Download Pintu App

How to Trade Crypto for Beginners: A Complete Guide

Jakarta, Pintu News – Trading cryptocurrencies, especially Bitcoin, has become increasingly popular. However, for beginners, it can be confusing. Here is a step-by-step guide to getting started trading Bitcoin and other cryptocurrencies!

1. Difference between Trading and Investing

Bitcoin (BTC) investing is generally done by buying and holding Bitcoin for the long term, with the hope that the price of Bitcoin will increase over time. Bitcoin trading, on the other hand, involves buying and selling Bitcoin over short periods of time to profit from volatile price movements.

2. Choosing a Trading Platform

The first step in Bitcoin trading is to open an account on a cryptocurrency trading platform. After that, users must verify their identity, deposit funds, and be ready to start buying or selling Bitcoin.

3. Trading Strategy

Some of the strategies that can be applied in Bitcoin trading include:

- Buy and Hold (HODL): Buying and holding Bitcoin for the long term. This strategy is suitable for beginners who want to understand market volatility.

- Trend Following: Following the existing price trend in the market by buying when prices rise and selling when prices fall.

- Scalping: Making many transactions in a short period of time to get small profits from small price movements. This strategy requires extra attention.

- Swing Trading: Based on larger price movements, suitable for those who don’t want to monitor prices too often.

Read also: How to Play Crypto for Beginners: A Complete Guide to Cryptocurrency Investing

4. Market Analysis

There are two main types of analysis used in Bitcoin trading:

- Fundamental Analysis: Analyzing news and technological developments that may affect the price of Bitcoin, such as government policies and technological innovations (e.g. Lightning Network).

- Technical Analysis: Analyzing price charts and trading volumes to predict future price movements.

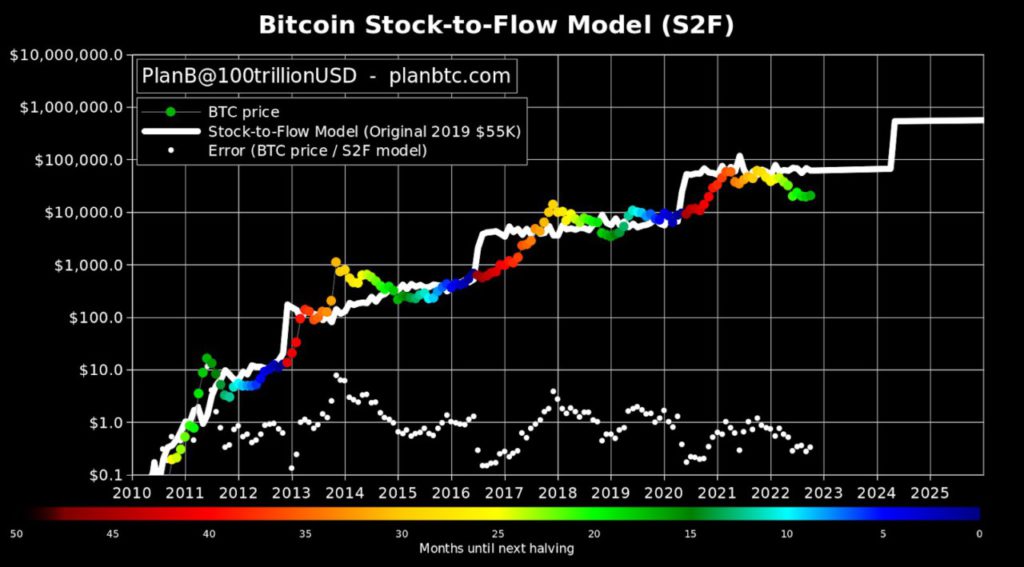

5. Stock-to-Flow Pricing Model

This model is used to predict the price of Bitcoin based on its scarcity. The fewer Bitcoins in circulation, the higher the price. This model is useful for long-term analysis.

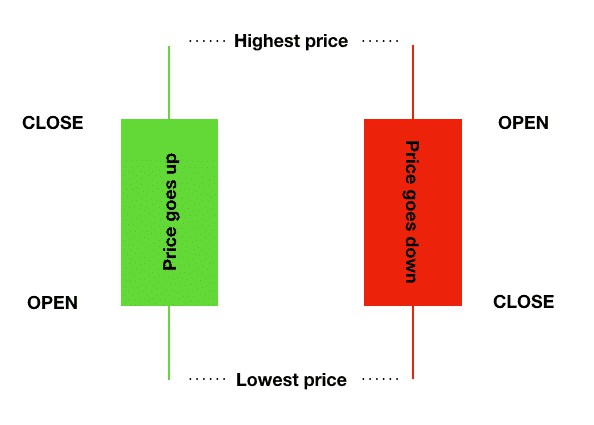

6. Candlesticks and Price Charts

- Candlesticks are used to spot price movements within a certain period of time. If the candle is green, the price is rising, while if it’s red, the price is falling.

- Support and Resistance Levels: These levels indicate price points that are difficult to cross. Support is the lowest point, while resistance is the highest point the price can reach.

7. Order Type (Orders)

- Market Order: An order that is executed immediately based on the best available price.

- Limit Order: An order that will only be executed if the price reaches a predetermined level.

- Stop-Loss Order: An order to sell Bitcoin if the price falls below a predetermined point, in order to limit losses.

8. Common Mistakes in Crypto Trading

Some of the mistakes that often occur in crypto trading include:

- Risk More than You Can Afford: Trading is a risky activity. Using more funds than you can afford to lose will worsen your trading decisions.

- No Plan: Determine when to enter and exit the market and set goals and stop-losses before making transactions.

- Emotions Rule Decisions: Trading is often influenced by fear or greed. Making rash decisions without following a plan can have disastrous results.

Also read: 5 Potential Memecoins According to Crypto Bubble

9. Learn from Every Transaction

Every transaction, whether profitable or unfavorable, is an opportunity to learn. It is important to analyze each transaction in order to improve the trading strategy in the future.

10. Asset Security

It is important not to leave funds on the exchange unused. Move assets to a personal wallet to ensure safety.

Conclusion

Trading Bitcoin takes time and a lot of knowledge. For beginners, understanding the difference between trading and investing, choosing the right strategy, and being familiar with different types of market analysis are important first steps. With a better understanding, Bitcoin trading can be a profitable activity despite the risks involved.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- 99 Bitcoins. Bitcoin Trading Guide for Beginners. Accessed June 17, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.