Download Pintu App

Ethereum Holds Strong at $2,400 — Whale Activity Spikes Ahead of Potential Breakout!

Jakarta, Pintu News – Ethereum (ETH) is at an important crossroads, where massive accumulation by a handful of whales collides with weakening fundamental signals of the network.

While institutions and well-capitalized investors continue to add significant amounts to their ETH holdings, indicators such as address growth, transaction volume, and NVT ratio are showing warning signs.

Then, how is Ethereum’s current price movement?

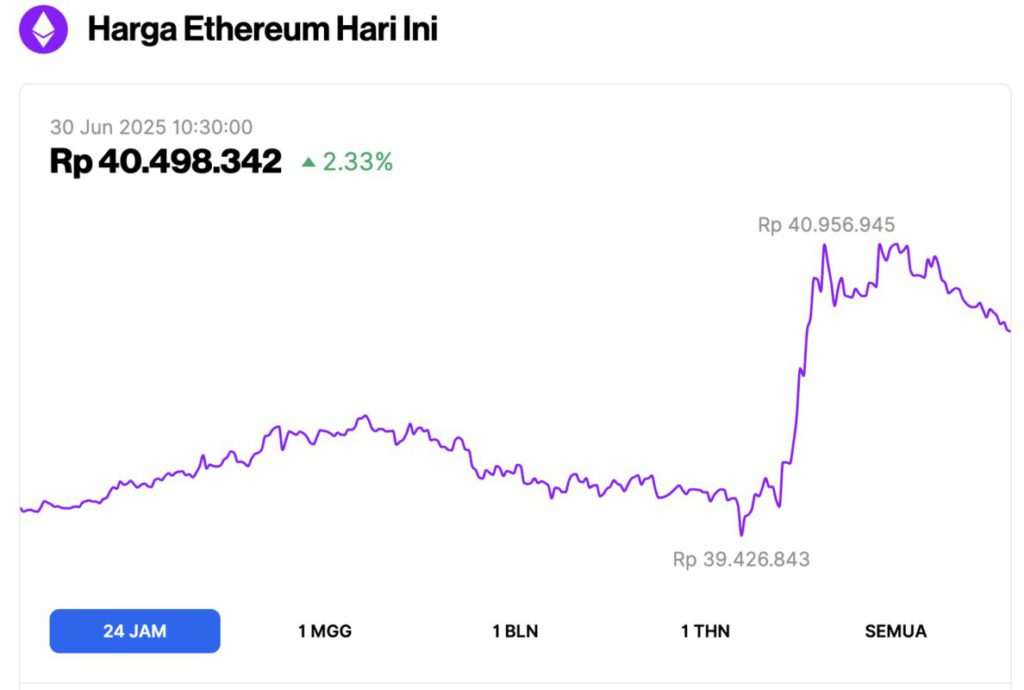

Ethereum Price Rises 2.33% in 24 Hours

As of June 30, 2025, Ethereum was trading at approximately $2,498, or around IDR 40,498,342 — marking a 2.33% gain over the past 24 hours. Within that time frame, ETH dipped to a low of IDR 39,426,843 and reached a high of IDR 40,956,945.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $301.86 billion, with daily trading volume rising 71% to $14.05 billion within the last 24 hours.

Read also: Bitcoin Hits $108,000 Today (June 30) — But Is the Network Slowing Down Beneath the Hype?

Ethereum Whale Accumulation Increases Despite Weak On-Chain Signals

Ethereum (ETH) accumulation by whales is getting more intense, even as on-chain signals show weakness.

SharpLink Gaming just added 1,989 ETH worth $4.82 million through an OTC transaction about five hours ago. With this purchase, their total ETH holdings now stand at 190,467 ETH, equivalent to nearly $478 million-following their previous accumulation of 188,478 ETH.

Meanwhile, whale with address 0x1fc7, who a week ago staked 3,201 ETH, reappeared with a purchase of 1,888 ETH (worth $4.56 million), which was directly deposited into Beacon Chain.

However, the price of ETH remains stuck around $2,428 without showing any significant reaction. This mismatch between massive accumulation and price stagnation naturally raises bigger questions.

Has the Ethereum Network Surge Started to Cool Down?

Ethereum’s network growth briefly spiked to surpass 250,000 new addresses, but immediately plummeted back to 24,800, according to data from Santiment.

These unnatural spikes and dips may signal speculative activity or a temporary bot-driven boom, rather than sustained organic growth.

In fact, long-term adoption requires consistency. If this decline persists, ETH may struggle to maintain its momentum at current price levels-especially if optimism is still dominated by whales alone.

