Download Pintu App

Bitcoin Holds Strong at $108,000 Today (May 28) — Bitwise Predicts Massive $426 Billion Inflow by 2026!

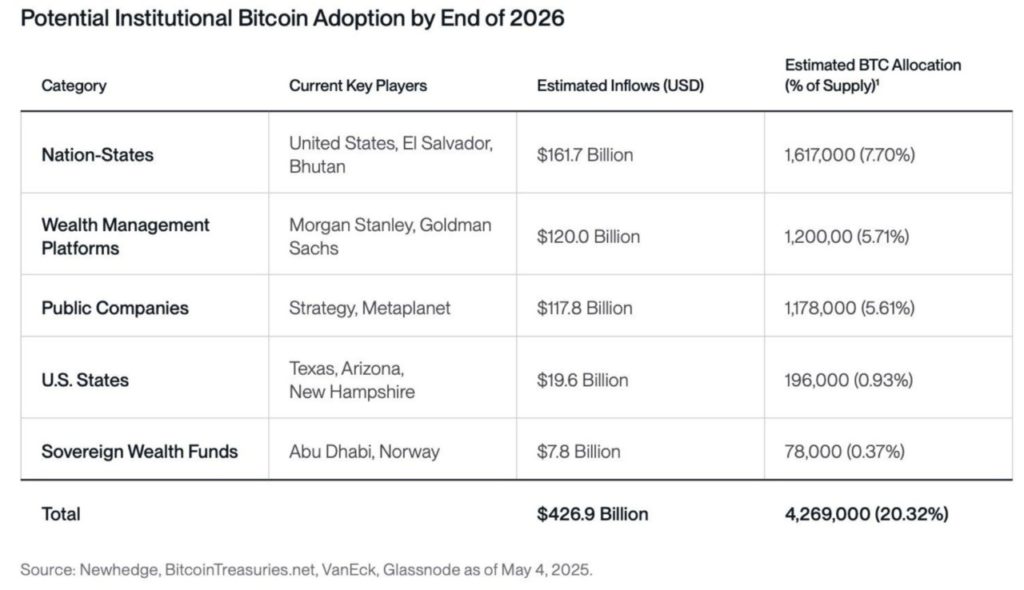

Jakarta, Pintu News – A recent report from Bitwise Investments revealed that institutional capital flows into Bitcoin (BTC) are expected to reach $426.9 billion by 2026.

This phenomenon is driven by the increasing adoption by major financial institutions and governments around the world.

With widespread involvement, the dynamics of Bitcoin (BTC) supply and demand are undergoing significant changes, potentially affecting the price and stability of the market.

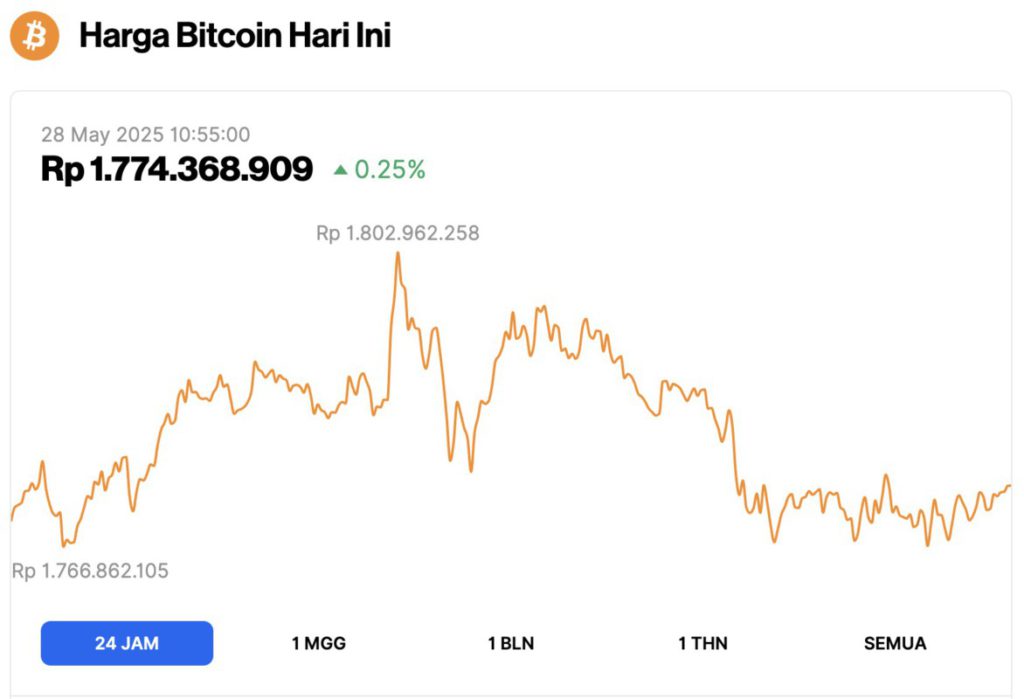

Bitcoin Price Up 0.25% in 24 Hours

On May 28, 2025, Bitcoin was trading at $108,937, or approximately IDR 1,774,368,909 — marking a modest 0.25% increase over the past 24 hours. During this time, BTC dipped to a low of IDR 1,766,862,105 and peaked at IDR 1,802,962,258.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.16 trillion, with trading volume in the last 24 hours rising 9% to $54.45 billion.

