Download Pintu App

Solana (SOL) Skyrockets After Israel-Iran Ceasefire — Is a Massive 35% Surge Next?

Jakarta, Pintu News – Solana (SOL) prices managed to break out of a one-week downward trend following news of a ceasefire deal between Israel and Iran.

As with most assets in the crypto market, Solana’s price declined due to rising geopolitical tensions in the Middle East.

However, since the beginning of this week the trend has changed after the President of the United States, Donald Trump, confirmed that both parties have agreed to temporarily halt the conflict.

As a result, SOL rose to $145, and a number of indicators suggest that the value of this altcoin has the potential to continue rising.

Here are the possible next developments for this altcoin if peace is maintained and market momentum continues to strengthen.

Solana Reverses Trend, Thanks to Ceasefire News

Solana prices experienced a downward trend between June 16 and 23. During that period, its price dropped from $157.84 to a low of $128.34. However, as of now, the altcoin has recovered and is back up to the $145 mark.

Read also: Shocking Move: U.S. Senator Unveils COIN Bill That Could Block the President from Touching Crypto!

As seen on the chart, SOL prices reached this level after successfully breaking out of the descending channel. This recovery seems to have been partly driven by the news of a ceasefire between Israel and Iran, which helped to ease general market tensions.

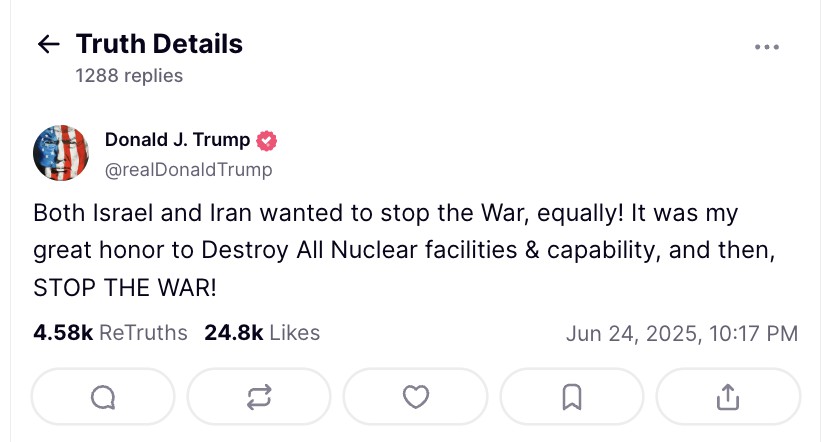

On Monday, June 23, US President Donald Trump announced via his Truth Social account that the two countries had agreed to maintain peace and mutual respect, prompting renewed interest in riskier assets such as the SOL.

In the midst of this breakout moment, the Moving Average Convergence Divergence (MACD) indicator displayed a bullish crossover signal. In this case, the 12-period Exponential Moving Average (EMA) (blue line) has crossed the 26-period EMA (orange line) from bottom to top.

This indicates that buyers are starting to take control. If this trend continues, Solana prices could potentially continue to rise, especially since the green line of the Supertrend indicator is now below the price-a supportive signal for a continuation of the uptrend.

Key Metrics Turn into Support

Supporting the bullish momentum, Glassnode’s on-chain analysis shows that Solana has once again managed to rise above its realized price– an important metric that reflects the average on-chain base cost for asset holders.

On Sunday, June 22, the SOL rate dropped to $131.93, slightly below its realized price of$132.35. This signals a temporary return of bearish sentiment and suggests a fairly strong resistance.

Read also: 5 Altcoins You Need to Grab on the Dip Before They Skyrocket 2x!

However, the subsequent price surge to $145 thwarted the downside risk, suggesting that the realized price is now acting as a support level in Solana’s price rise.

SOL Price Prediction: Potentially Up

Like the 4-hour chart (24/6), the daily chart also shows bullish tendencies. From the image below, Solana’s price appears to be on the verge of breaking the upper trend line of the descending channel.

If successful, the altcoin is likely to break the 20-period Exponential Moving Average (EMA). This outlook is further strengthened by the rise in the Relative Strength Index (RSI), which indicates continued bullish momentum.

If SOL manages to cross this barrier, it could test the resistance level at $171.76. In the event of a confirmed breakout of this level, Solana could potentially continue its rally up to $195.33 – which would mean an increase of around 35% from the current price.

However, if SOL fails to break the 20 EMA, the bullish scenario could weaken. In this case, the altcoin risks dropping below the lower trend line of the descending channel, and potentially falling towards $125.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Solana (SOL) Price Snaps Out of Downtrend After Israel-Iran Ceasefire – Targets 35% Hike. Accessed on June 25, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.