Download Pintu App

The Crypto Invoicing Revolution: Optimizing Crypto Invoicing for Business

Jakarta, Pintu News – The use of cryptocurrencies in business transactions has brought about significant changes in the way companies issue invoices. Crypto invoicing, which is designed to meet the unique needs of digital transactions, ensures that payments are made quickly and securely. This article will explain how crypto invoices are created, managed, and the challenges faced by companies in implementing them.

Introduction to Crypto Invoicing

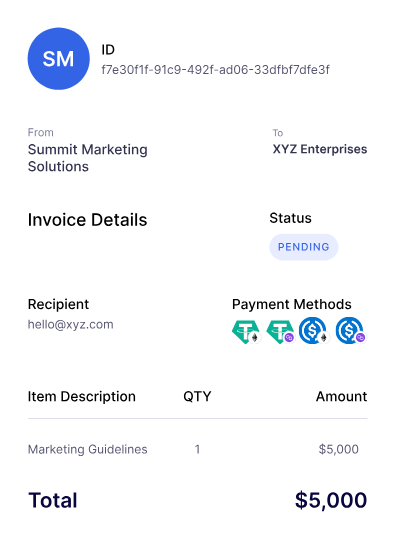

A crypto invoice is a document sent by a service or goods provider to a buyer to request payment in cryptocurrency. It includes important information such as the invoice date, invoice number, identities and contacts of both parties, a description of the goods or services, and the total amount to be paid in cryptocurrency and fiat.

The importance of these invoices lies in their ability to adjust to fluctuations in the value of cryptocurrencies and the need for secure transactions. Invoices should be professionally formatted, including elements such as a header with the provider’s name, body text describing the goods or services, and a footer containing payment terms.

The inclusion of clear payment terms, including accepted cryptocurrencies and their fiat equivalents, is essential to ensure that both parties understand how and when payments should be made.

Crypto Invoice Management

Once a crypto invoice is sent, managing the payment process becomes crucial. Keeping up with payments and ensuring that no invoices are duplicated or misunderstood is key to maintaining financial accuracy. Using accounting software that integrates with crypto payment systems can help track transactions and automate payment reminders.

Automation also plays an important role in streamlining the facturation process. By utilizing facturation software designed for crypto transactions, companies can reduce manual errors, speed up the transaction process, and improve customer experience by providing smooth and secure payments.

Challenges in Crypto Facturing

Companies operating in the crypto space often face unique challenges, especially when it comes to facturation. Payment errors, such as manual handling of wallet addresses, can lead to huge losses. Automated solutions can help address these issues by minimizing human error.

In addition, tax reporting is complicated by the constantly changing value of cryptocurrencies, requiring meticulous record-keeping. Regulatory compliance is also a big challenge, especially with strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Companies must ensure that all facturation processes comply with these regulations to avoid legal sanctions.

Conclusion

By understanding how to create, manage, and overcome the challenges of crypto-invoicing, companies can leverage this technology to speed up transactions, improve security, and strengthen business relationships. Automated payment solutions offer an efficient and economical way out, allowing companies to remain competitive in the rapidly evolving digital economy.

Also Read: XRP hit by selling pressure, price slumps-Will there be a resurgence in August 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- OneSafe. Crypto Invoice Requests Guide. Accessed on August 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.