Bitcoin Adoption by Financial Institutions

According to recent reports, a number of reputable financial institutions have included Bitcoin (BTC) in their investment portfolios.

Morgan Stanley and Fidelity, for example, have been involved since 2024. BlackRock’s Bitcoin ETF, known as IBIT, currently manages $71 billion worth of Bitcoin.

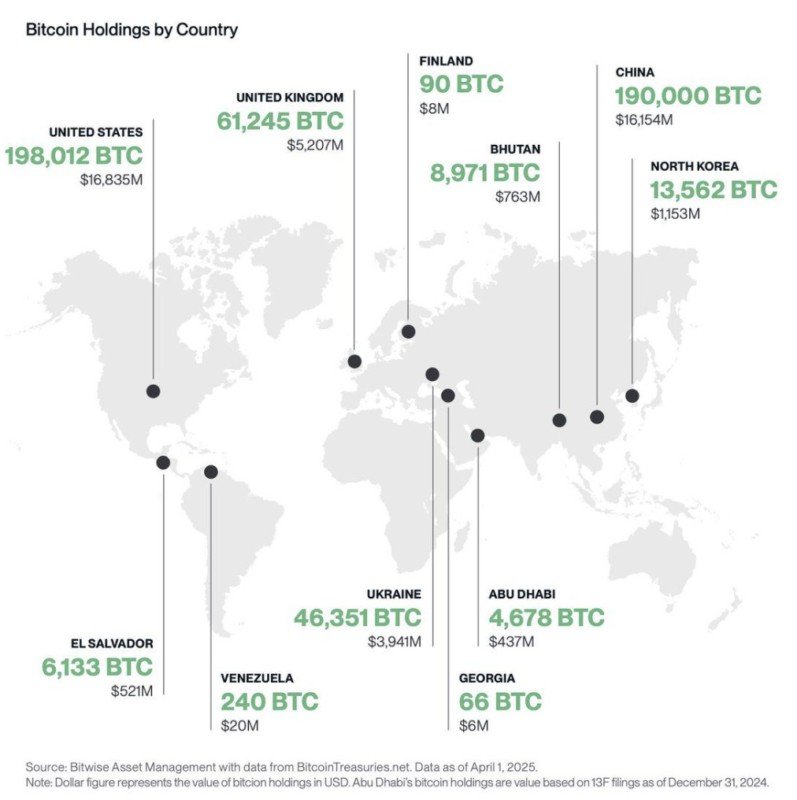

On the other hand, Strategy became the largest institutional investor with holdings of 576,230 BTC, which accounts for 2.74% of the total supply. Additionally, countries such as El Salvador and China have also secured significant amounts of Bitcoin (BTC).

El Salvador has 6,133 BTC, while China, despite banning crypto trading, has around 190,000 BTC. These engagements show that Bitcoin (BTC) is increasingly accepted as a legitimate investment asset on a global level.

Read also: Michael Saylor’s Strategy Buys Another 4,020 BTC Worth $427 Million, MSTR Shares Plummet 7%!

Supply and Demand Implications

With projections that 4.2 million BTC will move into institutional hands, representing 20.3% of the total supply, the market is facing a severe supply shortage. This is compounded by the fact that only around 164,250 BTC is issued annually post the 2024 Bitcoin Halving.

This supply shortage has contributed to the surge in Bitcoin price in May 2025, reaching new record highs. It has also created price pressure that may be sustained.

However, if large institutions decide to sell their Bitcoin (BTC) simultaneously, the market could experience significant volatility. The balance between limited supply and high demand is key in predicting the future price movement of Bitcoin (BTC).

Risk and Regulation

While the growth prospects for Bitcoin (BTC) seem tantalizing, there are significant risks attached to it. High market volatility and potential heavy selling by institutions could destabilize the price.

In addition, increased scrutiny by the United States SEC of Bitcoin ETFs adds to the uncertainty in institutional capital flows.

Macroeconomic factors such as the Federal Reserve’s interest rate expected to remain fixed in June 2025 also have the potential to slow capital flows into risky assets such as Bitcoin (BTC).

Therefore, investors and stakeholders should consider all these aspects in making investment decisions.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Institutional Inflows to Reshape Bitcoin Trajectory. Accessed on May 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.