Download Pintu App

A Year of DCA Solana (SOL): From Rp12 Million to Rp13.23 Million, Here’s the Journey

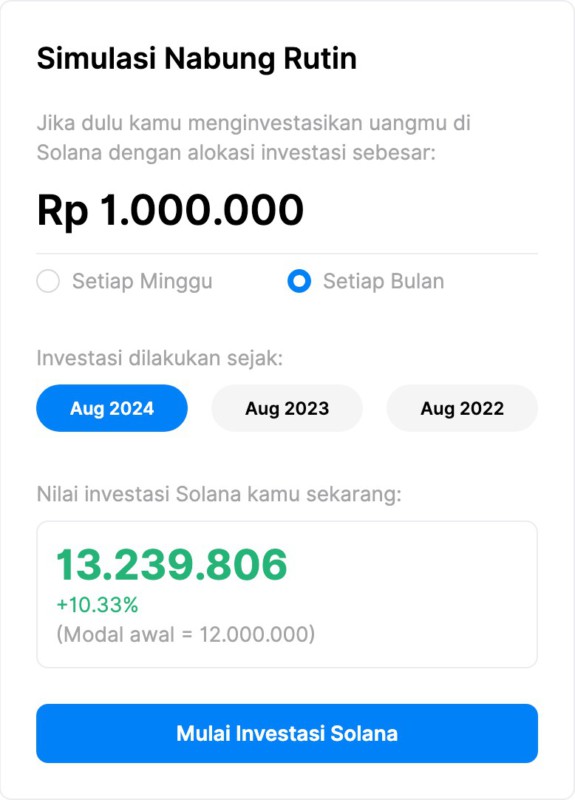

Jakarta, Pintu News – The Dollar-Cost Averaging (DCA) strategy has once again proven its superiority in managing investment risk in the volatile crypto market. This time, we will discuss the DCA simulation results for Solana (SOL) with a fixed monthly fund allocation over the past year.

DCA Strategy and Starting Capital

In this simulation, investors allocate Rp1,000,000 every month to buy Solana, starting in August 2024 until August 2025. The total capital invested for 12 months is IDR12,000,000.

This DCA approach makes investors buy SOLs regularly regardless of the daily market price, resulting in a more stable average purchase cost and reduced risk of price volatility.

Also Read: A Year of DCA XRP: From Rp12 Million to Rp29.78 Million, Here’s the Journey

Investment Return After 12 Months

As of August 2025, the total value of Solana’s portfolio reached IDR13,239,806, a +10.33% increase compared to the initial capital. This means that over the past year, the profit earned was around Rp1.23 million.

Although Solana’s percentage gain is smaller than Cardano’s over the same period, this result still shows that consistency in investing can lead to positive growth.

Solana Current Price and Market Conditions

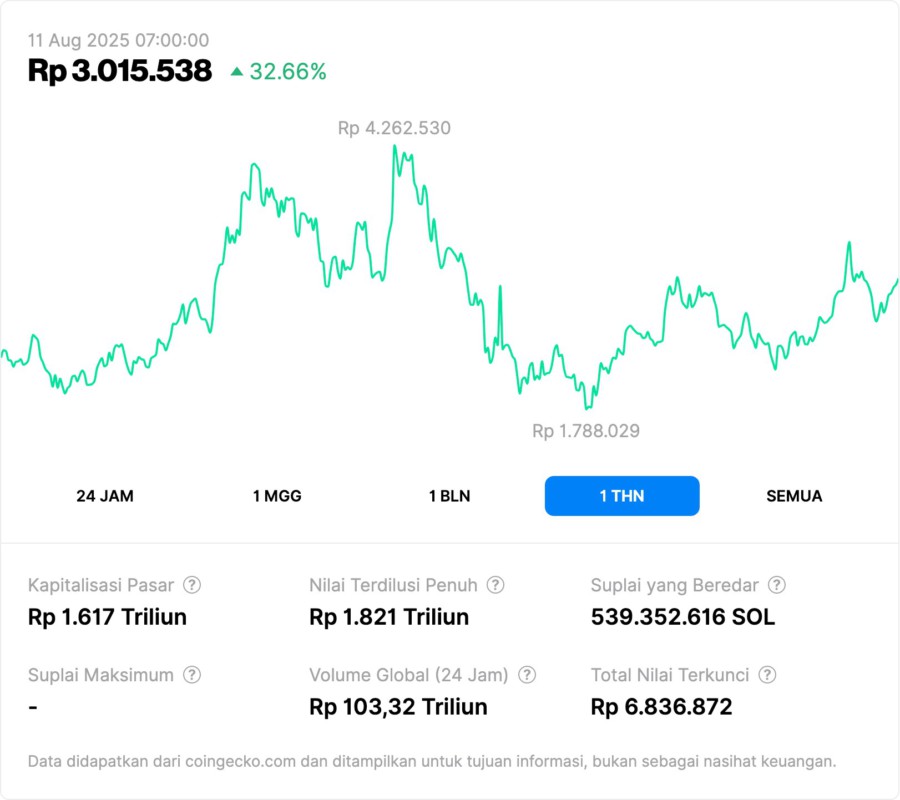

Based on data for August 11, 2025 at 07:00 WIB:

- SOL Price: IDR 3,015,538 per coin

- Market Capitalization: IDR1,617 trillion

- Fully Diluted Value: IDR1,821 trillion

- Circulating Supply: 539,352,616 SOLES

- 24-Hour Trading Volume: IDR103.32 trillion

- Total Locked Value: Rp6,836,872

Over the past year, SOL prices moved in the range of IDR1,788,029 to IDR4,262,530, registering high volatility but still providing growth opportunities.

Why is Solana interesting for DCA?

- Fast and Cheap Blockchain

Solana is known for its high transaction speed and low fees, making it a popular choice for DeFi and NFT applications. - A Growing Ecosystem

Many DeFi, gaming, and NFT projects are built on Solana, driving long-term demand for SOL. - Active Community and Developers

Strong community support and developers who continue to develop innovations keep Solana relevant in the market.

Conclusion

Over the past year, Solana’s DCA strategy resulted in a 10.33% growth in portfolio value. From a capital of Rp12 million, the value is now Rp13.23 million.

For investors who want to invest in assets with long-term potential and advanced technology, Solana can be an attractive option, especially if accumulated consistently through the DCA method.

Using the DCA Door Feature for Solana Investments

For investors who want to implement a similar strategy, the Pintu app provides a Routine Saving Simulation (DCA) feature that makes it easy to automatically purchase crypto assets, including Cardano. With this feature, investors can determine the investment amount, purchase frequency, and monitor the results directly in the app.

The DCA method in Pintu helps investors be disciplined in investing without having to guess the best time to enter the market. Although profits are not always consistent every year, this strategy is suitable for long-term financial goals, especially for those who believe in the growth potential of crypto assets such as Cardano.

Read More: A Year of DCA Cardano (ADA): From Rp12 Million to Rp15.67 Million, Here’s the Journey

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.