Download Pintu App

Ethereum Stalls at $2,600 — Are Crypto Whales Plotting a Massive ETH Breakout?

Jakarta, Pintu News – Ethereum (ETH) is still moving flat in trading, but underneath it all, it seems that momentum is starting to build.

Although market participants appear to be holding back due to stagnant market conditions, on-chain data shows that the Ethereum ecosystem is more active than ever.

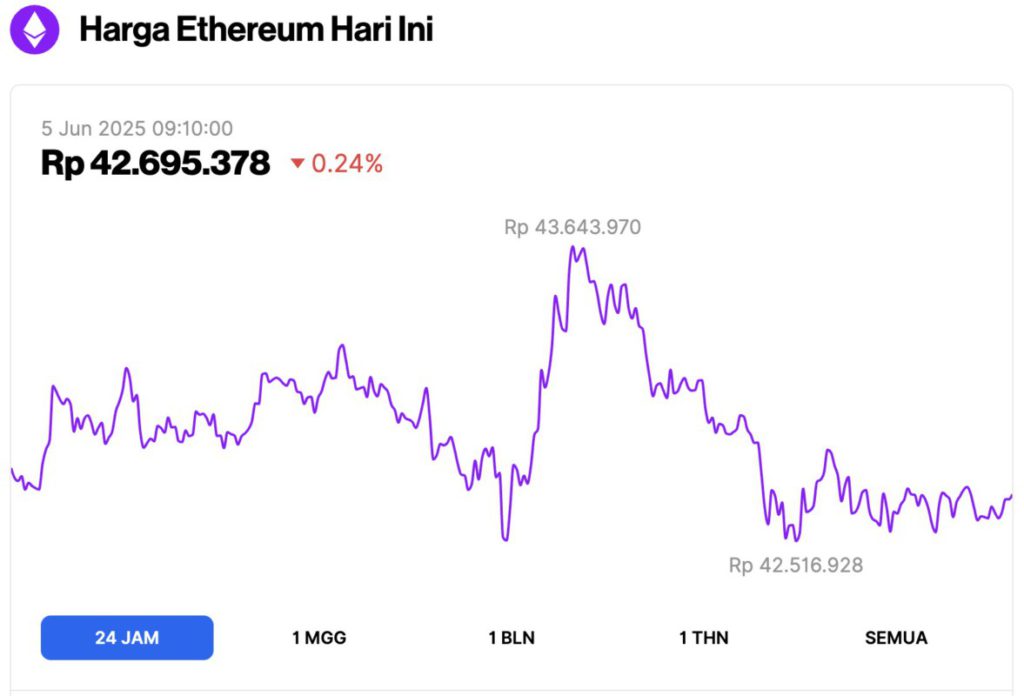

Ethereum Price Drops 0.24% in 24 Hours

As of June 5, 2025, Ethereum (ETH) was trading at approximately $2,613, or around IDR 42,695,378. Over the past 24 hours, the price saw a slight dip of 0.24%. During this period, ETH reached a high of IDR 43,643,970 and a low of IDR 42,516,928.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $315.91 billion, with daily trading volume rising 13% to $18.3 billion in the last 24 hours.

Read also: Bitcoin Crashes to $104K — Is History Repeating Itself Like 2017? Massive Surge Incoming?

ETH Market Makers Back in Action

Aphractal founder Joao Wedson observed that Ethereum market makers are back in full force.

Based on his analysis using the Wyckoff approach, he sees that both accumulation and distribution patterns are happening simultaneously, but accumulation seems to dominate.

Of course, this is not just speculation.

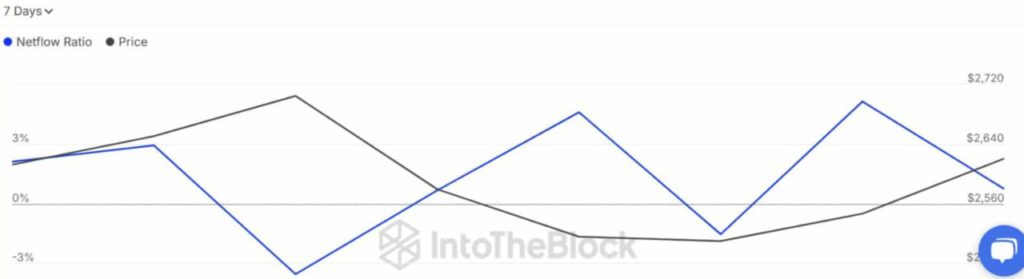

Ethereum is undergoing heavy accumulation from various market participants. As an early indicator, Ethereum Spot Netflow has been negative for an entire week, signaling consistent outflows from exchanges.

This shows that there are more buyers in the market than sellers. Currently, buyers come from all walks of life, including Ethereum whales who are aggressively buying.

Whales are on the Hunt for Ethereum

Furthermore, the Large Holders Netflow to Exchange Netflow ratio also supports this view. The ratio fell sharply from 4.28% to 0.62%, indicating that the whales have started to reduce their activity on the exchanges.

