Download Pintu App

CLARITY Act: New Steps in Digital Asset Regulation, What will it Mean?

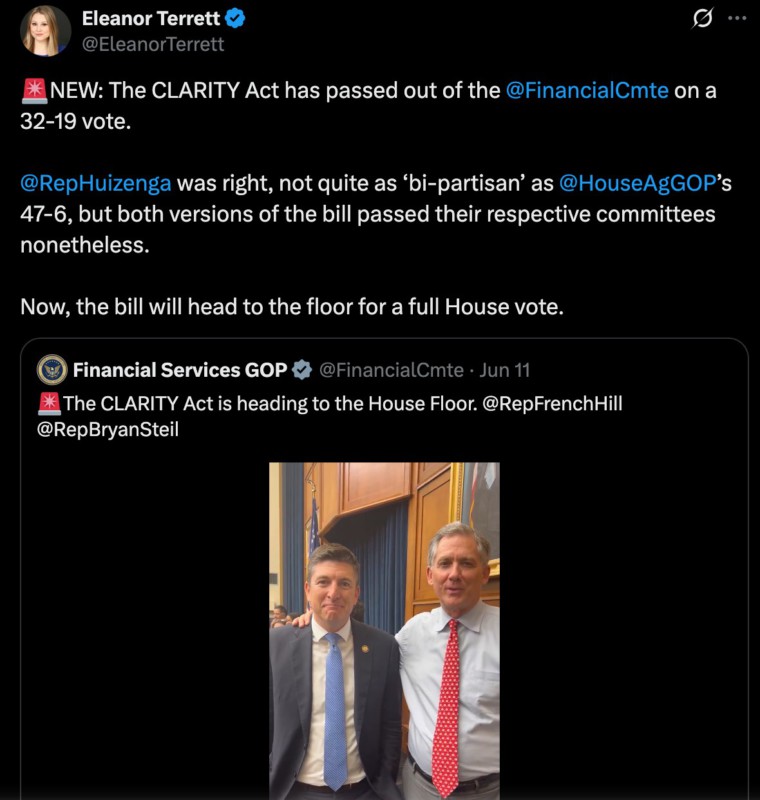

Jakarta, Pintu News – The United States House of Representatives recently passed the CLARITY Act (H.R. 3633) with strong bipartisan support. The bill, which has successfully passed two major House committees, the Financial Services Committee and the Agriculture Committee, aims to end the regulatory uncertainty surrounding digital assets by defining clear roles for the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission).

The Role of SEC and CFTC in Digital Asset Regulation

The CLARITY Act has been designed to provide clarity in the oversight of digital assets. The SEC will have the authority to determine whether or not digital tokens are securities, on a case-by-case basis. This is an important step given the ever-evolving digital asset market and the complexity of the products on offer.

On the other hand, the CFTC will continue to oversee commodities and derivatives related to digital assets, ensuring that the market operates in a transparent and fair manner. These two agencies, the SEC and CFTC, will work together to ensure that there are no loopholes that market participants can exploit to avoid regulation. This cooperation is expected to increase investor confidence and market stability, while also providing better protection for consumers and investors.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Controversy over the SEC’s new powers

While the CLARITY Act has widespread support, there is one provision that raises concerns. This provision, dubbed the “Gensler-era provision”, gives the SEC the power to determine the security status of a digital token, even if the token has been publicly traded or has received prior approval.

It is feared that this will bring back the uncertainty that the law is supposed to eliminate. Critics argue that this provision could stifle innovation and growth in the digital asset industry. They worry that the SEC may overuse these powers, which will ultimately burden developers and companies with heavy and unnecessary regulation.

Push for Protection for Developers from Crypto Companies

As the CLARITY Act progresses towards a vote in the full House of Representatives, several crypto companies have urged that this legislation be expanded. Eight groups, including Uniswap, Jump, and Coin Center, have urged that the Blockchain Regulatory Certainty Act (BRCA) be included in this legislation.

They argued that the BRCA would provide stronger protections for developers, who are often caught in a complicated web of regulations. These protections are considered vital to ensure that the United States remains a center of innovation in blockchain technology. By providing legal certainty, developers can focus more on improving and developing their products without worrying about potential legal issues that may arise.

Conclusion

With the enactment of the CLARITY Act, it is expected that a more conducive environment will be created for growth and innovation in the digital assets industry. This move will not only strengthen the United States’ position as a global leader in financial technology, but will also provide greater safety and confidence for investors and consumers in the sector.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Blockchain Reporter. Clarity Act Wins Bipartisan Approval with SEC. Accessed on June 12, 2025

- Featured Image: PYMNTS

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.