Download Pintu App

Ethereum Soars Past $2,400 Today (June 24) — ETH Dominance On the Rise!

Jakarta, Pintu News – Since hitting a local high of $3,700 in early January, Ethereum (ETH) has experienced a significant decline.

After attempting a breakout from this downward trend a month ago, ETH faced resistance at the $2,800 level, which led to another decline.

Despite the pressure on its price chart, CryptoOnchain observed that ETH’s dominance continues to increase.

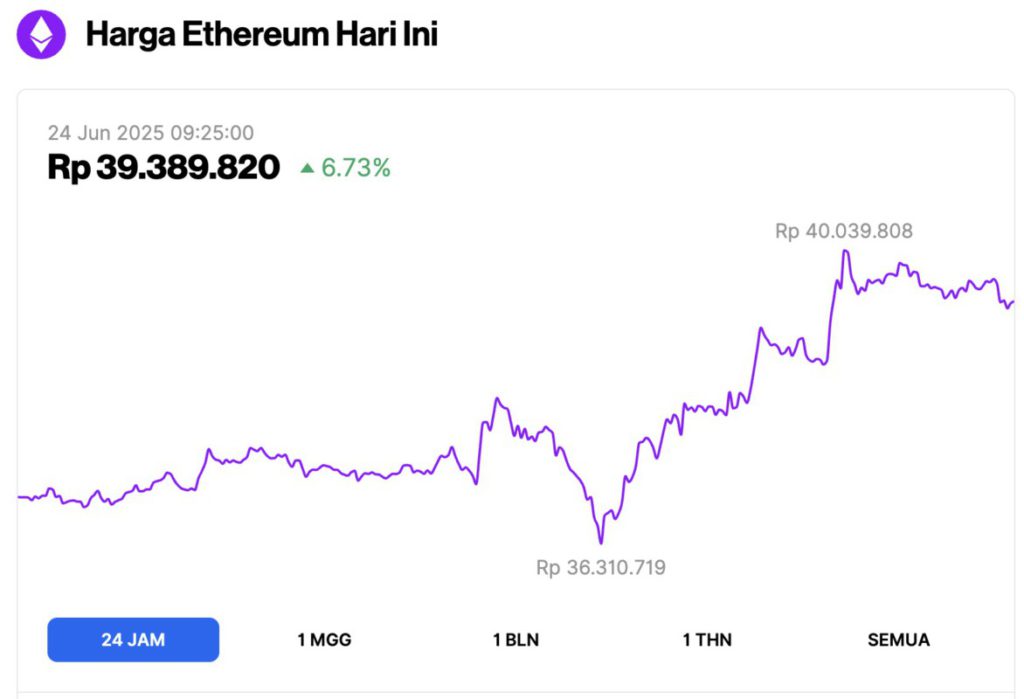

Ethereum Price Up 6.73% in 24 Hours

As of June 24, 2025, Ethereum is trading at approximately $2,400, or around IDR 39,389,820 — marking a 6.73% gain over the past 24 hours. Within the same timeframe, ETH dipped to a low of IDR 36,310,719 and climbed as high as IDR 40,039,808.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $289.14 billion, with daily trading volume falling 5% to $23.85 billion within the last 24 hours.

Read also: Ethereum Whale Snaps Up $39 Million in ETH — Even as Prices Crash Harder Than Bitcoin!

