Download Pintu App

Bitcoin Halving & Market Cycle: A Complete Guide to Understanding the Bitcoin Cycle

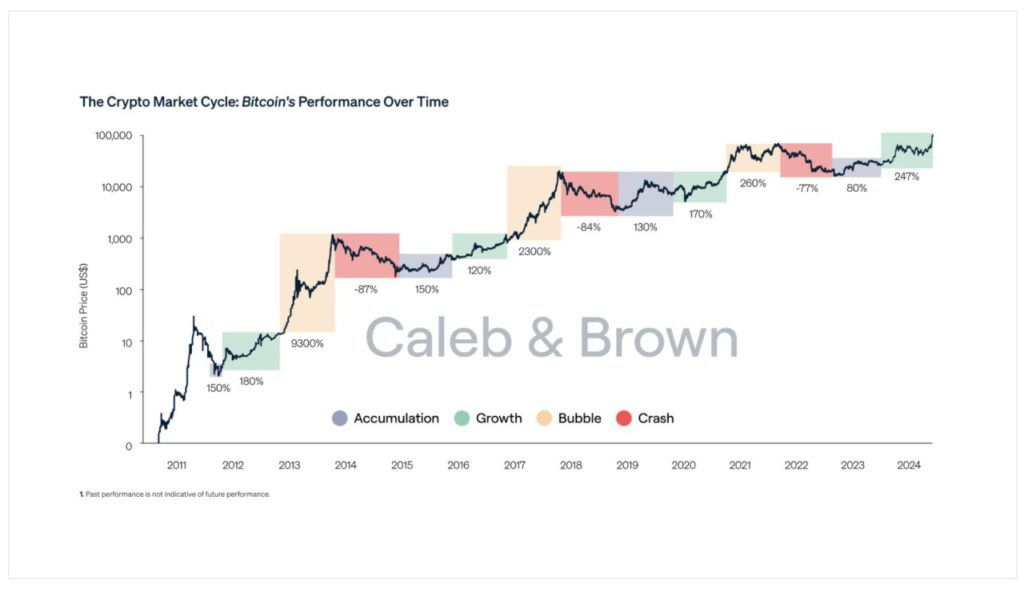

Jakarta, Pintu News – The Bitcoin (BTC) market is known for a unique cycle in which its price can spike sharply or plummet dramatically at any given time. These cycles repeat every four years, driven by halving events that affect supply and market sentiment.

From accumulation to crashes, crypto investors can take advantage of this pattern to make huge profits. In this article, we’ll break down the phases of the Bitcoin crypto market cycle and how it affects the price and mainstream adoption of cryptocurrencies!

What is the Bitcoin Market Cycle?

The Bitcoin (BTC) market cycle is a recurring pattern of price behavior, characterized by periods of appreciation and depreciation in value. These fluctuations are heavily influenced by investor sentiment, which changes with global economic conditions, regulations, and technological innovations.

A key event in this cycle is the halving, which is a 50% cut in rewards for Bitcoin miners that occurs every four years. The last time, the halving occurred was on April 19, 2024, when the reward decreased from 6.25 BTC to 3.125 BTC.

Furthermore, the next halving is expected to occur in April 2028. These new supply drops often trigger price spikes due to the limited availability of BTC in the market.

Read also: 5 Crypto Predicted to Beat Bitcoin (BTC) and Potentially Rise 9900%

Phases of the Crypto Market Cycle: From Accumulation to Crash

The Bitcoin market cycle consists of four phases: accumulation, growth, bubble, and crash. The first phase, accumulation, occurs when the price is still low, but there are early signs of recovery. Smart investors usually start buying in this phase because the long-term profit potential is huge.

The growth phase comes when the price starts to rise towards the previous record high. During this phase, trading volumes begin to rise, and many investors start buying in bulk. Usually, a halving event occurs in this phase, driving price expectations higher. The supply of BTC on exchanges also starts to shrink as many investors choose to HODL their coins.

Price bubbles appear when BTC prices exceed previous records and rise exponentially. In this phase, many retail investors start to enter for fear of missing out (FOMO), despite high volatility. The Fear & Greed index usually shows “Extreme Greed”, signaling market euphoria. However, prices that rise too quickly also make it vulnerable to major corrections.

The crash phase occurs after a euphoric peak, where the price falls to 80% of its peak. For example, BTC plummeted from $69,000 in November 2021 to $15,476 a year later.

