Download Pintu App

Pi Network Holds Steady at $0.47 — But Is a Major Breakdown Coming as It Breaks Free from Bitcoin’s Grip?

Jakarta, Pintu News – Pi Coin, the digital currency that has attracted the attention of millions of followers, is still having a hard time in the market.

After separating from the influence of Bitcoin (BTC), the price of Pi Coin has continued to decline and is getting closer to its all-time low.

The altcoin is facing a 26.4% drop in the last two weeks. As Pi Network tries to set its own course, it faces challenges in maintaining its value, especially amid increasingly volatile markets.

Pi Network Price Rises 1.7% in 24 Hours

On July 10, 2025, the price of Pi Network was recorded at $0.4706, having risen 1.7% in the last 24 hours. If converted into today’s rupiah ($1 = IDR 16,220), then 1 Pi Network is IDR 7,633.

In the 24-hour period, PI moved within a price range of $0.4612 to $0.4730, showing relatively stable volatility.

Read also: Massive Investment from 137 Ventures Pours into Pi Network – What Does This Mean for Its Future?

This price increase was supported by a 24-hour trading volume of $81.9 million, signaling increased market activity. Market capitalization stood at $3.6 billion, while fully diluted valuation stood at $5.55 billion.

Pi Network Goes Its Own Way

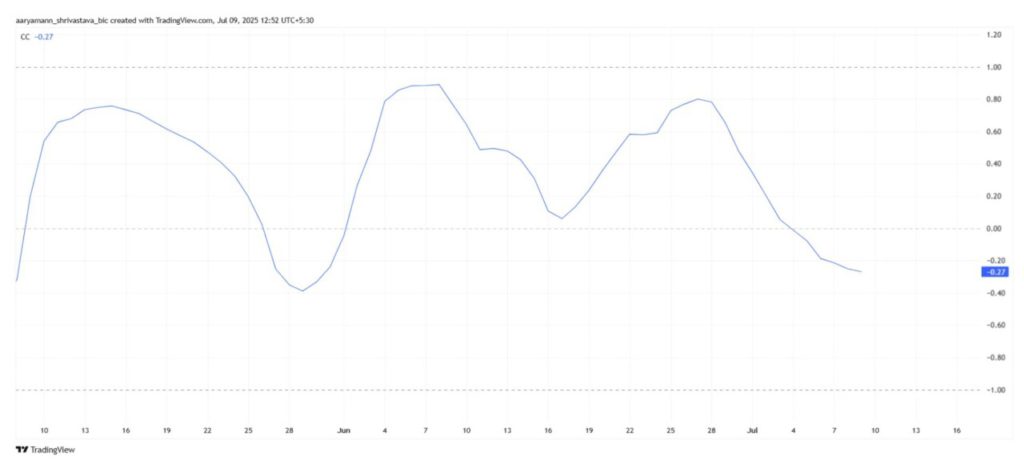

Reporting from BeInCrypto (9/7), Pi Network experienced a drastic change in its correlation with Bitcoin, which is now at negative 0.27. This negative correlation means that Pi Coin’s movement is in the opposite direction of Bitcoin. In simple terms, when Bitcoin goes up, Pi Coin actually continues to experience pressure.

This negative correlation suggests that Pi Coin will not take advantage of the positive trends occurring in the cryptocurrency market in general. Instead, Pi Coin faces the risk of further decline.

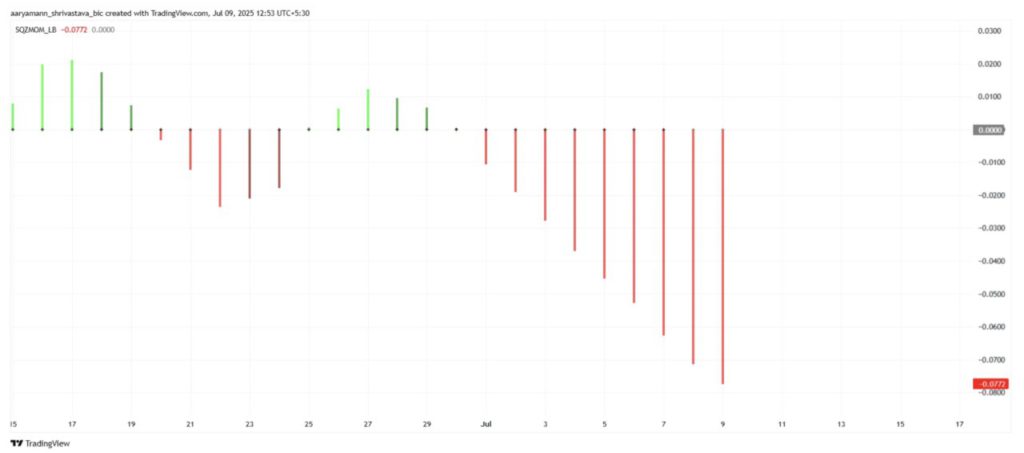

Pi Coin is also showing changes in macro momentum, as indicated by the Squeeze Momentum indicator. Currently, the indicator is experiencing a squeeze release, a term used to describe the occurrence of explosive volatility in the market.

This event usually signals a large price movement, but in the case of Pi Coin, the appearance of a red bar on the indicator indicates a continuation of bearish momentum.

This squeeze release most likely signals a potential further decline, not a recovery in the near future.

Read also: Dogecoin Surges 5% Today – Is This the Start of a Rally or Just Another Fakeout?

PI Price is Predicted to Decline

As of July 9, Pi Coin was trading at $0.465, only slightly above the crucial support level of $0.450. With the altcoin positioned only about 14% away from its all-time low of $0.400, Pi Coin faces significant downside risks.

This price range puts Pi Coin in a precarious position, as if the price drops below $0.450, further declines are likely.

In the last two weeks alone, Pi Coin has seen a drop of 26.4%, which confirms its continued difficulty in recovering its momentum.

Looking at the current technical indicators and market sentiment, it appears that Pi Coin could potentially fall to its lowest point at $0.400. Fear of further losses will likely prompt additional sell-offs, which could accelerate the price decline.

The depressed market sentiment resulting from Pi Coin’s disconnect with Bitcoin further complicates the road to recovery.

However, there is still hope for Pi Coin if investors are able to exercise restraint. If Pi Coin manages to stay above the $0.450 support level, there is a chance for a bounce back.

If it is able to break the resistance level at $0.493, it would be a positive signal that could potentially push the price towards $0.518. Such a recovery would invalidate bearish assumptions and open a new, more optimistic outlook for the altcoin.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Decouples From Bitcoin, Pushes Price Towards All-Time Low. Accessed on July 10, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.