Ethereum’s Dominance Growth Continues

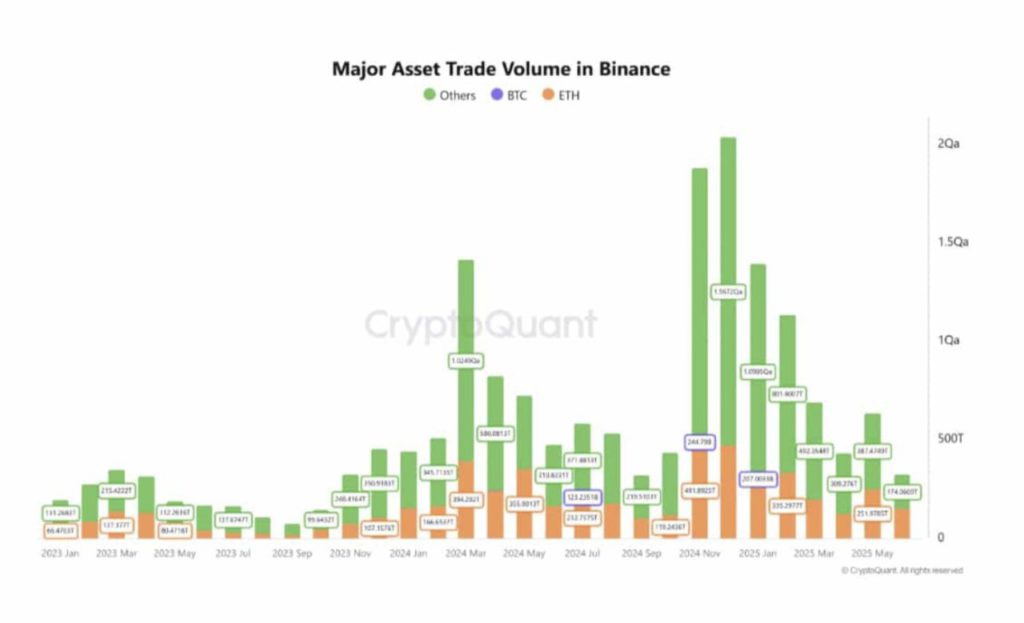

According to data from CryptoQuant, Ethereum has managed to command a significant market share based on data from January to May 2025. This surge in ETH’s dominance was mainly driven by a considerable drop in the trading volume of other altcoins.

Contrary to market expectations, this surge is not due to increased Ethereum trading activity. From 2024 to 2025, ETH trading volume remained relatively stable, hovering between 300 trillion and 490 trillion.

In contrast, altcoin trading volume peaked at 1.5672 quadrillion in November 2024, but fell sharply to just 387.47 trillion in May 2025. The trading share of altcoins slumped from over 1 quadrillion to under 400 trillion, reflecting a significant decline.

This trend suggests that investors are withdrawing liquidity from projects that are considered riskier. Some of these funds appear to be diverted to Ethereum, which is seen as a relatively safer alternative.

As such, Ethereum’s dominance is not primarily due to its own growth, but rather the retreat of its competitors. Even though ETH is not experiencing significant growth, it is still considered much more profitable compared to other smaller altcoins.

If we look at Altcoin’s Season Index, we can see that the altcoin market as a whole is on the decline. The index drops from 88 to 12 between December 2024 and June 2025, signaling a weakening altcoin market.

Read also: Ethereum Just Dropped the Fusaka Upgrade — And It Could Change Smart Contracts Forever!

Is there any impact on ETH price movement?

While Ethereum’s dominance experienced a significant surge, its growth showed some problems. Since then, demand and on-chain activity have struggled to keep up with market movements.

As of June 23, Ethereum’s NVT (Network Value to Transactions) ratio jumped to 1041, indicating networkovervaluation.

This means that on-chain activity is low compared to the current price, indicating that the current ETH price may not be supported by real organic demand.

Historically, this kind of imbalance-where the value exceeds the actual usage of the network-is often a signal that the market is at its peak and is usually followed by a price correction.

If this trend continues, the price of ETH will likely undergo aretracement to better align with actual demand, indicating that the current market is more speculative in nature.

Despite Ethereum’s increasing market dominance, long-term holders are still recording losses.

In addition, the MVRV Long/Short Difference indicator remains negative and has been in this state for the past four months, signaling that Ethereum’s long-term investors are still not making profits.

This negative value indicates that short-term holders have higher unrealized gains than long-term holders. For example, those who bought ETH between December 2024 and February 2025 are still mostly in a loss position.

This suggests that despite Ethereum’s increasing influence, the price of ETH has not registered a significant increase, while other altcoins continue to decline. Under current market conditions, ETH appears to be overvalued and will likely have to undergo a correction to reflect real demand.

If a correction occurs, there is a possibility of the ETH price dropping below $2,000. However, if speculators continue to dominate the market, Ethereum could continue its recovery and try to reclaim the $2,500 level.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum dominance surges 12%, yet ETH struggles to hold $2K – Why? Accessed on June 24, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.