Download Pintu App

Will Solana (SOL) Surge? Golden Cross Signal Appears

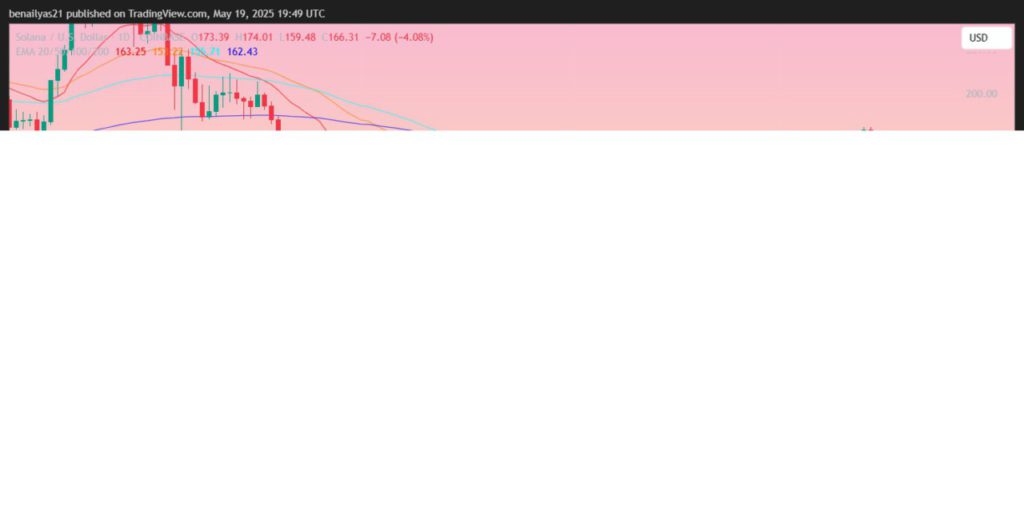

Jakarta, Pintu News – Solana (SOL) has performed impressively with prices stabilizing around $170 over the past week. Following the rally earlier in the month, analysts are now watching the development of the Golden Cross indicator which could signal further upward momentum.

With Solana’s 50-day daily moving average (SOL) now higher than the 200-day average, many are predicting a potential price increase of up to 50%, possibly reaching $240 in the short term.

Golden Cross Observation

A Golden Cross occurs when the 50-day price moving average crosses above the 200-day moving average, a signal that is often considered bullish by traders. In the case of Solana (SOL), this phenomenon has sparked speculation about the possibility of a large rally. History has shown that when a Golden Cross is formed, prices tend to rise significantly.

If this trend continues, it is possible that Solana (SOL) will reach $240 in the near future. With the bullish “cup and handle” formation also visible, this adds to the confidence that the price could move higher. The $200 level is a critical zone to watch, as a break above this level could trigger further gains.

Also Read: XRP Futures Launches on CME: A New Beginning for Crypto Investing!

Price Analysis and Prediction

According to crypto analyst Ali Martinez, a price close above $200 would confirm the bullish setup currently forming. This level is not only technically important but also has psychological implications, related to the call options that will expire on June 27.

Solana’s (SOL) rise of 57.75% since April 8 has surpassed Bitcoin’s (BTC) rise in the same period, suggesting that Solana (SOL) has potential that has yet to be fully explored. However, it is important to note that if the price falls below $160, the progress that has been made could be reversed, and the price could drop to $150. Analysts emphasize that maintaining the price above $160 is crucial to reaching the $200 target.

Market Dynamics and Solana ETFs

Optimism about Solana (SOL) is not only driven by price trends. The launch of two Solana futures ETFs in the US has added momentum. The Solana ETF (SOLZ) and 2x Solana ETF (SOLT) launched by Volatility Shares on March 20, while not as hyped as the first Bitcoin ETF launch, have been well received.

With total assets under management now reaching $17 million for SOLZ and $32 million for SOLT, it shows signs of increased investor optimism. While still far behind Bitcoin (BTC) with a market capitalization of $2 trillion and Ethereum (ETH) with $300 billion, Solana (SOL) with a market capitalization of around $90 billion shows significant growth potential.

Conclusion

With a range of favorable technical indicators and positive market dynamics, the future looks bright for Solana (SOL). Investors and traders will continue to monitor this development, as any price movement above critical levels could be a turning point for an even higher price increase.

Also Read: SEC and Crypto Regulation: Between Stability and Innovation

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Solana Approaches Golden Cross, SOL Rally. Accessed on May 20, 2025

- Featured Image: ZipMex

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.