Download Pintu App

Ethereum Holds Strong at $3,700 — Is a Massive Breakout to $4,000+ Just Around the Corner?

Jakarta, Pintu News – Recently, the Ethereum blockchain network experienced an increase in transaction capacity (throughput) after more validators expressed support for raising the gas limit to 45 million units.

The move aims to increase scalability and lower transaction fees at the same time. The price of Ethereum (ETH) briefly rose by 3.5% following this news, with optimistic investors targeting a potential break above $4,000 after a weekly gain of 25%.

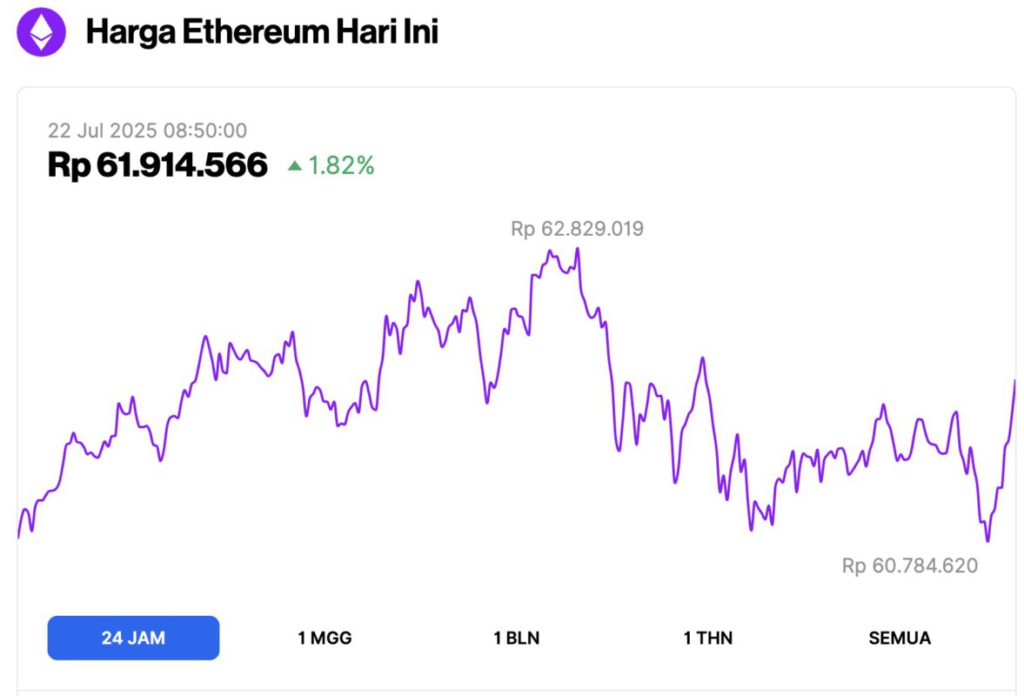

Ethereum Price Up 1.82% in 24 Hours

As of July 22, 2025, Ethereum was trading at approximately $3,792, or around IDR 61,914,566 — marking a 1.82% gain over the past 24 hours. Throughout the day, ETH fluctuated between a low of IDR 60,784,620 and a high of IDR 62,829,019.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $457.71 billion, with daily trading volume falling 7% to $43.13 billion in the last 24 hours.

Read also: Top Bitcoin Holders of 2025 – The Billion-Dollar Wallets Revealed!

