Download Pintu App

Smart strategies for using OCO orders in trading: Benefits and Application of OCO Orders

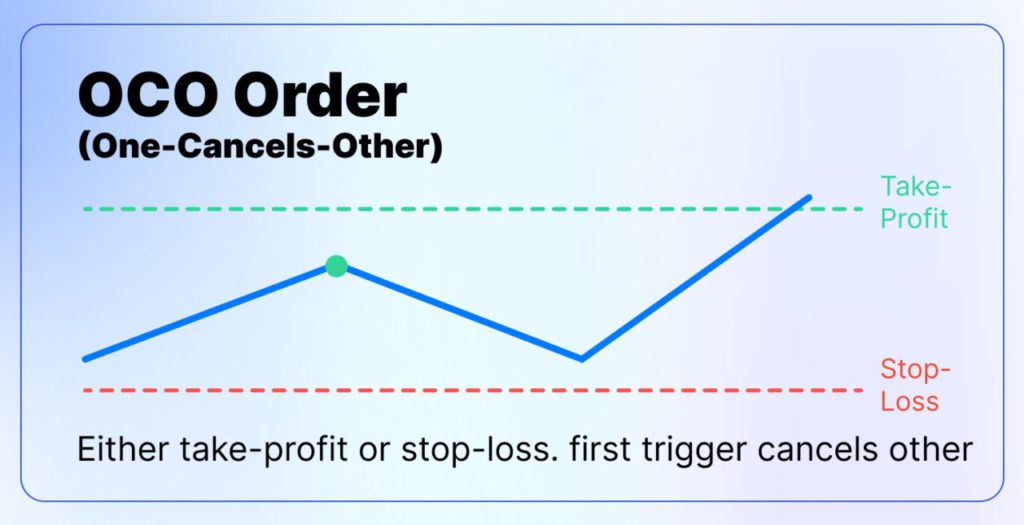

Jakarta, Pintu News – The use of One-Cancels-the-Other (OCO) orders has become a popular strategy among traders to manage risk and maximize potential profits. These orders allow the execution of one order to cancel another order automatically, which is especially useful in volatile market conditions.

Definition of OCO order

OCO orders are trading instruments that consist of two conditional orders; when one order is executed, the other will be canceled automatically. Usually, it combines a stop order with a limit order. If the price reaches one of the two predetermined points (stop or limit), the corresponding order will be executed and the other order will be canceled.

This helps traders to enter the market while effectively managing risk. OCO orders are very different from order-sends-order (OSO) conditions, where the execution of one order will trigger the application of a second order, rather than its cancellation. As such, OCO provides added security in managing volatile positions without the need for constant manual intervention.

Also Read: 6 Top Crypto Movers 24 Hours July 23, 2025: Some skyrocketed, some heavily discounted!

Benefits and Application of OCO Order

Traders can utilize OCO for retracement and breakout trading strategies. For example, if a trader wants to enter the market when a stock price breaks above resistance or below support, they can set OCO with a buy stop above the resistance price and a sell stop below the support price.

When the stock price breaks one of these limits, the relevant order will be executed and the other orders will be canceled automatically. This is particularly useful in scenarios where traders are unable to monitor the market constantly. OCO orders ensure that only one of the two strategies will be executed, reducing risk and maximizing potential profits from significant price movements.

Example of OCO Order Implementation

To illustrate, imagine an investor owns 1,000 shares of a volatile company with a current price of $10. This investor anticipates large price fluctuations in the near future and targets a selling price of $13, while not wanting to lose more than $2 per share.

Then, the investor can place an OCO order consisting of a stop-loss order to sell 1,000 shares at $8 and a limit order to sell at $13. If the share price rises to $13, the limit order will be executed and the shares will be sold at that price. Simultaneously, the stop-loss order at $8 will be canceled. This avoids the risk of forgetting to cancel the stop-loss order which could lead to an unwanted short position if the stock price subsequently drops to $8.

Conclusion

OCO orders offer flexibility and security in trading that cannot be ignored. By utilizing these orders, traders can reduce risk and increase potential profits without having to constantly monitor market movements. It is an invaluable tool in the arsenal of any trader who is serious about effectively managing their investments.

Also Read: 5 Cryptos with the Highest Gains at the Market Door on July 23, 2025-Anything Over 24% in a Day!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. OCO Order Definition. Accessed on July 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.