This means that the whales aren’t selling Ethereum – they’re buying it.

Read also: Major Shakeup Rocks Ethereum Foundation — What It Means for Your Crypto Holdings

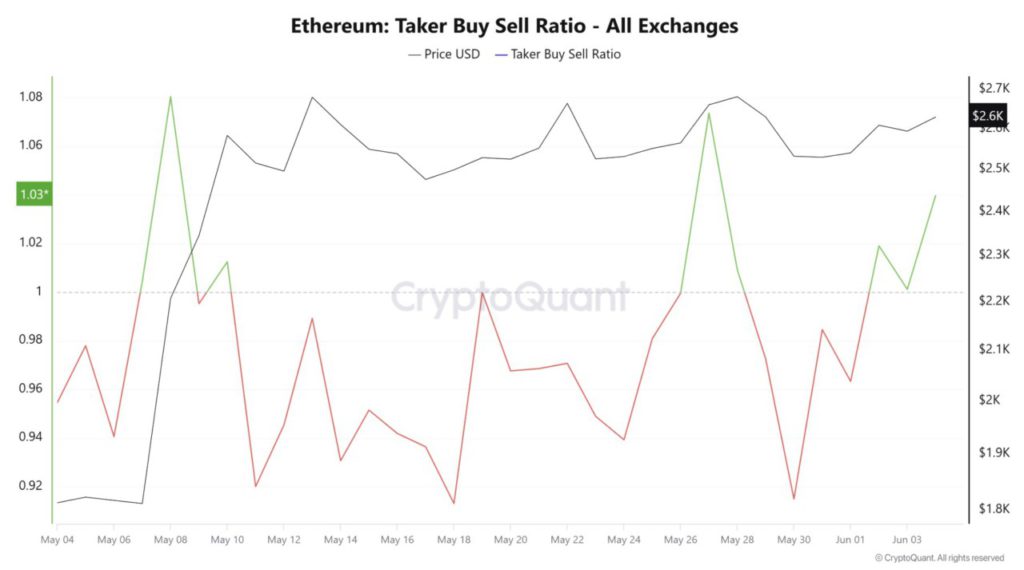

Increased buying activity has made buyers dominate the market in the last 24 hours (4/6/25). Therefore, the ETH Taker Buy-Sell Ratio turned positive.

This positive ratio indicates that most investors in the market are currently buying.

In other words, more buy orders were executed, and buyers were willing to pay the offered price, reflecting strong accumulation across the market.

Can ETH Finally Breakout?

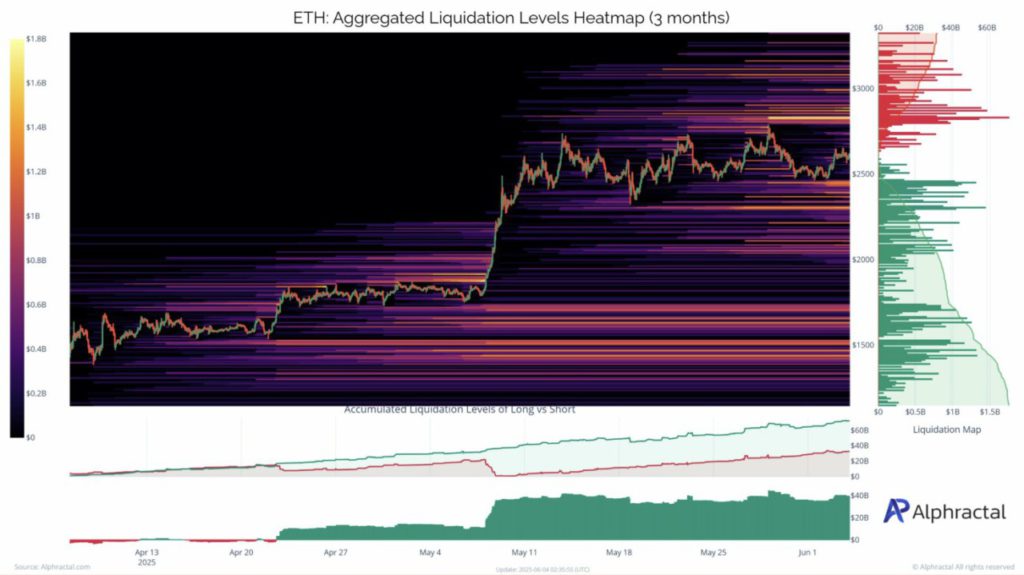

As observed earlier, Ethereum is undergoing massive accumulation, which could be the trigger for the next big move. The longer this accumulation phase lasts, the greater the potential movement.

If Ethereum manages to break the $2,660 level, then the road to $2,830 will be open – a zone that has high liquidity and has the potential to attract aggressive movements from market participants.

However, Ethereum needs to cross that area with conviction. If successful, the next resistance level to face is at $3,000.

For this scenario to remain valid, the bulls must be able to maintain support at $2,556. If the price falls below this level, then the bullish scenario could be considered void.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum surge ahead? – Traders, watch THIS range for ETH’s big move. Accessed on June 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.