This correction usually lasts about a year and brings back bearish sentiment. In this phase, panicked investors start selling, while patient investors prepare for the next phase of accumulation.

Also read: 10 Examples of the Most Popular Crypto in 2025

Market Sentiment and Supporting Data

Crypto market sentiment can be seen from various indicators such as trading volume, the Fear & Greed index, as well as Bitcoin reserves on exchanges.

When reserves on exchanges decrease, it means that many investors are holding onto their BTC, signaling confidence in the price increase. This often happens ahead of a growth or bubble phase.

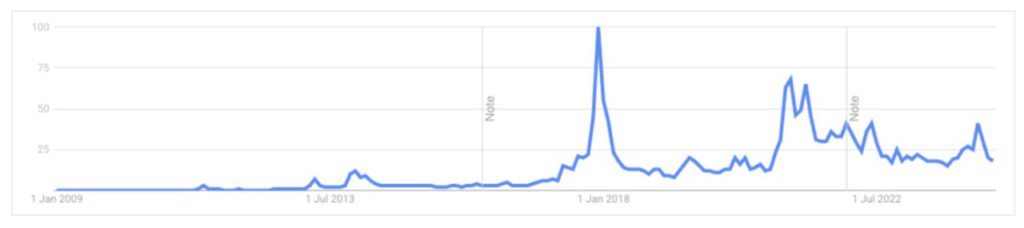

In addition, search trends on Google for the words “bitcoin” or “crypto” are also an indicator of public interest. The peak of searches occurred in December 2017 and during the bull run of 2021.

However, since then, searches have never been that high again, despite BTC prices setting new records. This shows that crypto is becoming more widely recognized, and information about cryptocurrencies is now spread through social media and mainstream news channels.

Correlation with Traditional Markets and Macro Impact

Bitcoin price is now increasingly showing a high correlation with risky assets such as stocks on the S&P 500 and Nasdaq. In April 2025, the correlation reached 0.73 and 0.76 after President Trump’s tariff announcement. As geopolitical tensions escalated in the Middle East, this correlation even jumped to 0.90.

This means that while Bitcoin was initially recognized as a hedging asset, it is now also affected by external factors such as macro uncertainty and government policies. These correlations can change depending on global conditions, and investors should take note of them in their investment strategies.

Also read: 3 Cryptos Worth Buying When Crypto Market is Bullish

Mainstream Bitcoin Adoption and Recent Regulations

Bitcoin is increasingly being recognized as a store of value and legal tender in various countries and large corporations. For example, MicroStrategy now holds 576,230 BTC at an average purchase price of $66,384 (approximately Rp1.08 billion per BTC). Tesla also holds more than 11,500 BTC on its balance sheet, indicating growing institutional interest.

More than ten spot Bitcoin ETFs have been launched, making it easier for traditional investors to invest in BTC without having to understand the technology in depth. However, privacy-conscious crypto users still prefer to buy BTC directly and store it in a cold wallet, following the “not your keys, not your coins” principle.

US Regulatory Measures and the Role of Government

Cryptocurrency regulation has been a major focus of the Trump administration since 2025. President Trump established two state digital funds: Strategic Bitcoin Reserve (SBR) and a national digital asset reserve. These funds are financed from criminally confiscated crypto assets, and will likely be expanded with the use of public funds.

So far, three US states-Arizona, New Hampshire, and Texas-have authorized the establishment of SBRs with state funds. On the other hand, 19 states have rejected this bill. Several other bills, such as the GENIUS Act and the CLARITY Act, are being discussed to provide legal certainty and further potential price spikes in the crypto market.

Routinely Save Bitcoin at Pintu: A Simple Strategy for Market Cycles

In the face of Bitcoin (BTC) price fluctuations due to market cycles and halvings, a regular savings strategy or Dollar Cost Averaging (DCA) is the most practical way for long-term investment. With DCA, you buy a fixed amount of Bitcoin at regular intervals without having to guess the market price, making it suitable for all phases of the cycle-from accumulation to crash.

Through the Pintu app, you can start saving Bitcoin from just IDR 11,000, automatically and hassle-free. This allows you to stay consistently invested, while taking advantage of the post-halving decline in BTC supply and the potential for future price spikes.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Caleb & Brown. Bitcoin’s Market Cycle. Accessed July 21, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.