Download Pintu App

7 Key Facts About CHEX: Deflation Token for RWA Infrastructure

Jakarta, Pintu News – CHEX features an interesting combination of real utility, deflationary scarcity, and cross-cycle technology integration-making it representative of the new wave of real asset tokenization.

Despite its innovative potential, CHEX also comes with high volatility and risks related to market adoption. An objective approach and in-depth research remain essential in understanding CHEX’s place in today’s crypto landscape.

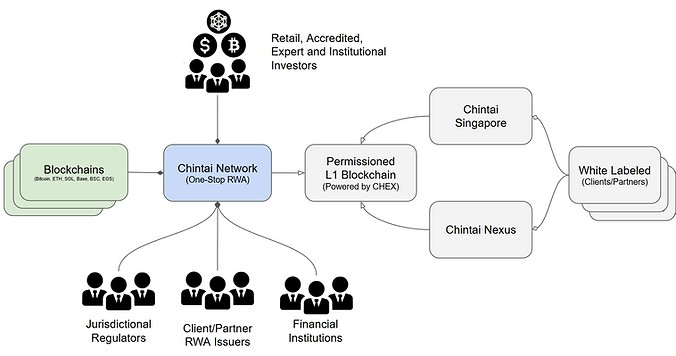

1. What is CHEX and the Chintai Ecosystem?

CHEX is the native utility token of the Chintai Network, a Layer-1 blockchain designed for the tokenization ofreal-world assets(RWA) such as real estate or infrastructure. All activities in the Chintai ecosystem-from token issuance to trading-are executed using CHEX.

Also Read: Top 3 DePIN Tokens August 2025: These Altcoins Show Positive Performance!

2. Scarce Economic Tokens & Deflation

All CHEX tokens have been in circulation and there is no additional emission in the future. In addition, Chintai implemented a buyback & burn mechanism of approximately 5% of platform activity to reduce supply, creating a long-term deflationary mechanism.

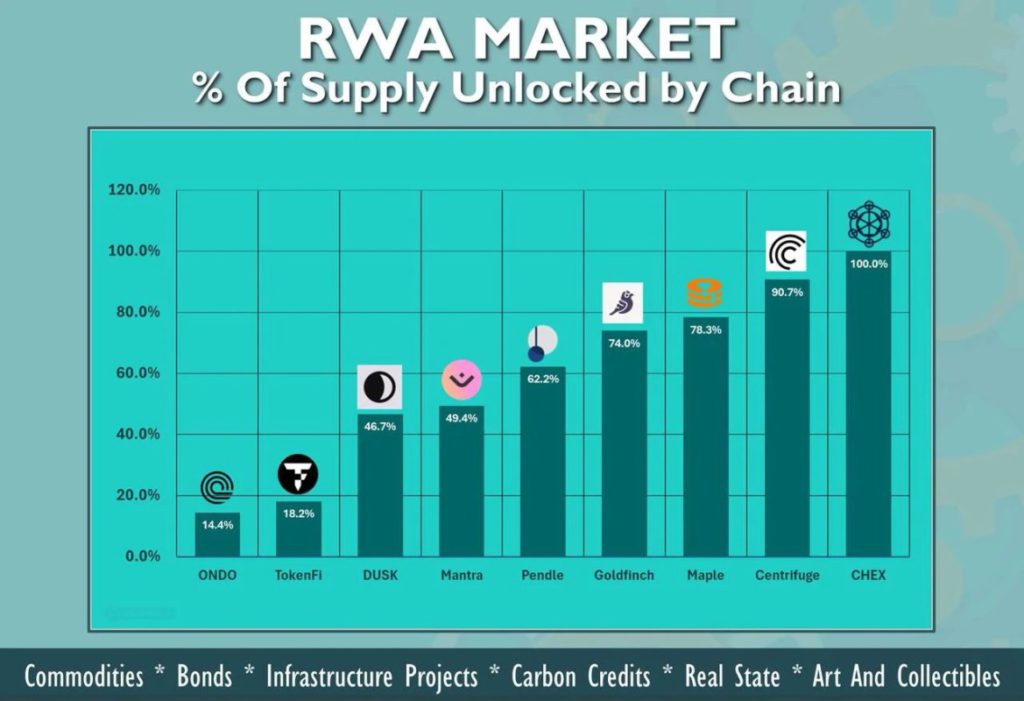

3. Multi-Chain Integration and RWA Access

CHEX supportsmulti-chain integration, including Ethereum, Solana, BNB Chain, and others, to facilitate the distribution of tokenized real assets to various networks and traditional financial providers(TradFi).

4. Staking & Rewards from Platform Activities

Users who stake CHEX can receive actual rewards from platform activities, such as issuance fees and RWA trading. In addition, some clients may perform airdrops to staking CHEX holders.

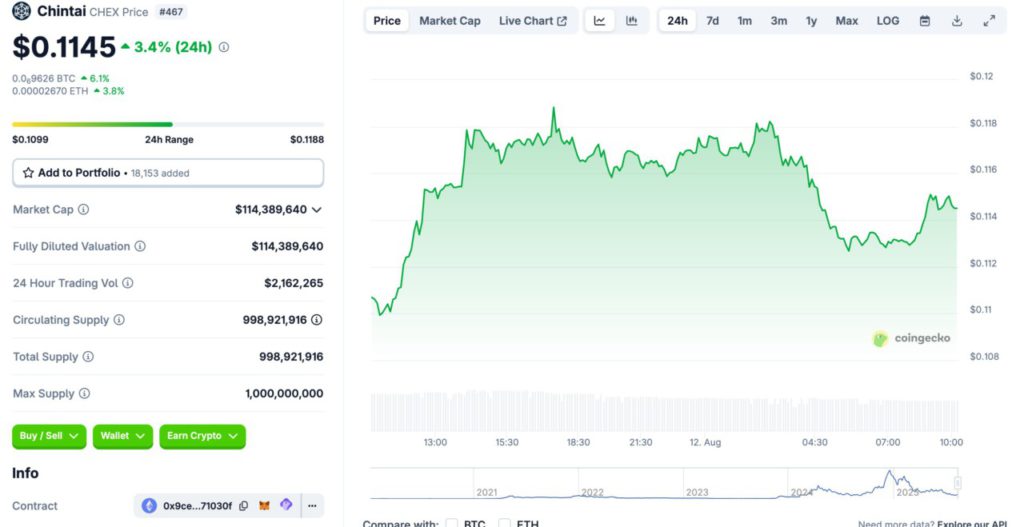

5. Recent CHEX Price and Performance Data

- The current price hovers around $0.11-$0.116.

- Market cap stands at around $112-114 million, with a similar diluted capitalization.

- Daily trading volume was recorded at around $1.6-2.2 million.

6. Historical Records & Volatility

CHEX once reached anall-time high of around $0.80 in December 2024, but has since declined by more than 85%. The token exhibits high volatility with highly variable historical ROI.

7. Institutional Adoption & Real Use Cases

Chintai through CHEX has been used to tokenize various RWA products by large institutions, such as a $30 million Bitcoin infrastructure fund, $100 million real estate fund, and $795 million infrastructure tokenization by R3 Sustainability.

Also Read: Top 3 Token Unlock August 2025: Redacted, Dappad, and GameGPT in the Spotlight

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Chintai Network. CHEX Token Utility & Mechanics. Accessed August 12, 2025.

- Coinbase / Crypto Asset Info. Chintai (CHEX) Price & Market Data. Accessed August 12, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.