Download Pintu App

Pi Network Soars 10% Today (July 22) — Is This the Start of a Massive Comeback Rally?

Jakarta, Pintu News – Pi Network tokens are still showing weak performance, moving stagnantly despite the crypto market being on a positive trend.

While the crypto market experienced a surge last week-with some assets hitting record highs and others climbing to their highest levels in months-PI prices remained in a narrow range.

The lack of interest in this altcoin meant that it did not show enough impetus to break out of the pattern. Then, how is Pi Network’s current price movement?

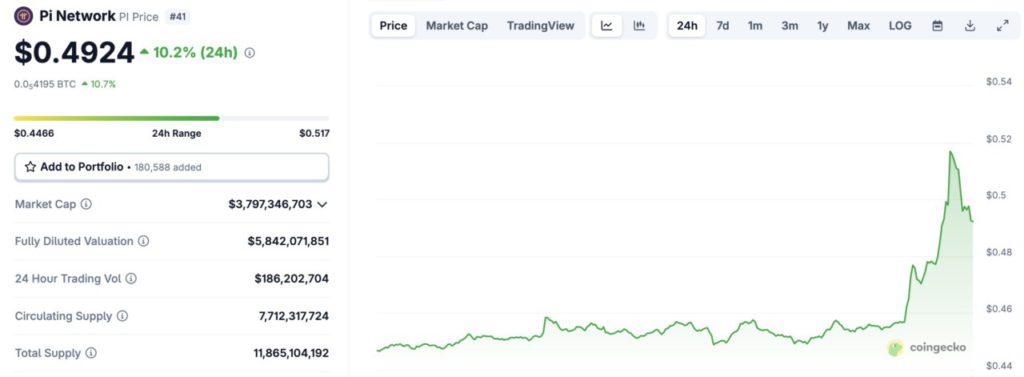

Pi Network Price Up 10.2% in 24 Hours

On July 22, 2025, the price of Pi Network was recorded at $0.4924, having risen 10.2% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,302), then 1 Pi Network is IDR 8,027.

Read also: Dogecoin Inches Up Today — Is a Massive Breakout to $0.33 Just Around the Corner?

PI’s 24-hour trading volume also surged, reaching $186 million, signaling very active buying and selling activity in the market. This helped push PI’s market capitalization to $3.79 billion, while its fully diluted valuation hit $5.84 billion.

Investor Interest Declines, PI Moves Flat and On-Chain Activity Drops

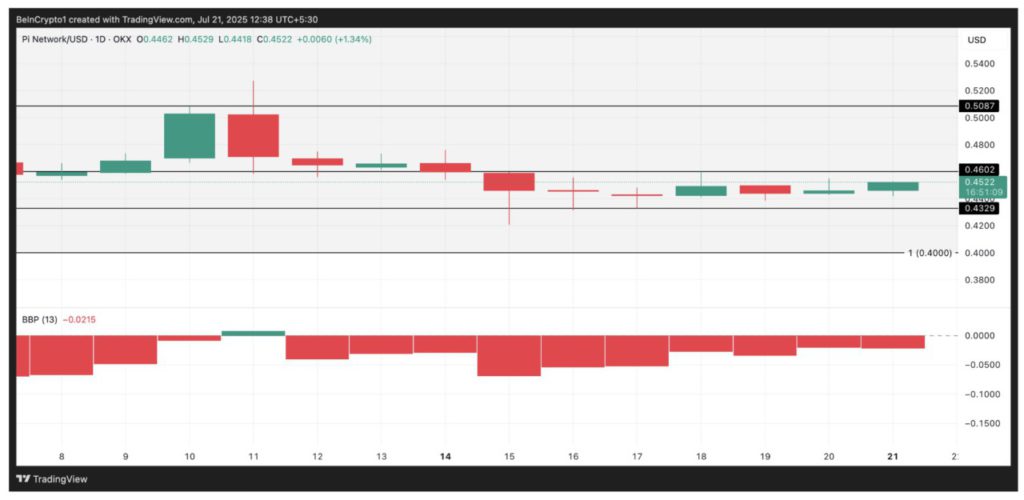

As of July 21, PI is stuck in a flat moving trend, facing strong resistance at $0.46 and solid support at $0.43.

