Download Pintu App

Bitcoin’s Grip on the Market Loosens as Ethereum Eyes the “Flippening”

Jakarta, Pintu News – As reported by Cryptopolitan (11/8/25), Bitcoin’s (BTC) share in the crypto market is declining, while Ethereum (ETH) has surged past $4,300. This has led many experts to predict that ETH could surpass BTC in value within a year.

Strong chart patterns and increased interest from large corporations further reinforce the possibility of a “flippening,” which is the moment when Ethereum becomes the number one cryptocurrency.

Ethereum’s rapid growth coincided with the break in Bitcoin’s trend of market dominance that began in late 2022.

Analyst Lark Davis notes that a similar drop last time saw ETH reach a record high of $4,900, and with the price now above $4,000, analysts expect an even bigger rally.

BTC Dominance Today

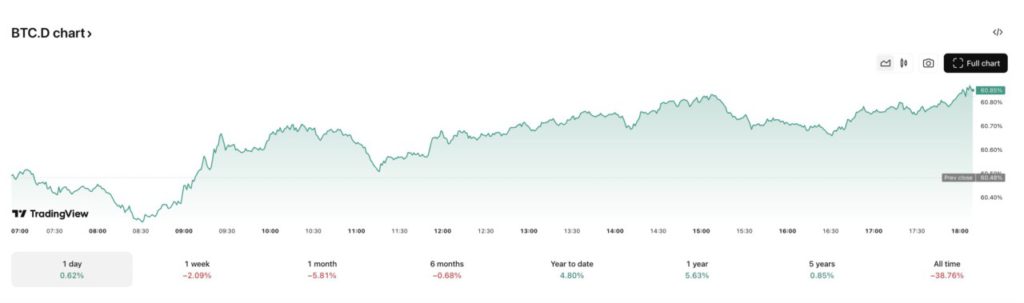

Based on the Bitcoin (BTC.D) dominance chart from TradingView (11/8), it can be seen that in the past day Bitcoin’s market dominance has slightly increased by 0.62%, up from its previous closing position of 60.48% to 60.85%.

Read also: Ethereum Surge Pushes Vitalik Buterin’s Net Worth Past $1 Billion!

Despite the daily gains, the short- and medium-term trend shows pressure:

- In the past 1 week, Bitcoin’s dominance fell by 2.09%.

- In the past 1 month, the decline was sharper at 5.81%.

- In the past 6 months, the decline has been relatively mild at 0.68%.

Analysts Expect Ethereum to Rise Sharply

According to Cryptopolitan, traders, instiutional investors, and analysts believe that Ethereum’s current rise in value could be the start of a larger, sustained rally after the price of Ethereum rose about 24% to trade above $4,330.

Much of this optimism stems from Ethereum’s breakout from the long-standing Wyckoff Accumulation pattern. This long phase forms the basis of an upward trend after the market absorbs selling pressure from sellers and weak holders, before the power shifts completely to buyers.

Analyst Lord Hawkins said a move above the $4,200 resistance zone indicates the dominance of buyers in the market, and marks what Wyckoff’s theory calls a “Sign of Strength.”

He explained that prices may experience a small correction(Last Point of Support) before an acceleration of price increases when demand exceeds supply(markup phase).

Hawkins estimates that this markup phase could push Ethereum towards its technical target of around $6,000 and give the overall crypto market a new boost.

Additionally, popular analysts Crypto Rover and Titan of Crypto highlighted Ethereum’s breakout from a multi-yearsymmetrical triangle pattern, and explained that the size of the triangle suggests a potential target of $8,000.

A similar breakthrough in 2020 proved Ethereum was capable of surpassing its initial target, when its price rose from under $200 to over $4,000 in just a year.

Analyst Nilesh Verma points out that Ethereum’s recent price rise from the $1,750-$1,850 support zone is similar to price movements in 2017 and 2020. Back then, market cycles lifted Ethereum from relative lows to record highs, with gains reaching 8,000% in a year.

Read also: Dogecoin Price Headed to $2? Crypto Analyst Patel Predicts DOGE’s Sharp Rise

Verma believes Ethereum could reach at least $10,000 in the next 6-8 months, and may even break $20,000 in the same period.

Bitcoin’s dominance falls, altcoin season and flippening potential strengthens

Analyst Ali says the altcoin season has begun, after data showed Ethereum’s net capital flows surpassed Bitcoin for the first time this cycle. This indicates that investors are starting to shift large funds to major cryptocurrencies other than BTC.

Ethereum’s founder projects that if more companies hold ETH as treasury assets-either alongside or in place of BTC-then ETH’s market value could overtake Bitcoin within a year.

Lark Davis sees the trend of institutional buying and the increasing talk of “ETH vs BTC” starting to dominate market strategies.

However, Samson Mow warns that the surge in ETH may not be purely due to long-term demand, but rather the actions of large holders capitalizing on the hype.

According to him, some Ethereum insiders who also own a large amount of BTC might move their assets to ETH to boost the price, then sell and return to BTC when the profit target is reached.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopolitan. Bitcoin dominance falls as Ethereum targets flippening. Accessed on August 11, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.