Download Pintu App

Ethereum Surges 6% to $2,700 — Is a Breakout to $3,000 Just Around the Corner?

Jakarta, Pintu News – Ethereum (ETH) performed aggressively in the third quarter (Q3), successfully breaking back through not one, but two major resistances in less than a week.

Not surprisingly, this rapid price movement led many traders to start opening short positions, with 60% of positions on the exchange showing bearish tendencies.

This suggests that the bears may be trying to anticipate an early price rejection, or they may be underestimating the strength of ETH’s impulsive movements.

Then, how is Ethereum’s current price movement?

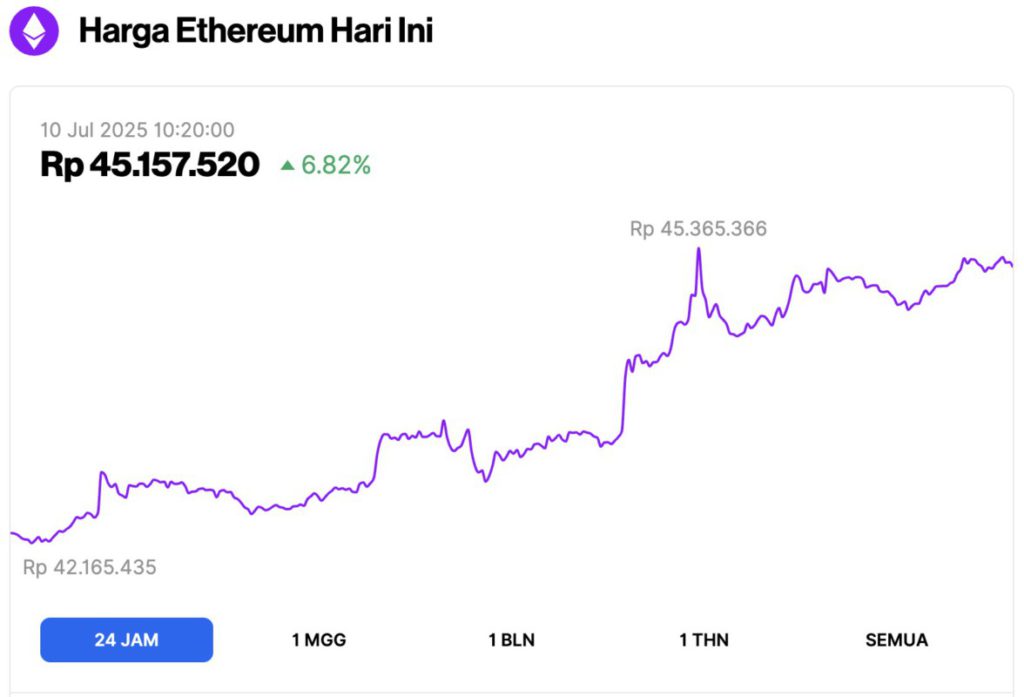

Ethereum Price Up 6.82% in 24 Hours

As of July 10, 2025, Ethereum was trading at approximately $2,780, or around IDR 45,157,520 — marking a 6.82% gain over the past 24 hours. During this time, ETH dipped to a low of IDR 42,165,435 before climbing to a daily high of IDR 45,365,366.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $335.59 billion, with daily trading volume rising 59% to $27.45 billion within the last 24 hours.

Read also: Bitcoin Skyrockets to $111K — Here’s What Triggered Today’s Shocking New All-Time High!

The Differences that Shape Ethereum’s Third Quarter Outlook

According to AMB Crypto, Ethereum’s near 7% rally to $2,620 is not just a bounce. It’s a technical breakout from the narrow move that formed last week below $2,400.

The range started to form after ETH hit a multi-month low of $2,114 on June 22.

In total, ETH has surged nearly 23% in just under twenty trading days. Generally, a sizable consolidation phase like this serves as the foundation for a sustained bullish movement.

However, context is important. In the May-June cycle, similar projections for Ethereum failed when the price was only able to reach $2,800, and did not manage to break the $3,000 barrier.

After that, there was a sharp deleveraging event that saw the ETH price drop 20% in less than two weeks.

Today, Ethereum’s Open Interest (OI) stands at $36.5 billion, slowly approaching back to its mid-June high of $41.75 billion – just before the massive liquidation cascade.

Not surprisingly, short positions are now starting to dominate on various exchanges, anticipating a similar price drop.

But could a key divergence this time be the trigger that proves the bears are too hung up on the old narrative – and that this moment could change the direction of Ethereum’s future projections?

Read also: Which Crypto will Boom in 2025? Check out the Analysis of Ethereum, XRP, and Pi Network!

ETH Builds a Strong Foundation

Ethereum did not start July quietly. After suffering a sharp 3.2% drop on the first day of the month, ETH bounced straight back with a 6.86% rally the next day, triggering a classic short squeeze.

Importantly, this surge in Ethereum projections was not solely triggered by the 3.78% rise in the ETH/BTC ratio.

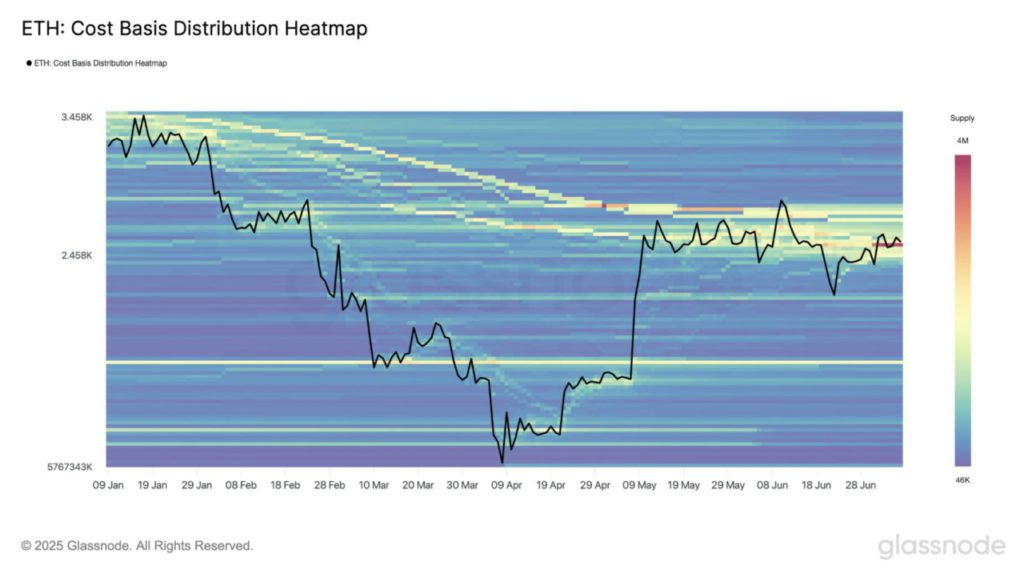

On-chain data from Glassnode shows that the $2,513-$2,536 price range was a major area of demand, with over 3.45 million ETH accumulating at that level – making it one of the strongest support zones seen in recent months.

Supporting this, the spot ETH ETF recorded a surge in inflows of $148 million on July 3 – the highest daily total in almost a month.

In fact, total ETF inflows for July have now reached $300 million, signaling a steady increase in spot-based demand.

This distinction is important. Turning resistance into support is the first step to seizing higher price levels.

With spot fund flows continuing to rise, Ethereum’s projections seem to be on a strong path towards the $3,000 target – it could even surpass it as the third quarter progresses.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum Projections Shift Bullish, Is $3k in Q3 Possible? Accessed on July 10, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.