Download Pintu App

3 Cryptos Whales Are Dumping Ahead of Donald Trump’s Global Tariff Rollout

Jakarta, Pintu News – The Trump administration is scheduled to announce the full details of tariffs for most countries in the world on August 7, 2025.

Tariff announcements like this usually trigger turmoil in both the stock and crypto markets. Because of this, large holders of crypto assets – often dubbed whales – seem tohave started to reorganize their positions and offload some of their holdings before the news was released.

Uniswap (UNI)

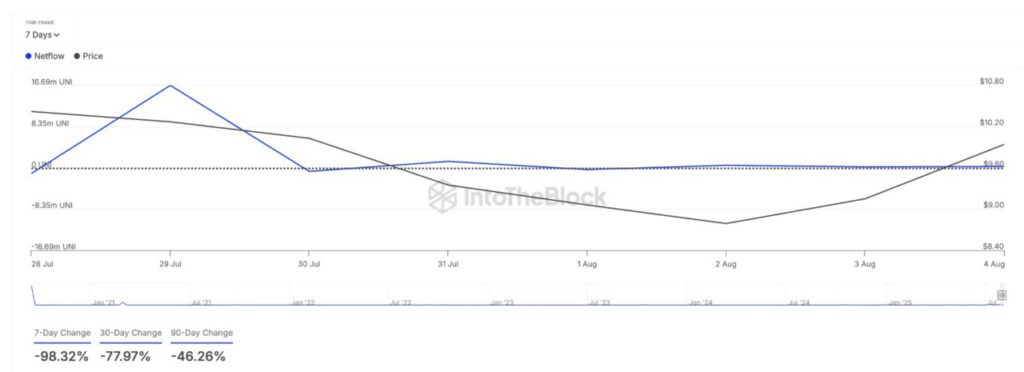

DeFi token Uniswap (UNI) is one of the assets that crypto whales seem to be distributing ahead of August 7. This is evident from the netflow metrics of large holders, which plummeted by 98% in the last seven days, according to data from IntoTheBlock.

Read also: Altcoins on the Rise? Altcoin Season Index Rises Rapidly from 34 to 50

Large holders are wallet addresses that control more than 1% of the total circulating supply. This netflow metric measures the difference between token inflows and outflows from these wallets.

When net flows go down, it means that large holders are moving their assets out of accumulation wallets, usually towards exchanges or other destinations for sale.

In UNI’s case, the 98% drop in netflow over the past week signals that whale wallets are drastically reducing their token purchases. This suggests a wave of distribution that could potentially add selling pressure to the UNI price ahead of August 7.

If the sell-off continues, the UNI price could drop to $8.67. However, if buying pressure increases and traders start opening new positions, the UNI price could potentially rise to $10.25.

Ethene (ENA)

Ethena (ENA), the native token that powers the Ethereum-based synthetic dollar protocol called Ethena, was one of the assets that crypto whales took off ahead of August 7.

Data from Nansen shows that the activity of large ENA holders has decreased over the past week. According to the on-chain data provider, token balances in whale wallets-whichhold over $1 million worth of ENA each-dropped by about 25% in the last seven days.

Currently, this large group of investors still holds nearly 42 million ENA tokens.

The sell-off comes as ENA prices continue to slide from its cycle peak of $0.70 on July 28, when many traders opted to secure profits. If this downward trend continues, ENA could potentially fall further towards the $0.48 support zone.

Conversely, if the buying pressure strengthens again, ENA could bounce and try to break the $0.64 area.

Read also: Solana Rolls Out Seeker Mobile to 50 Countries — Here’s What Makes It Stand Out

Cardano (ADA)

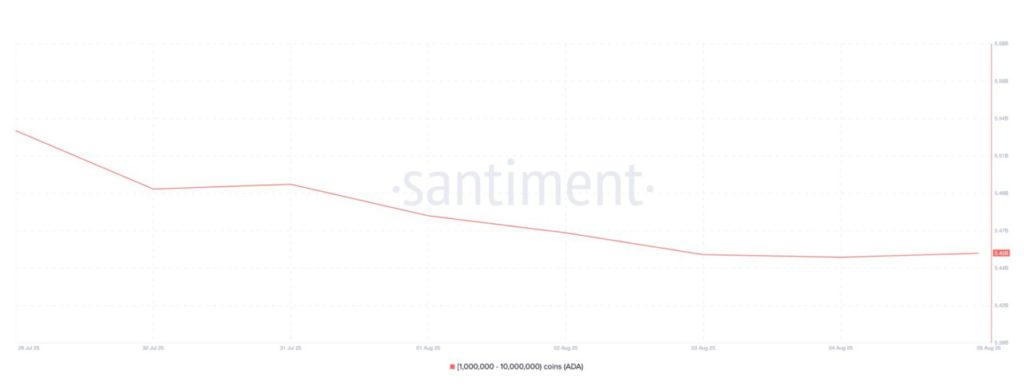

Cardano’s Layer-1 (L1) coin (ADA) was one of the digital assets distributed by major investors ahead of Trump’s global tariff announcement on August 7.

Based on on-chain data from Santiment, whale wallet addresses holding between 1 million and 10 million ADA have sold around 80 million ADA in the past seven days.

If this distribution action continues and the supply coming into the market exceeds the demand, the price of ADA could potentially drop to around $0.66. Conversely, a sharp surge in buying interest could push the altcoin through the $0.76 resistance level.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Whales Selling Altcoins Amid Trump Tariffs. Accessed on August 6, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.