Download Pintu App

Is Bitcoin (BTC) about to surge? Strong Indications from the Whales!

Jakarta, Pintu News – Recent observations of on-chain data suggest that large holders of Bitcoin (BTC) appear to be preparing for a significant price increase. This is evident from an increase in the amount of Bitcoin being withdrawn from Binance, as well as a large influx of stablecoins onto exchanges signaling increased liquidity on the buyer side.

Bitcoin Withdrawal by Whale: Early Signals of a Rally?

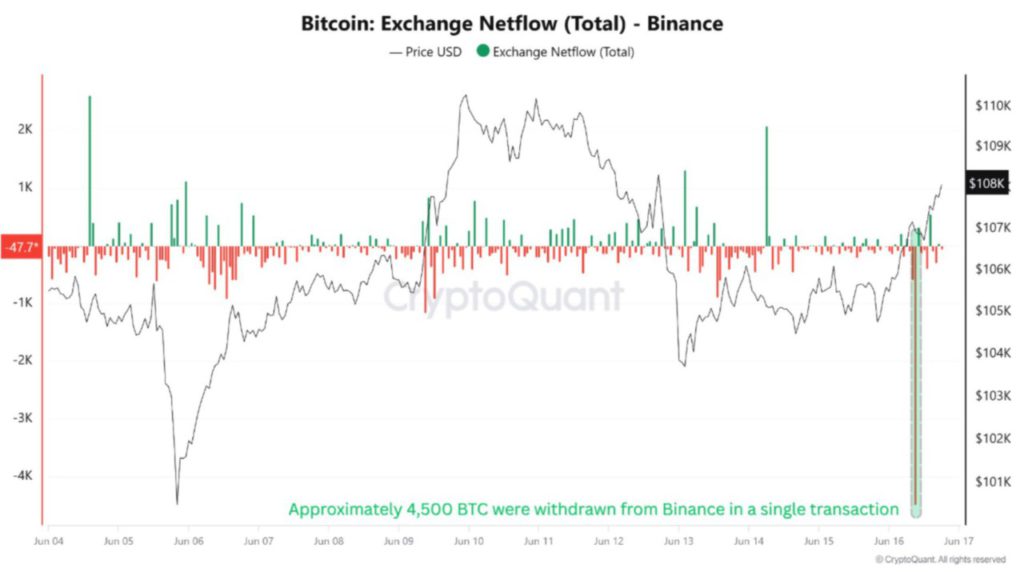

Recent data from CryptoQuant shows that there was a withdrawal of nearly 4,500 BTC from Binance on June 16. This is one of the largest withdrawals by whales this month. Bitcoin whales are usually wallet addresses that hold significant amounts of Bitcoin.

Based on historical data, such large withdrawals often precede price increases, as they reduce the amount of Bitcoin available on exchanges for trading. These large withdrawals suggest that whales may be anticipating a price increase and choosing to keep their assets off-exchange. This can reduce selling pressure in the market and make the price tend to rise due to reduced supply.

Also Read: Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

Increased Flow of Stablecoins to Exchanges

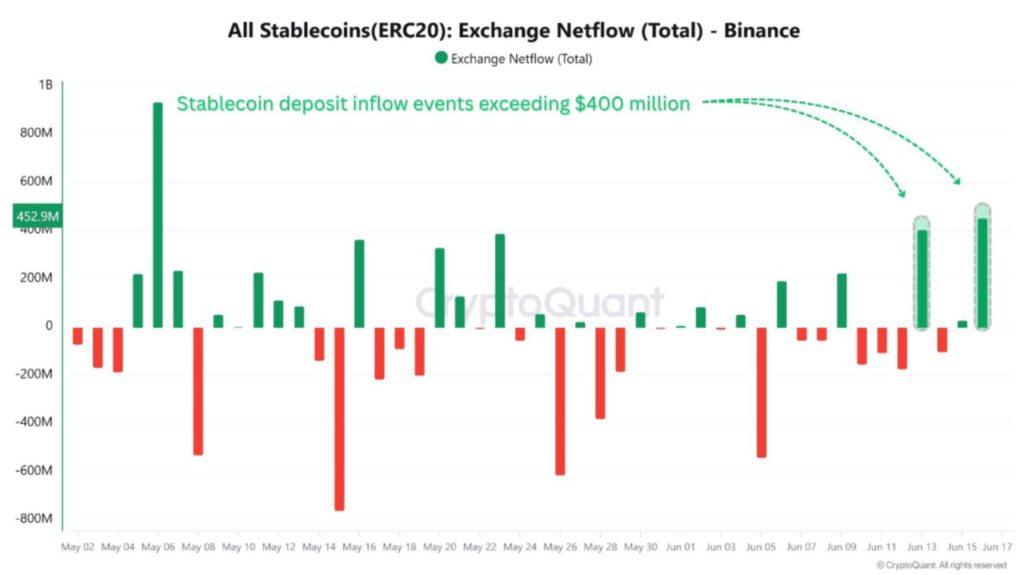

Alongside the Bitcoin withdrawal, there was also a surge in stablecoin flows to Binance. On June 13 and 15, more than $400 million worth of stablecoins flowed into the exchange. Large stablecoin flows are usually associated with liquidity preparations on the buyer side, indicating that large investors are ready to allocate their capital to crypto assets like Bitcoin (BTC).

This sharp rise in stablecoin flows suggests an increased risk appetite among investors. With capital readily deployed and a reduced amount of Bitcoin on exchanges, this creates an imbalance between supply and demand that could push the price of Bitcoin up.

Additional Indicators Support Upside Potential

Aside from Bitcoin withdrawal data and stablecoin flows, there are other indicators that support Bitcoin’s price upside potential. For example, the consistently negative funding rate on Binance is often a prelude to a short position squeeze. This suggests that many traders are betting on a price drop, but the market may be moving in the opposite direction.

This often triggers a short squeeze, where traders with short positions are forced to buy back Bitcoin to cover their positions, which in turn can push the price up further. The combination of these factors suggests that the market may be gearing up for a rally.

Conclusion

With various indicators pointing to potential upside, investors and market watchers should pay close attention to the next moves of Bitcoin. Large whale withdrawals and increased stablecoin flows are signals that cannot be ignored. The market may be on the verge of a significant price movement.

Read More: Will Selling Pressure Shake Chainlink’s Bullish Dominance?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Whales Pull 4500 BTC from Binance, Hinting at Incoming Rally. Accessed on June 19, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.