Download Pintu App

PEPE on the Edge: Whale Activity Surges 1,645% — Is a Massive Rally Coming?

Jakarta, Pintu News – PEPE is again testing the 50% Fibonacci level as the large holder net flow spike of 1,645%. Can this meme coin rise towards $0.00001550?

The price of Pepe Coin (PEPE) experienced a sharp correction to touch back the 50% Fibonacci level that was previously broken, thus creating a risk of reversal to a bearish trend.

Even so, a significant jump in net flows from large holders as well as positive sentiment in the derivatives market signaled a possible recovery.

Will this encourage the continuation of the bullish trend until it reaches the resistance level at $0.00001550?

On-chain Data Supports Bullish Opportunities

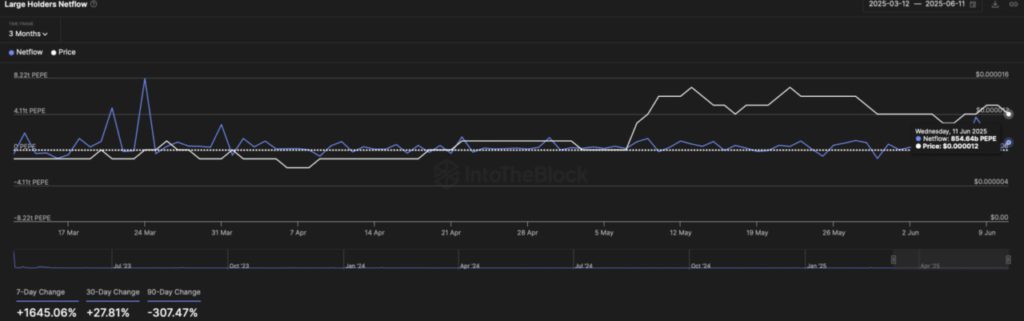

Based on data from IntoTheBlock, net flows from large holders surged by 1,645% in the last seven days.

Read also: Hamster Kombat Freefalls 27%: Is This the End of HMSTR?

As of June 11, Net Flow stood at 854.64 billion, indicating increasing confidence from large holders.

This indicator measures net flows from investors who own more than 0.1% of the total supply in circulation.

Pepe Coin Price Analysis

As of June 12, 2025, Pepe was trading at $0.00001242, with an intraday decline of 0.64%. This reflects the rejection of the price lower than the 24-hour low of $0.0000121.

After experiencing a mild bounce, Pepe is still holding above the 50% Fibonacci level at $0.0000122. However, Wednesday’s 4.80% drop suggests a slight increase in selling pressure.

However, the previous bullish momentum that resulted in a golden cross and the potential for a bullish crossover at the 100-day EMA line signal that the uptrend could still continue.

Additional technical signals come from the MACD indicator and the signal line which is expected to flatten around the zero line – an indication of a possible bullish crossover.

Based on price action analysis, in the event of an immediate bounce, Pepe is likely to face initial resistance at $0.0000155, followed by major resistance at $0.00001705.

Conversely, if the price closes below the 50% Fibonacci level, it is likely to test the 200-day EMA line at $0.00001155.

PEPE Derivatives

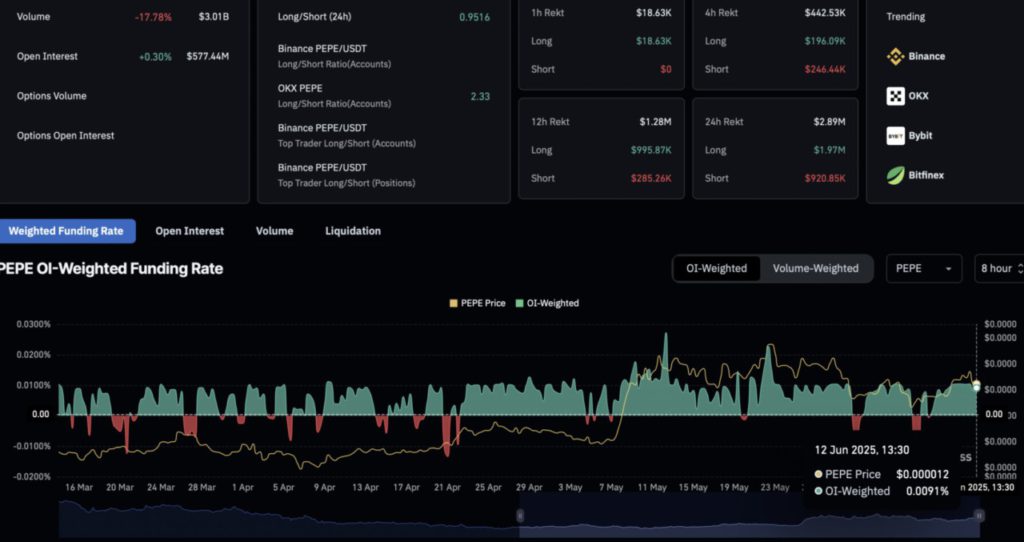

Supporting the bullish sentiment, optimism in the PEPE derivatives market remained strong, with the open interest value rising by 0.30% to $577.44 million.

However, in the last 24 hours, there has been a surge in the liquidation of long positions to the tune of $1.97 million – more than double the short liquidation of just $920,000.

This indicated a massive purge of traders in favor of the uptrend, which caused the long-to-short ratio to drop to 0.9516 as short positions increased.

Despite increased selling pressure, the funding rate remained high at 0.0091%, reflecting market participants’ continued commitment to a bullish direction.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Pepe Tests Critical 50 Fibonacci Support as Large Holders Boost Net Flows by 1645%. Accessed on June 13, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.