Download Pintu App

How Whipsaw Shocks the Stock Market: Here’s the Analysis and Strategy!

Jakarta, Pintu News – The stock market is often unpredictable, and rapid and sudden price movements-known as whipsaws-can cause huge losses for investors. This phenomenon occurs when stock prices move in one direction and then quickly reverse course.

A deep understanding of whipsaws and strategies to deal with them is essential for investors to optimize their portfolios amid market uncertainty.

Check out the full information here!

Definition of Whipsaw

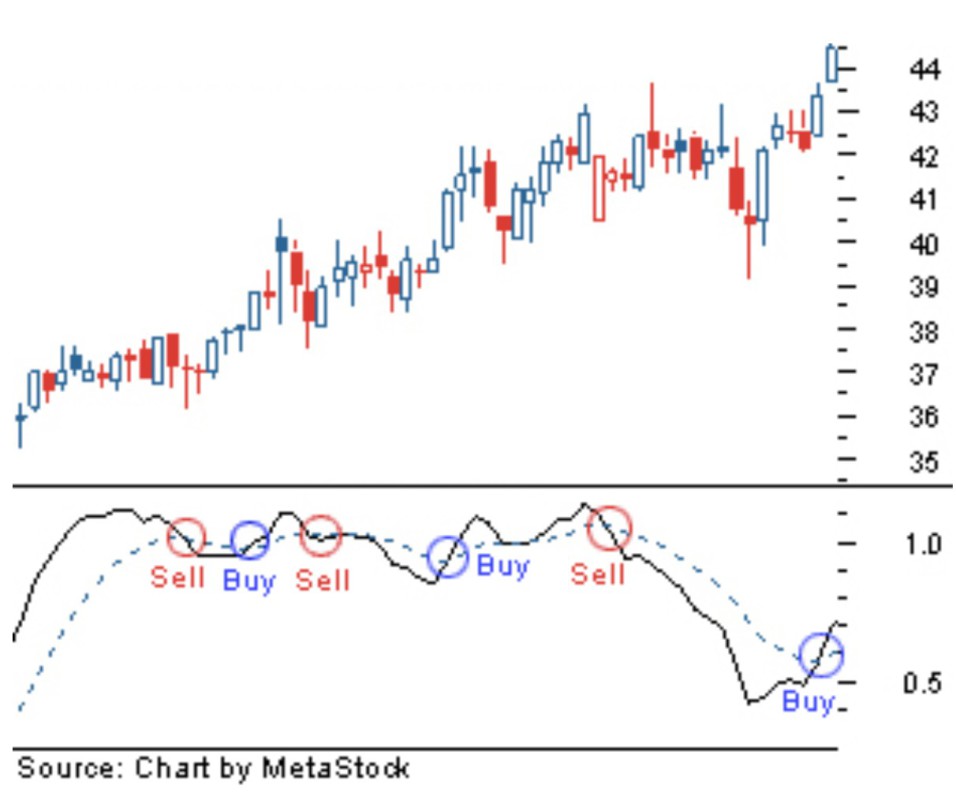

Whipsaw is a term used to describe a situation where the price of a security moves in one direction and then suddenly reverses in the opposite direction.

The term comes from the pushing and pulling motion of a saw used by carpenters, which is similar to these price fluctuations. Investors are said to experience a whipsaw when the price of the security they have just invested in moves unexpectedly in the opposite direction.

Two common whipsaw patterns are first, a sharply rising stock price followed by a drastic drop. Second, a stock price that drops briefly and then suddenly spikes. Both of these situations can lead to significant losses for investors if not managed with the right strategy.

Also read: Bitcoin set to surge to $130,000, time to invest?

Impact of Whipsaw on Stock Price

Whipsaws often occur in volatile markets, where stock price fluctuations are difficult to predict. This pattern is especially detrimental to day traders or short-term investors who are often subjected to rapid and unpredictable price changes.

However, for investors with a long-term approach who prefer a buy-and-hold strategy, this market volatility can be overcome. For example, an investor who buys a stock with the expectation that the price will go up, may end up incurring a huge loss if the stock suddenly falls after the purchase.

This situation often occurs when investors buy stocks at the peak of a market rally unaware of quarterly reports that can drastically change market sentiment.

Also read: Charles Schwab Prepares to Rival Coinbase in Bitcoin and Ethereum Trading, Here’s the Strategy!

Strategies to Deal with Whipsaw

Financial analysts are trying to find models that can explain patterns in the market to help investors choose the right asset class. According to research by Sonam Srivastava and Ritabrata Bhattacharyya, investors need to adjust their trading style to take advantage of different phases in the stock market.

They also suggest that investors choose different asset classes in each market regime to ensure a stable and risk-adjusted return profile. In the face of volatility, it is recommended to stick to long-term strategies that capitalize on investors’ strengths.

Investing in more stable sectors, such as healthcare, and avoiding more volatile sectors, such as real estate, can help in reducing whipsaw risk. While short-term market volatility is expected, a long-term, stock-based portfolio is still considered the best option.

Conclusion

Dealing with whipsaws requires a good understanding of market dynamics and the ability to adjust investment strategies quickly. With the right approach, investors can reduce the risk of loss and even capitalize on market volatility for long-term gains. The key to success in the stock market is flexibility and resilience in the face of change.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. What Is Whipsaw? Accessed on July 22, 2025

- Featured Image: Investopedia

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.