Read also: These 4 Cryptos Could Explode to New All-Time Highs by July 2025 – Don’t Miss Out!

Additionally, Ethereum’s MVRV Z score dropped to -0.18, indicating that many ETH holders are currentlyunderwater.

This change could reduce the pressure to take profits and open up a potential accumulation zone, as long-term investors tend to buy when MVRV is in negative territory.

This trend often coincides with a market bottom or at least a short-term rebound. However, traders are advised to wait for confirmation from other metrics before interpreting this signal as a green light.

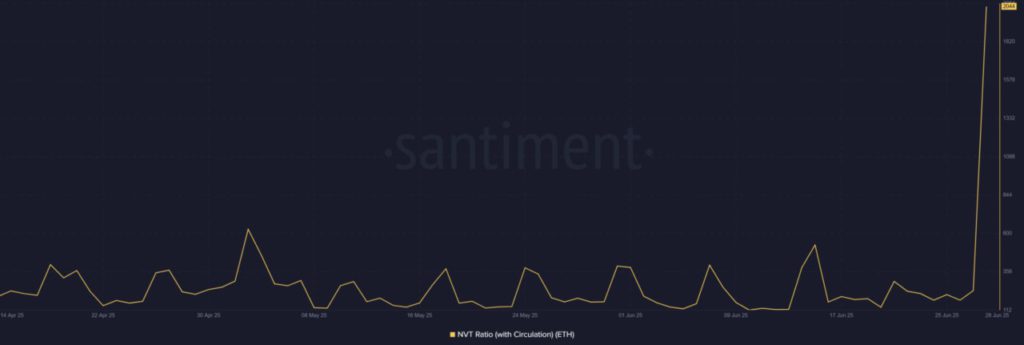

Ethereum’s NVT Explosion Indicates This

As reported by AMB Crypto, Ethereum’s NVT ratio surged to 2,044-its highest level in months.

Spikes like this usually signal an imbalance, where the valuation of the network far exceeds the actual utility or volume of transactions taking place.

This fact is often a sign of a correction or a period of flat price movement over a period of time. Unless the volume of transactions soon follows, even the recent buying spree of the whales could encounter resistance zones sooner than expected.

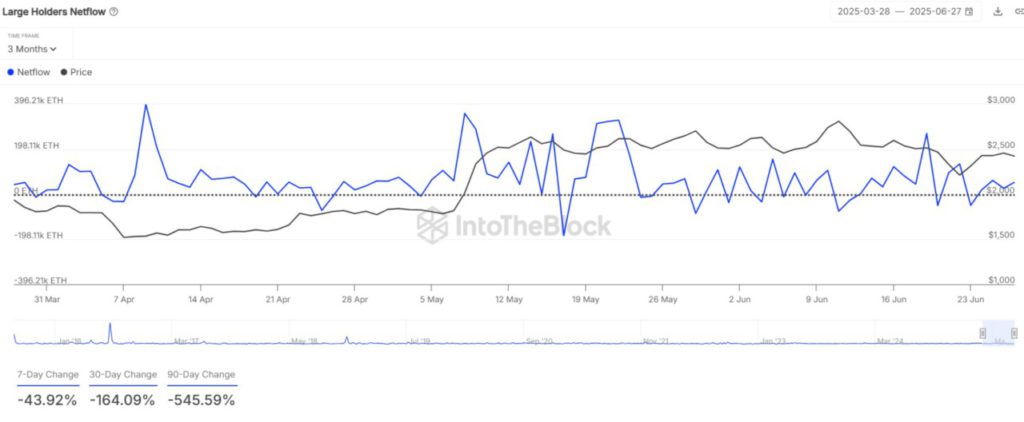

Why is the Whale Divergence Widening?

Here’s what’s interesting: while a few whales are in the spotlight, another large group of ETH holders are stepping back.

According to data from IntoTheBlock, Netflow from large holders fell by 43.92% in the last seven days. This shows that outflows are greater than inflows overall.

So, for the broader picture, most institutions have not started buying-at least for now.

ETH is currently facing a tug-of-war between bullish whale activity and weakening on-chain signals. While well-capitalized buyers continue to add to their holdings, metrics such as NVT, network growth, and netflow are signaling caution.

The potential for future upside largely depends on whether this selective accumulation will develop into a broader trend. If not, ETH may struggle to breakout until fundamental activity strengthens again.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum whale gathers millions, but THIS sparks doubts on ETH’s upside. Accessed on June 30, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.