Download Pintu App

5 Important Facts About Private Employee Retirement Age 2025 and How to Prepare the Fund

Jakarta, Pintu News – The retirement age of private sector employees is often debated among HR and management. Many companies do not have a clear policy, even though this has a major impact on regeneration planning, cost efficiency, and legal compliance.

Entering 2025, the official rules provide guidelines that can be used as a reference, although companies still have room for flexibility.

1. Retirement Age 2025: 59 Years

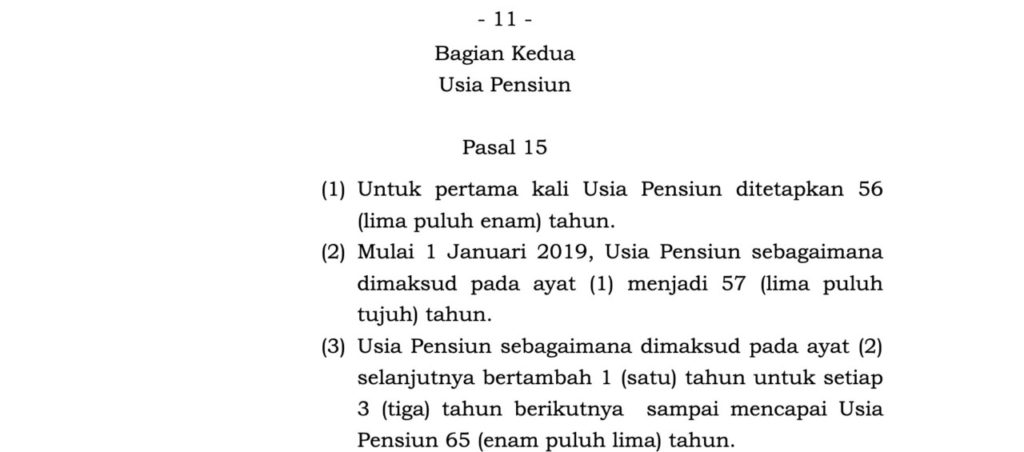

Referring to Article 15 of Government Regulation No. 45/2015 on the Implementation of the Pension Insurance Program, the retirement age was initially set at 56 years, increased to 57 years as of January 1, 2019, and increased by 1 year every 3 years until a maximum of 65 years.

With this scheme, in the period 2025-2027, the retirement age for private employees will be 59 years. The next increase will occur in 2028 to 60 years.

Also Read: Top 3 DePIN Tokens August 2025: These Altcoins Show Positive Performance!

2. Retirement Age Can Be Different According to Company Policy

Private companies are allowed to set a different retirement age than the government provision, as long as it is clearly stated in the work agreement, company regulation, or collective labor agreement (PKB).

In fact, some companies implement a phased retirement system, for example, technical positions retire at 55 years old, managerial positions at 60 years old, and strategic positions up to 65 years old. This approach allows knowledge transfer from seniors to juniors before full retirement.

3. Indonesia’s Retirement Age Continues to Rise as Life Expectancy Rises

The retirement age continues to increase as life expectancy and the quality of public health improve. BPS data recorded that Indonesia’s life expectancy reached 73 years in 2023, making workers considered still productive until their 60s.

This policy also supports the sustainability of BPJS Ketenagakerjaan’s Pension Guarantee (JP), where a longer service period and contributions mean greater retirement benefits. Even so, private companies can still set a different retirement age, as long as it is written in the contract or employment agreement.

4. Common Retirement Fund Preparation Instruments of Choice in Indonesia

Relying on severance pay and BPJS benefits alone is usually not enough to sustain life after retirement. Therefore, fund preparation needs to start early. Instruments that can be considered include:

- Pension savings and deposits

- Fixed income mutual fund

- Government Securities (SBN)

- Financial institution pension fund (DPLK)

5. Crypto becomes a modern option for pension fund diversification

In the digital age, many workers are starting to incorporate digital assets such as cryptocurrencies into their retirement portfolios. Assets like Bitcoin (BTC), Ethereum (ETH), and stablecoins can be an additional diversification.

However, given its high volatility, crypto placements should ideally only be a small portion of the total pension fund. This strategy can provide potential for value growth, while maintaining asset stability with conventional instruments such as bonds or mutual funds.

For employees, preparing for retirement as early as possible is a wise move. Portfolio diversification, including digital assets such as crypto, can be a modern strategy for a safe and comfortable retirement.

Also Read: Top 3 Token Unlock August 2025: Redacted, Dappad, and GameGPT in the Spotlight

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Dealls. Latest Private Employee Retirement Age Limit 2025 According to Law. Accessed August 12, 2025.

- Abul Muamar. The Rising Retirement Age of Workers Amidst Rising Unemployment. Accessed August 12, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.