Download Pintu App

Pi Coin Price Prediction Ahead of May 10: Can Pi Network Rise After Falling 80%?

Jakarta, Pintu News – After experiencing a drastic price drop of up to 80% from its peak last February, Pi Coin is now under the spotlight of crypto investors. Although Pi Coin’s price currently stands at around Rp9,565 (equivalent to $0.58, at an exchange rate of Rp16,491/USD), market interest in the asset has fallen sharply. Slumping trading activity and weak technical indicators raise the question of whether Pi Network can recover or if it will continue its downward trend.

Trading Volume Plummets, Signaling Market Unwillingness

One of the key indicators reflecting Pi Coin’s current weak performance is its trading volume. From reaching IDR57 trillion ($3.5 billion) per day in February, trading volume has now fallen below IDR660 billion ($40 million). This drastic drop reflects significantly reduced market interest and suggests that liquidity and sentiment towards Pi Coin is weakening.

This drop in volume also goes hand in hand with a significant drop in price. In the past week alone, Pi Coin recorded an additional decline of 10%. This situation makes many investors hesitant to re-enter the market, given that there are no strong signals of recovery from the fundamental or technical side.

Also Read: Will Solana Reach $420 in 2025? Check out the Prediction!

Technical Indicators Are Still Negative

In terms of technical analysis, indicators are currently showing that bearish pressure is still dominant. On the four-hour chart, the Bollinger Bands show a narrowing of volatility, a pattern that often precedes the next big price move. However, the Awesome Oscillator indicator is in the negative zone at -0.0073, signaling that selling forces still rule the market.

In addition, Pi Coin’s price is still trading below its 20-day exponential moving average (EMA), and the Bull Bear Power indicator is also giving a negative signal. These indicators combined suggest that selling pressure is likely to continue to dominate in the near term, barring a significant surge in trading volume.

Short Term Price Targets and Rebound Potential

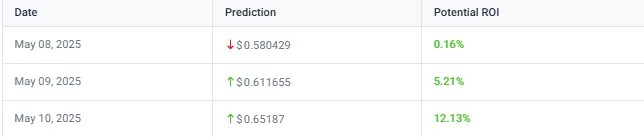

According to CoinCodex’s price prediction model, there is a possibility of Pi Coin’s price rising by approximately 12.13% in the short term, towards a range of IDR10,749 ($0.65187). However, this upside potential is highly dependent on increased trading volumes and changes in market sentiment. If the selling pressure continues, the critical support level is around IDR6,596 ($0.40), which could be the next testing area.

On the other hand, in the event of an unexpected surge in volume, the price could move up to resistance around Rp12,184 ($0.74). In an optimistic scenario, Pi Coin’s price could even try to break the psychological threshold of IDR16,491 ($1), although this scenario currently looks difficult to achieve.

Pi Network’s Long-term Outlook: Contrasting Optimism

Despite the current disappointing performance, some long-term predictions still show optimism. A prediction model from CoinCodex estimates that Pi Coin could reach IDR 31,370 ($1,904305) by June 2025, which translates to an increase of about 228.09% from its current price. However, the discrepancy between this optimism and technical reality as well as the low trading volume are important notes for potential investors.

The Fear & Greed index shows a level of 67 (Greed), which historically indicates high buying interest in the market. However, with only 43% green trading days in the past month, this data shows a mismatch between market sentiment and Pi Coin’s actual performance.

Conclusion

Pi Coin is facing major challenges after a sharp drop in price and trading volume. Although some short-term predictions suggest the possibility of a limited recovery, technical indicators and declining market interest signal that the path to recovery is still long and full of risks. Market participants in the crypto sector need to consider these factors carefully before making an investment decision on Pi Network.

Also Read: Bitcoin Poised for a Big Spike Amid US Economic Chaos?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Loredana Harsana / Watcher.Guru. Pi Coin May 10 Forecast: Can Pi Network Recover After 80% Meltdown? Accessed May 7, 2025.

- Featured Image: Coinpedia

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.