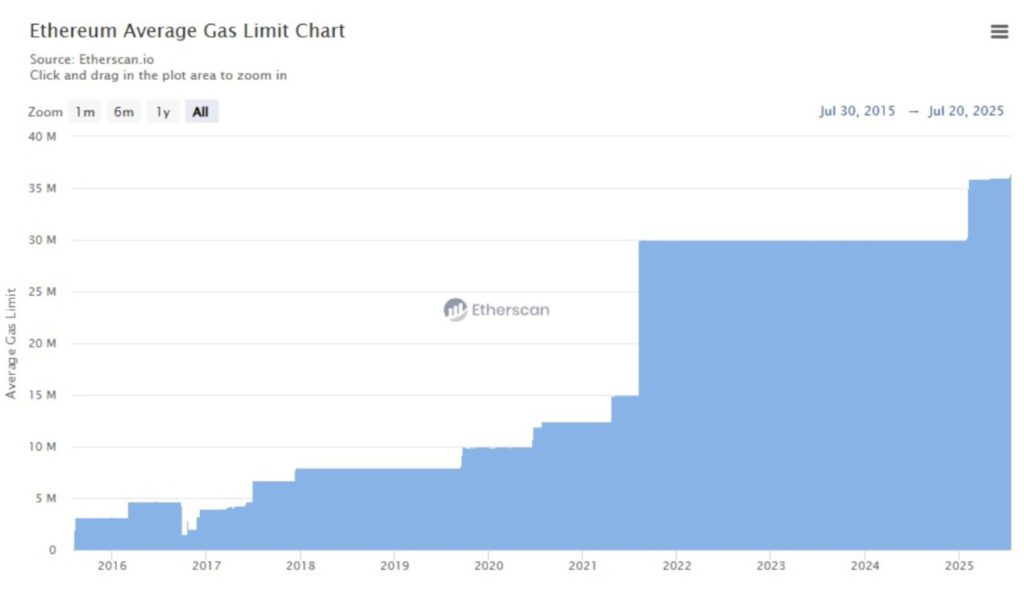

Ethereum Gas Limit Jumps to 37.3 Million in Network’s Latest Upgrade

Based on data from Etherscan, the Ethereum network gas limit increased to over 37.3 million units on July 20. This represents an increase of almost 3% compared to the end of last week.

This surge reflects increased support from validators, with some proposed blocks using higher gas limits.

This is the first significant increase in the gas limit since last February, when it was raised from 30 million to 36 million units. Validators can signal support for gas limit adjustments, which can then be automatically increased or decreased by about 0.1% per block.

According to Chainspect, Ethereum’ s throughput rose to almost 18 transactions per second (TPS) over the weekend, registering a 20% jump compared to around 15 TPS at the time of the previous gas limit increase.

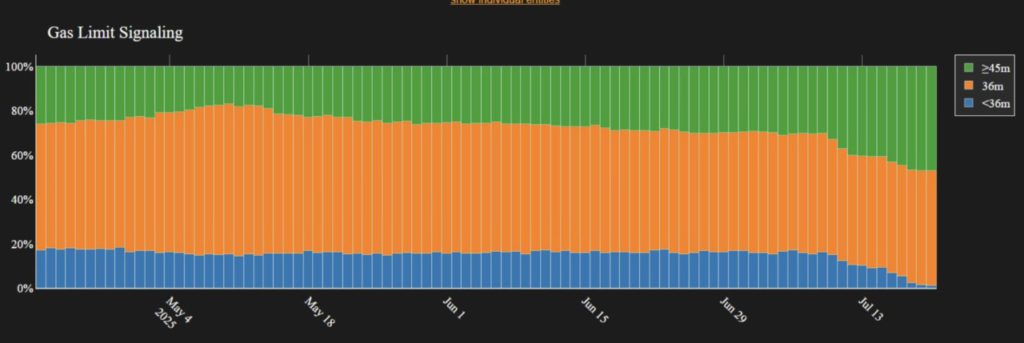

This weekend’s gas cap increase comes as nearly 50% of staked ETH now supports the proposal to raise the network gas cap to 45 million units or more.

Based on data from GasLimits.pics, around 47.2% of validators staking are currently in favor of increasing the gas limit. This indicates a broader consensus within the community to increase Ethereum’s throughput capacity at layer-1.

Read also: Dogecoin Beats Shiba Inu and Pepe – Will DOGE’s Surge Continue?

ETH Price Eyes Rise Past $4,000

After recording a weekly increase of 25%, the price of Ethereum (ETH) is now preparing to break the $4,000 level and open up opportunities for further gains.

Ethereum is approaching an important technical milestone, which is retesting the upper limit of its long-term macro range between $2,200 and $3,900, according to crypto analyst Rekt Capital.

The analyst noted that ETH has recovered by 120% from the key historical demand zone marked in light blue on the chart, and is now on track to test the upper limit of that range, marked in red.

Ethereum is also gaining acceptance from large institutions, as companies are increasingly interested in making ETH part of their treasury.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Ethereum Focuses on Scalability With 18 TPS as ETH Price Eyes Rally Past $4,000. Accessed on July 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.