Download Pintu App

Dogecoin Tumbles 2% Today – Is This the Start of a Bearish Frenzy for DOGE?

Jakarta, Pintu News – The 22% decline in Dogecoin (DOGE) in the past 30 days has seen it test the lower boundary of a symmetrical triangle pattern. As of June 18, the Dogecoin price is trading at $0.1699.

However, a look at some of the indicators shows that these memecoins are at risk of falling below the lower boundary of the channel. If this is proven, DOGE could enter into bear market territory.

But will this happen or not? Let’s find out.

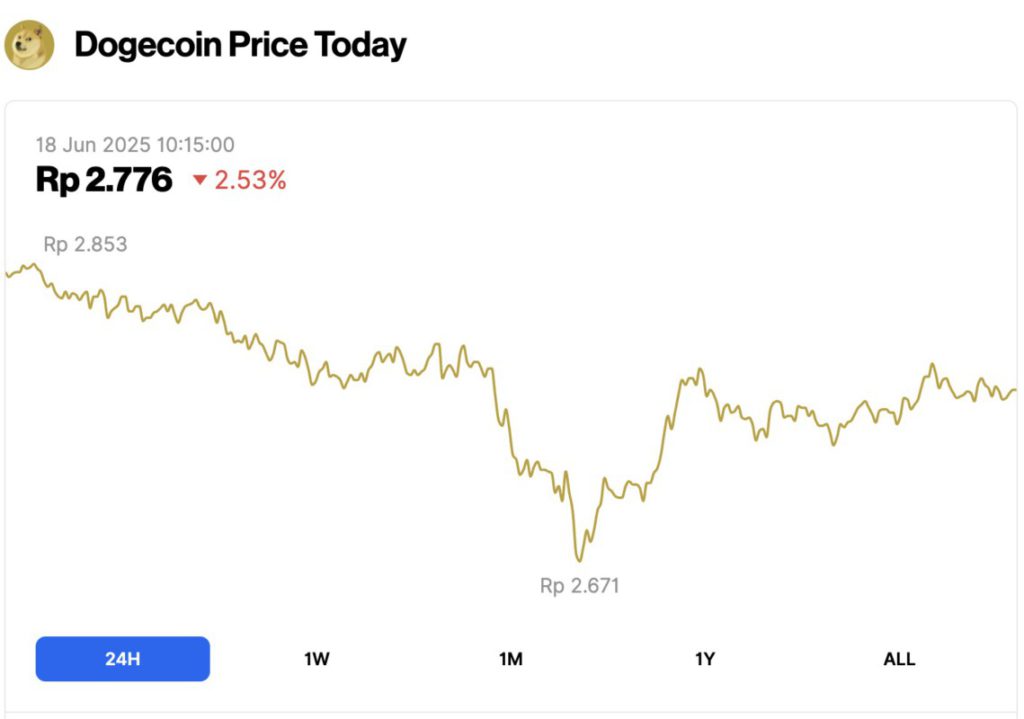

Dogecoin Price Drops 2.53% in 24 Hours

On June 18, 2025, Dogecoin’s price slipped by 2.53% over the past 24 hours, settling at $0.1699, or approximately IDR 2,776. Throughout the day, DOGE reached a high of IDR 2,853 and dipped to a low of IDR 2,671.

At the time of writing, Dogecoin’s market cap stands at around $25.48 billion, with trading volume falling 19% to $1.08 billion within 24 hours.

Read also: Ethereum Slides 3% Today (June 18) — Are Whales Gearing Up for the Next Big Rally?

Dogecoin at Risk of Continuing to Fall

According to CCN (17/6), on the daily chart, the price of DOGE has been moving in a symmetrical triangle pattern since January 23. This triangle consists of two trend lines approaching each other with the same slope.

The upper trend line represents resistance, while the lower line shows support. Dogecoin price is expected to drop below the support line as seen in the image below.

Amidst this technical setup, the CCN page examined the Moving Average Convergence Divergence (MACD) indicator to gauge momentum around theseecoins. As seen below, the MACD has moved into negative territory.

The decline in MACD readings indicates a stronger bearish momentum. This outlook is further reinforced by the position of the Exponential Moving Averages (EMAs).

Specifically, the 26 EMA (orange) has crossed the 12 EMA (blue) from above, confirming a bearish crossover and could accelerate DOGE’s downward trend.

If this setup continues, it is unlikely that the coin will retest the upper trendline of the symmetrical triangle amid low volatility.

Bearish Pressure Intensifies

Furthermore, the CCN website also examines the Market Value to Realized Value (MVRV) Long/Short difference from an on-chain perspective. This metric compares the unrealized gains by long-term holders to short-term holders.

A positive reading indicates that long-term holders are making profits, which is usually a bullish signal for Dogecoin’s price movement.

However, the current reading is -24.10%, which suggests that short-term holders have more unrealized gains.

Read also: 3 Meme Coins Set to Explode This Week – Don’t Miss Out on These Potential Explosive Gains!

If this trend continues, it could limit DOGE’s ability to break key resistance levels, especially the psychological zones at $0.20 and $0.25.

DOGE Price Prediction: 25% Drop Likely

Looking at the daily chart, the Awesome Oscillator (AO) is still in negative territory, which reinforces the bearish momentum mentioned earlier.

Additionally, the red segment of the Supertrend indicator is above the Dogecoin price – a signal of resistance above. Usually, when the green line is below the price, it signifies support, but the opposite scenario indicates increasing selling pressure.

If this bearish setup holds, DOGE could drop towards $0.13, which would register a 25% drop from its current value. In more extreme cases, the price could fall to as low as $0.10.

Conversely, if buying pressure returns and DOGE manages to break the upper trend line of the triangle, the price could rise to $0.24, in line with the 0.382 Fibonacci retracement level.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Price Drops 22% as Key Chart Support Level Teeters on the Edge. Accessed on June 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.