Download Pintu App

Bitcoin Takes a Hit as US CPI Hits 2.7%! What’s Next for the Market?

Jakarta, Pintu News – Bitcoin (BTC) is facing high volatility after the release of the US CPI data for June.

The annual CPI (Consumer Price Index) data that came out was higher than expected, which sparked concerns about how this could slow down further Fed rate cuts.

Bitcoin records huge volatility after CPI data release

Data from CoinMarketCap shows that the price of BTC quickly recovered above $117,000 following the release of the CPI data, before then dropping to as low as $116,000 after a short while.

Read also: Bitcoin Stuck at $117K – Will It Plunge Back Below $110K?

This development came amid a decline of around 4% on the day, after prices had reached $123,000 recorded the previous day.

According to data from the US Bureau of Labor, the US annual CPI stood at 2.7%, slightly higher than the 2.6% forecast. However, the monthly data was 0.3%, in line with expectations, which was the only positive for Bitcoin.

The US CPI data of 2.7% was the highest level recorded since February 2025 and much higher than the 2.4% recorded in May.

Experts say that the release of new economic data keeps the market on edge, as cryptocurrency prices fluctuate within minutes of the announcement.

This volatility comes after a record-breaking week, where Bitcoin recorded a new ATH (All-Time High). BTC had shot up to as high as $123,000 on July 14, but the price has since fallen from that peak.

What Does CPI Data Mean for the Market?

Ahead of the release of the CPI and PPI data, The Kobeissi Letter warned investors of a possible “big sell-off” if the data showed higher results, citing inflation concerns stemming from tariffs implemented by Trump.

Read also: Could Sui Soar 3X to $10 in the 2025 Crypto Bull Run? Here’s What Experts Are Saying!

“June US CPI just registered 2.7% year-on-year – slightly higher than the 2.6% forecast,” said the pseudonymous Kyledoops. “Not a huge miss, but enough to keep the Fed guessing and the markets on edge.”

As investors try to make sense of the latest economic data, Bitcoin is once again attempting to reclaim its peak and possibly reach a new ATH.

Prior to the release of the CPI data, crypto expert Ali Martinez noted that BTC’s previous fall suggests that it will surge after the release of the inflation data, regardless of the figure recorded.

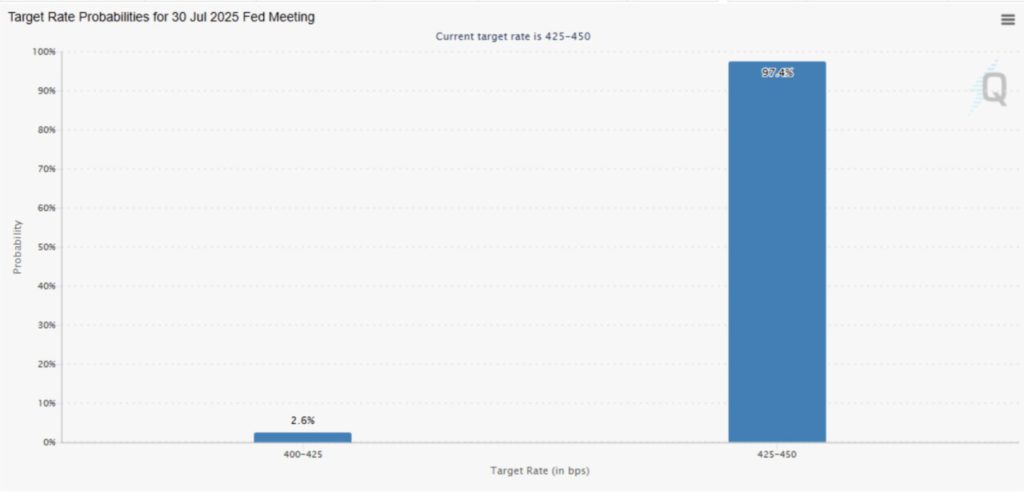

Meanwhile, the probability of a rate cut by the Fed in July to a level of 400-425 bps fell to 2.6%, while the figure for keeping rates high stood at 97.4%, according to CME FedWatch data.

Strong US jobs data and rising inflation concerns due to higher Trump tariffs have quelled hopes of a rate cut by the Fed in July, ahead of the FOMC meeting on July 30.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Reacts as US CPI Data Comes in at 2.7%. Accessed on July 16, 2025

- Coinpedia. June CPI Report Released, Inflation at 2.7% – Bitcoin Price Reacts. Accessed on July 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.