Download Pintu App

Antam Gold Price Chart August 14, 2025: Why Are Many Investors Holding Out?

Jakarta, Pintu News – On Thursday, August 14, 2025 at 08:28 WIB, the BRANKAS Corporate gold buying price was recorded at IDR 1,873,600 per gram. This price increased by Rp 16,000 from the previous day which was at Rp 1,857,600 per gram. A similar increase also occurred in the price of physical gold which now touches IDR 1,933,000 per gram from IDR 1,917,000.

This price movement shows promising stability amidst the volatility of crypto markets like Bitcoin (BTC) and Ethereum (ETH). At a time when many investors are skeptical about the sharp ups and downs of cryptocurrencies, gold remains a reliable conservative option.

Trends of the Last 6 Months: What Do the Charts Say?

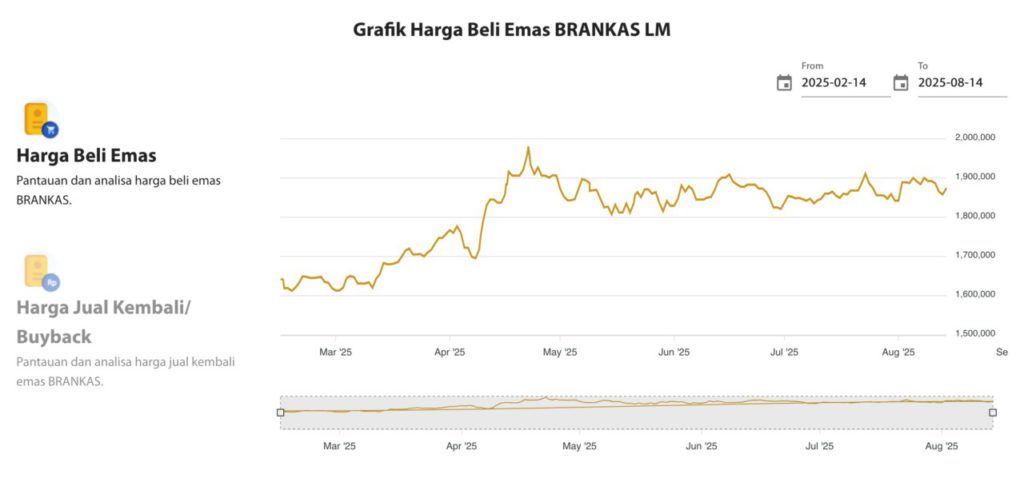

If you look at the graph from February 14 to August 14, 2025, the trend of BRANKAS gold purchase prices shows a fluctuating pattern but with an upward trend. The highest point was reached in mid-May 2025, where the price almost touched IDR 2,000,000 per gram. Thereafter, the price moved down but remained above IDR 1,800,000, showing medium-term stability.

This phenomenon is in contrast to some altcoins such as Pepe Coin (PEPE) or Ripple (XRP), which have experienced sharp declines due to global market pressures. Gold’s stable chart makes it a relevant hedging tool, especially for institutional and corporate investors.

Also Read: 5 Unique Facts Behind Ethereum (ETH) that You Might Not Know About

Why do corporates prefer BRANKAS?

BRANKAS Corporate’s gold purchase price is typically lower than physical gold, giving businesses a cost advantage. The digital storage and transaction security features are also a plus for businesses. In addition, BRANKAS provides real-time purchase and resale price analysis, facilitating decision-making.

With increasing regulation of cryptocurrency platforms in some countries, physical or digital storage of gold is becoming a safe alternative. Asset clarity and legal protection make gold a more predictable long-term investment option.

Crypto Vs Gold: Which One Wins?

Cryptocurrencies such as Ethereum (ETH) and Bitcoin (BTC) remain attractive for the short-term due to their volatility. For example, with an exchange rate of 1 USD = IDR16,107, a $50 jump in BTC could equate to a profit of IDR805,350 per unit. However, the risk of loss is comparable or even higher.

Gold, on the other hand, has not performed as fast as crypto but has been more stable. Investors seeking diversification will usually balance their portfolio by including some assets in precious metals such as gold.

What Should Investors Do Now?

Investors need to monitor price trends and global conditions to determine whether to buy or sell. When gold prices are showing an uptrend like now, it could be a good moment to consider accumulation. Meanwhile, the crypto market remains worth keeping an eye on, especially ahead of major events such as the next Bitcoin halving or government policy changes.

Using a platform like BRANKAS allows investors to gain access to real-time prices and charts that aid in decision-making. Digital security and buyback options also provide the flexibility to exit investments with minimal risk.

Choose Stable or Speculative?

Gold is still the top choice for investors looking to minimize risk amidst global market uncertainty. While crypto has the potential for high returns, gold’s stability has proven to be superior in volatile market conditions.

Both gold and cryptocurrencies have their place in an investment portfolio. The key lies in balance and understanding each investor’s risk profile.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. BRANKAS Gold Price Dashboard. Accessed August 14, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.