Download Pintu App

Ethereum (ETH) Price Surges to $4,700 Approaching ATH, What’s the Price Increase Factor?

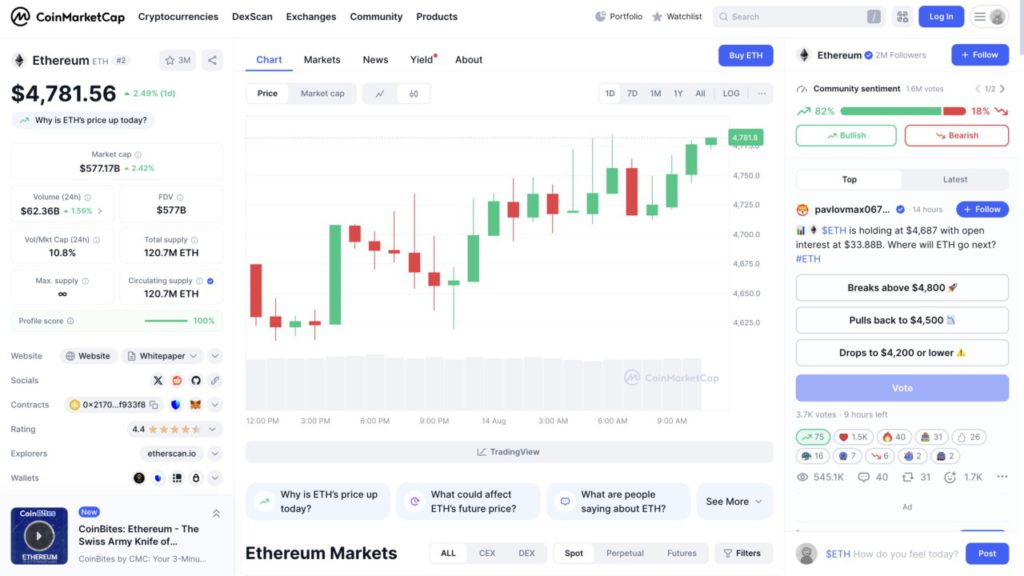

Jakarta, Pintu News – Ethereum (ETH) recently recorded a significant price increase, breaking the $4,700 mark. This surge coincided with the announcement from BitMine Immersion Technologies that it plans to increase its share sale target to $24.5 billion to strengthen its Ethereum (ETH) holdings.

Check out the full analysis in this article!

Ethereum Price Surges to $4,700

Ethereum (ETH) price broke through the $4,700 barrier, with a gain of 2.49% in the last 24 hours as of August 14, 2025. Not only that, ETH’s marketcap and trading volume also jumped 2.42% and 1.59% respectively in the last 24 hours.

Quoted from Coingape, this increase occurred along with the announcement from BitMine Immersion Technologies about their share sale expansion plans.

BitMine and Ethereum Accumulation Strategy

BitMine Immersion Technologies recently reached a significant milestone by having over 1.15 million Ethereum (ETH) in their coffers, valued at over $5 billion at current market rates.

This is an increase from the previous report in July which showed that BitMine had 625,000 Ethereum (ETH) with plans to buy back $1 billion worth of shares.

The NYSE-listed company has been aggressive in building up their Ethereum (ETH) reserves since launching their cash strategy earlier in the year. Industry data shows that total recorded Ethereum cash has exceeded $15 billion, with other notable holders including SharpLink Gaming and Bit Digital.

Also read: Scott Bessent Proposes 50 BPS Rate Cut by the Fed in September 2025!

Market Reaction to BitMine’s Strategy

Following the purchase, BitMine (BMNR) shares rose 9% on the day and have increased 634% since the start of the year, according to data from TradingView. This rise indicates the market’s positive response to BitMine’s aggressive strategy of accumulating Ethereum (ETH).

This increase not only strengthens BitMine’s position in the market, but also signals investor confidence in the long-term value of Ethereum (ETH) as a digital asset. It also demonstrates a growing trend where large corporations are beginning to adopt and hold cryptocurrencies as part of their financial strategy.

Conclusion

This significant rise in the price of Ethereum (ETH) marks an important moment in the cryptocurrency world, showing how corporate activities such as BitMine’s expansion can affect the market at large. With the right strategy, companies can not only increase the value of their own assets but also provide a positive boost to the cryptocurrency ecosystem as a whole.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Ethereum News: ETH Hits $4400 on Bitmines Stock Offering. Accessed on August 14, 2025

- Decrypt. Tom Lee’s Ethereum Treasury Bitmine ETH Raise $20 Billion. Accessed on August 14, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.