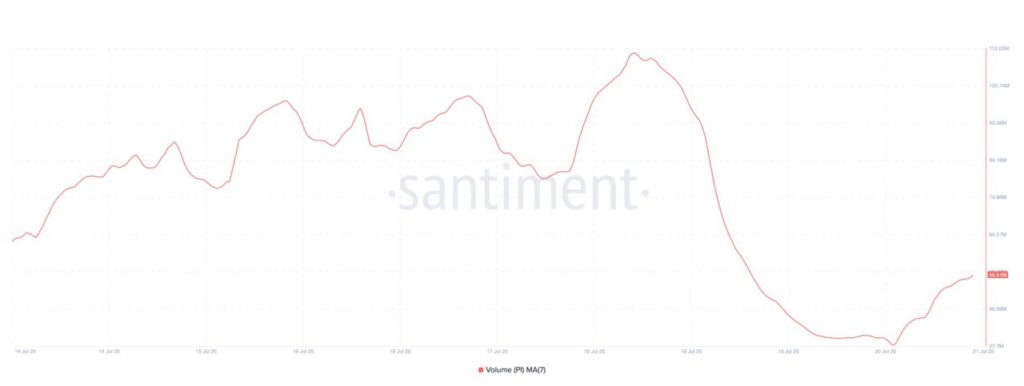

In contrast to other cryptocurrencies that are enjoying a surge in investor interest, PI has seen a decline in trading activity, reflected by a sharp drop in on-chain volume.

According to data from Santiment, PI’s on-chain trading volume fell by 21% in the last seven days. This indicates declining demand and increased caution from investors.

A decrease in trading volume means that fewer investors are buying or selling the asset. This reflects weakened interest, low liquidity, or general market uncertainty.

In the case of PI, if a volume decline occurs amidst a flat price movement, it signals a lack of market conviction. Neither side-both buyers and sellers-is dominating, leading to a weakening of price momentum.

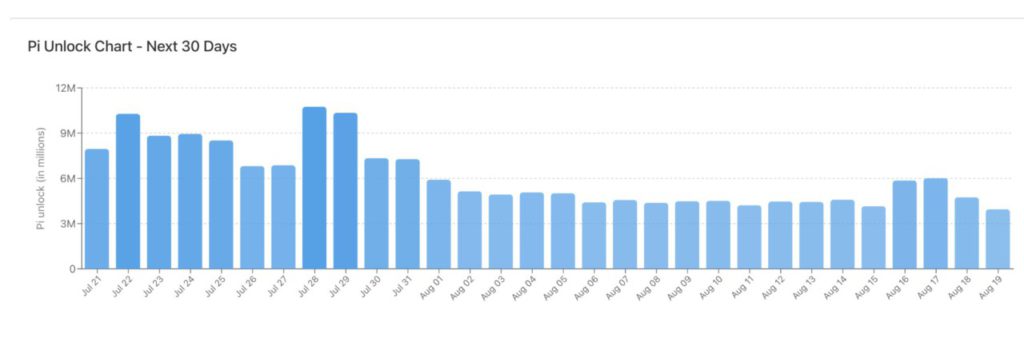

Pi Network to Unlock 95 Million Tokens

In addition, according to data from PiScan, the Pi network is scheduled to unlock 95 million PI tokens in the next eight days. This has added to the selling pressure on the token.

With stagnant prices and declining volumes, the unlocking of this token has the potential to prolong PI’s sluggish movement, or even push the price down below the $0.43 support level.

Read also: Crypto to Watch This Week: Kaito, Avalanche, and Pi Network Ready to Explode?

A large influx of token supply amid weak demand will amplify selling pressure, especially in a bearish market.

PI’s Bearish Trend Deepens – $0.43 Support Level is a Key Focus

An analysis of the Elder-Ray Index on the PI daily chart shows that the current market sentiment is leaning towards bearish. This indicator, which measures the strength between buyers (bulls) and sellers (bears), has recorded negative values since July 12 – signaling the dominance of strong selling pressure.

If this trend continues, the likelihood of a break below the $0.43 support increases. This could pave the way for a retest of the PI’s all-time low of $0.40.

However, if there is renewed buying interest from investors, the market momentum could change. If demand picks up, the PI token price could potentially break through resistance at $0.46 and even continue to rise towards $0.50.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Can PI Recover From Its Demand Drought as Volume Continues to Fall? Accessed on July 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.