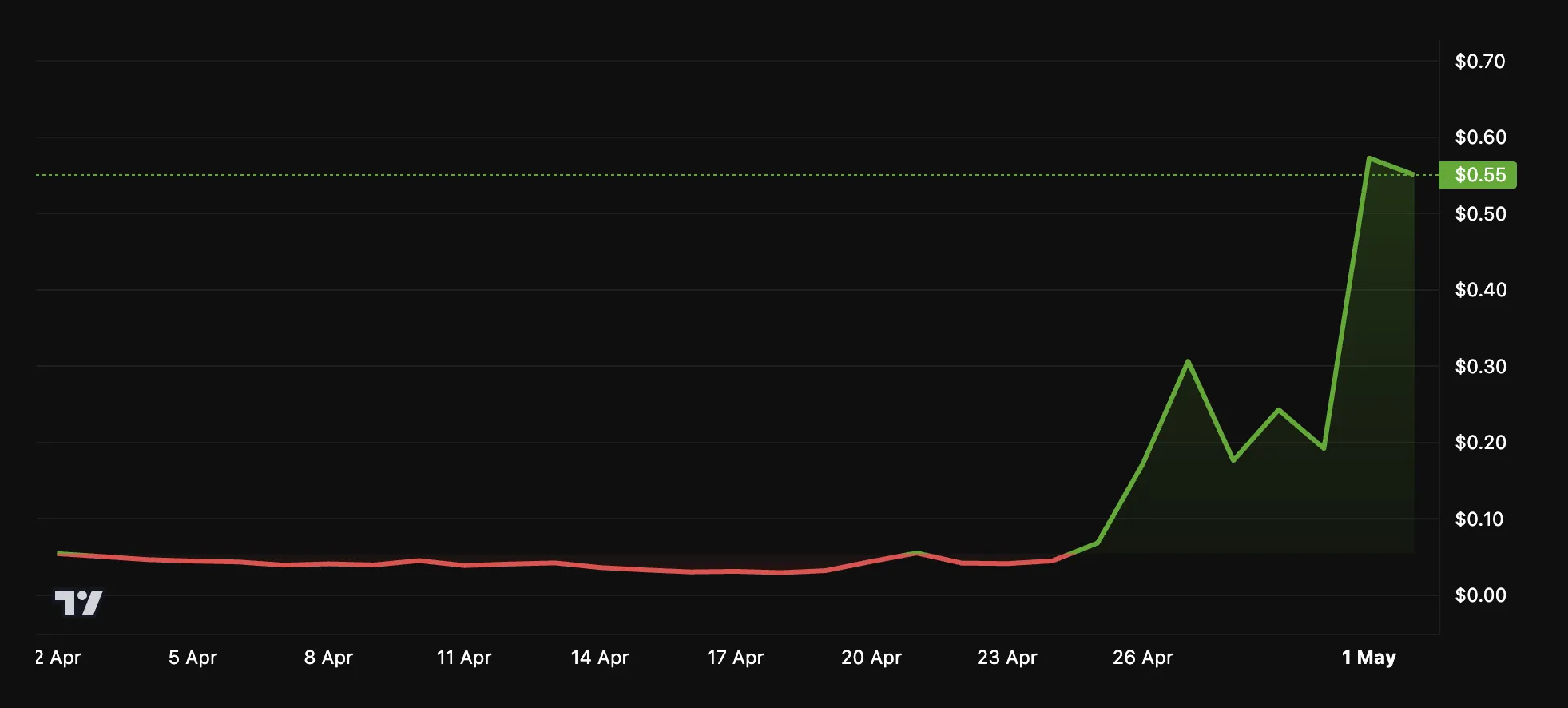

Jakarta, Pintu News – The Alpaca Finance (ALPACA) token has recently experienced an incredible price surge, rising more than 1,000% in just the past week.

This increase comes after Binance announced that it would delist the token from its platform—a condition that usually drives prices down.

This phenomenon immediately sparked considerable debate among analysts and traders. Many suspected that this price spike was not a natural occurrence, but the result of market manipulation.

So, why is ALPACA’s price on the rise? Here’s the full analysis from crypto experts!

Why is ALPACA’s price rising even though it will be removed from Binance?

According to BeInCrypto, when a digital asset is about to be removed from a large exchange like Binance, its price typically tends to fall due to reduced liquidity and exposure.

However, ALPACA surged sharply. After the delisting announcement on April 24, the token skyrocketed by more than 1,000%.

But ahead of its official delisting day on May 2, the price started to fall sharply. In the past day, the price has dropped by around 34.5% and is now trading at $0.55.

Read also: Antam Gold Price Chart Today May 2, 2025, How is the Movement?

Alleged Manipulation: “Pump & Dump” by Whale

One social media user called ALPACA’s price movement the crudest manipulation they had ever seen. The price had jumped from $0.02 to $ 0.30, then dropped to $0.07, then jumped again to $1.27, and finally back down to $ 0.30.

Crypto analyst Budhil Vyas describes this as a classic example of “liquidity hunting” – a strategy where whales deliberately drop prices to induce panic and prompt investors to sell at a lower price. Afterward, they quickly raise the price just hours before delisting, then sell at a huge profit.

According to Vyas, there was no real accumulation by retail investors. All just a ploy to drain market liquidity before assets are removed from trading.

Read also: 24 Karat Gold Price Today May 2, 2025, Check the Chart Below!

Exploitation Tactics Ahead of Delisting?

Another analyst, Johannes, explained that this kind of manipulation often occurs due to decreased liquidity following the delisting announcement.

Professional traders capitalize on these conditions by controlling a large portion of the token supply, then drive the price up by buying on the spot market and opening positions on derivative contracts, such as futures.

When prices soar and there is not much selling pressure (as supply is overwhelmed), they can close out futures positions with huge profits when delisting occurs – with minimal risk of loss.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Experts Break Down Why ALPACA’s 1,000% Surge Could Be Market Manipulation. Accessed May 2, 2025

- Featured Image: Coingape

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.