Download Pintu App

Crypto Week on Capitol Hill: XRP Gearing Up for a Price Spike!

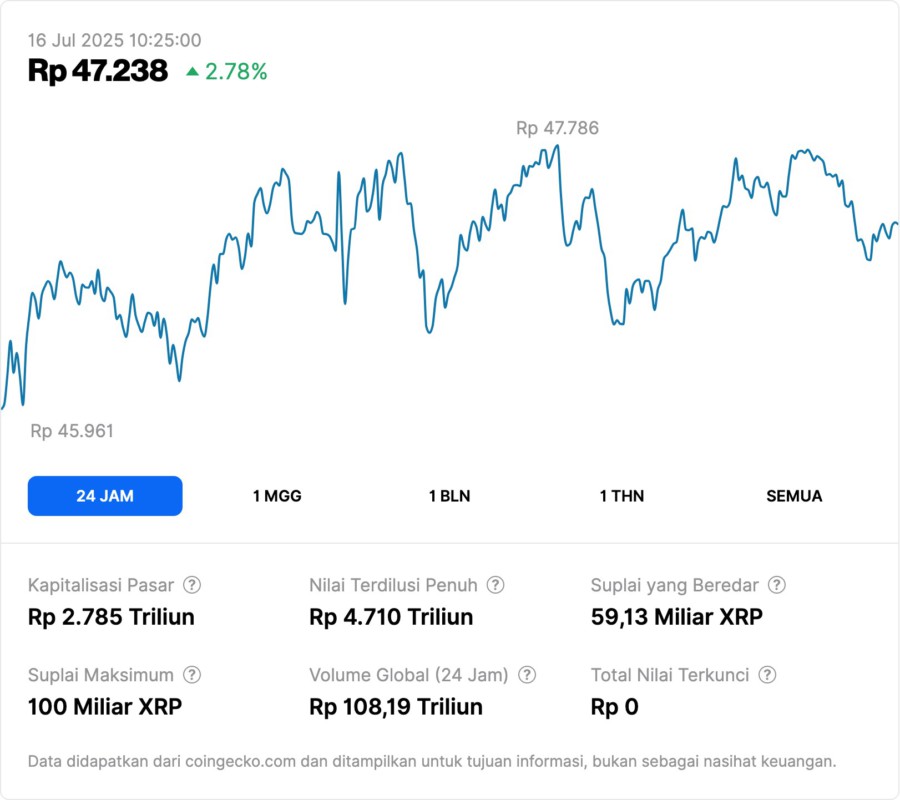

Jakarta, Pintu News – Kicking off a tumultuous week in the crypto market, Ripple (XRP) is showing indications of high volatility, signaling the possibility of significant price movements. Based on data from Volmex Finance, the seven-day implied volatility for Ripple (XRP) has jumped to 96% on an annualized basis, a drastic increase from 73% last week. This suggests an expected price change of around 13% in the next seven days, a phenomenon that investors and market watchers should take note of.

High Volatility in the Middle of Crypto Week

This heightened volatility comes as the US Congress prepares to discuss three major bills that will affect the digital asset industry. The first is the GENUIS Act, which would require stablecoin issuers to hold liquid reserves, receive annual independent audits, and publish monthly transparency reports.

The second bill, the CLARITY Act, aims to clarify whether cryptocurrencies fall under SEC or CFTC oversight. The third bill, the Anti-CBDC Surveillance Act, would prohibit the Federal Reserve from issuing central bank digital currency for retail. Ripple (XRP), which has been declared a US strategic asset by the SEC, would benefit from this regulatory clarity. The high volatility suggests that the market is anticipating major changes depending on the outcome of the legislation.

The Importance of Clarifying Regulations

Javier Rodriguez-Alarcón, Chief Investment Officer at XBTO, a crypto liquidity provider, emphasized the importance of the GENUIS Act and CLARITY Act in establishing institutional ground rules. According to him, this will clarify the way stablecoins are issued and supervised and formally define the role of the SEC and CFTC in overseeing the crypto market. These measures are expected to address one of the main barriers to institutional participation, which is legal uncertainty.

Rodriguez-Alarcón also added that regulatory clarity will allow for long-term capital deployment, in line with ongoing processes in other regions such as the United Arab Emirates, where established frameworks are opening up tokenized markets. If the bill is passed, it could open the door wider for the adoption of regulated stablecoins, regulated tokenization, and on-chain financial products with full legal backing.

XRP Outlook and Momentum

Although implied volatility is direction agnostic, meaning that the expected 13% price surge could move in any direction, Ripple (XRP) is currently showing strong bullish momentum. According to data from CoinDesk, Ripple (XRP) traded more than 5% higher on the day, reaching $3, a level that hasn’t been seen since early February. This suggests that investors may see positive potential despite the prevailing uncertainty.

Conclusion

With a week full of legislative activities that could significantly affect the crypto market, investors and market watchers should pay close attention to the price movements of Ripple (XRP). This high volatility signals not only potential gains but also risks, making this week crucial for the future of Ripple (XRP) and the crypto market as a whole.

Also Read: Big Drama: Coinbase and Binance Deny Each Other Over Media Leaks and Market Grab!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. XRP’s Implied Volatility Explodes, Suggests 13% Price Swing as Congress Crypto Week Kicks Off. Accessed on July 16, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.