Download Pintu App

Bitcoin (BTC) Prepares to Surpass Gold, a New Era of Growth Begins!

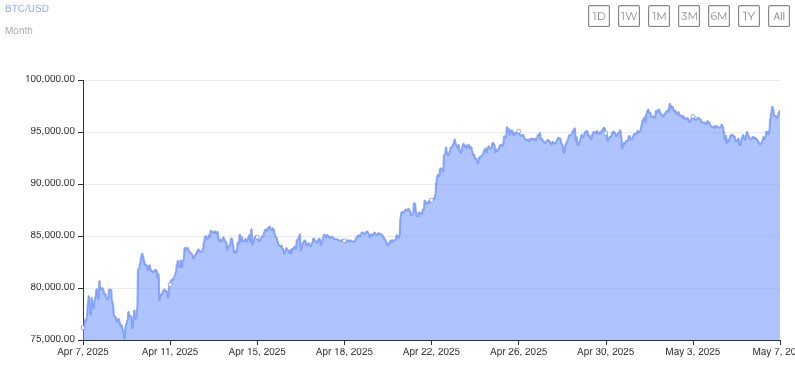

Jakarta, Pintu News – Bitcoin (BTC) is currently attempting to surpass its previous high of $109,000, after experiencing a significant rise from $74,000 to $93,000. Recent market analysis suggests that macroeconomic factors will be the main trigger in positioning Bitcoin (BTC) as an inflation hedge.

Comparison with Amazon

An analyst has compared the growth of Bitcoin (BTC) to Amazon (AMZN) stock which has grown from $1 to $230 from the beginning of 2000 to 2025. Although Amazon (AMZN) experienced some downturns, the asset showed resilience and the ability to overcome various challenges and extensive market liquidation. This trait of resilience and strength is also seen in Bitcoin (BTC), which has bounced back several times from major crashes due to exchange failures and crypto crackdowns.

Also Read: 3 Altcoins Ready to Surge Before SEC-BlackRock Meeting, See Why!

Quadrennial Cycle Change

According to Matt Hougan, Chief Investment Officer at Bitwise, the traditional four-year cycle of Bitcoin (BTC) is over. Now, economic factors are the main driver of this cycle, rather than Bitcoin block reward halving events. Bitcoin Archive revealed that this situation could align Bitcoin’s (BTC) long-term growth with Amazon’s (AMZN) in the next 20 years. Other analysts assert that the four-year cycle is indeed over, and Bitcoin (BTC) is now influenced by broader macroeconomic forces.

Prediction and Institutional Investment

Bitcoin’s (BTC) supply shortage is in the spotlight as only 165,000 BTC is expected to be mined by 2025. Meanwhile, in the first quarter of 2025, a total of 95,000 BTC has been acquired by institutional investors. Gracy Chen, Managing Director and CEO of Bitget, predicts that the market capitalization of Bitcoin (BTC) will surpass that of gold by 2025. Currently, the market capitalization of gold is about $22.6 trillion, while Bitcoin (BTC) is only about $1.86 trillion.

Conclusion

With various predictions and analyses describing a bright future for Bitcoin (BTC), the asset looks set to continue to grow and possibly surpass gold in terms of market capitalization. This growth not only shows the potential of Bitcoin (BTC) as a digital asset, but also as an investment tool that is increasingly recognized on a global level.

Also Read: New Hampshire Becomes a Pioneer, Officially Keeping Bitcoin as a Reserve!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Bitcoin May Be Entering a New Growth Era Similar to Amazon’s Rise. Accessed on May 7, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.