Download Pintu App

ETH Climbs 3% Today, Rebounding from $4,100 with Whales Showing Resilience!

Jakarta, Pintu News – Ethereum (ETH) recorded a 3% rise on Thursday (Aug 21), as large investors continued to add to their holdings of the altcoin despite many retail investors taking profits.

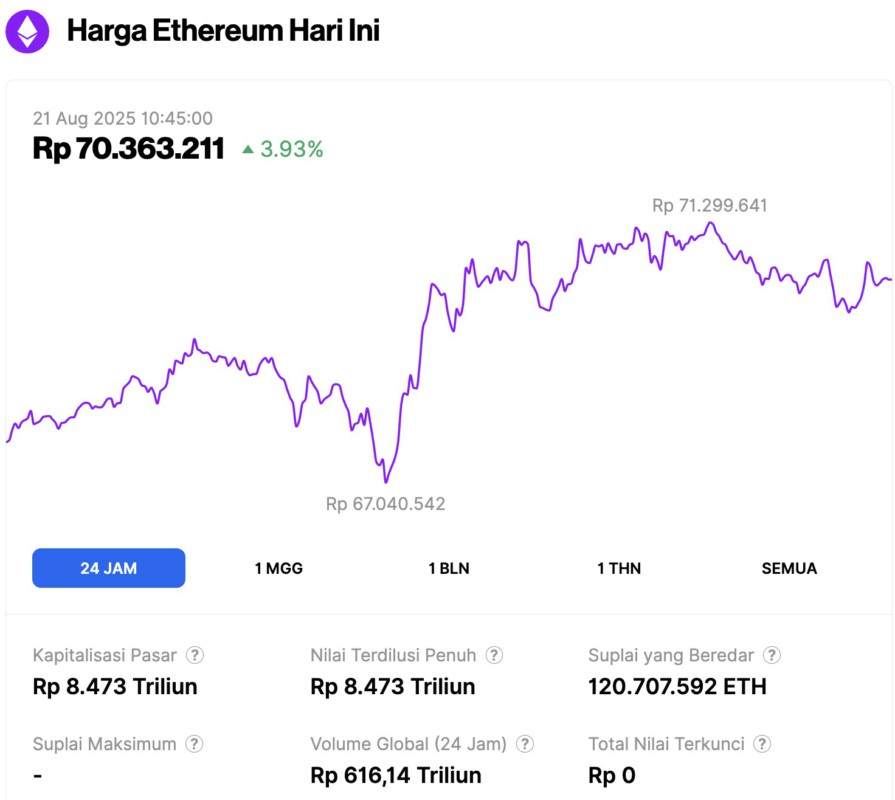

Ethereum Price Up 3.93% in 24 Hours

On August 21, 2025, Ethereum was trading at around $4,286 (approximately IDR 67.77 million), marking a 3.93% gain over the past 24 hours. Within the same period, ETH dipped to a low of IDR 67.04 million and climbed as high as IDR 71.30 million.

At the time of writing, Ethereum’s market capitalization is valued at roughly IDR 8,473 trillion, while its daily trading volume slipped 3% to IDR 616.14 trillion.

Read also: Bitcoin Climbs to $114K but Faces Pressure — Can the $110K Support Level Hold?

Ethereum Whales Keep Suppressing Buying

According to FX Street, after two consecutive days of decline, Ethereum rallied back with a gain of more than 6% on Wednesday (20/8). This rise triggered a surge in liquidation of short positions, with more than $100 million liquidated in the last 24 hours, according to Coinglass data.

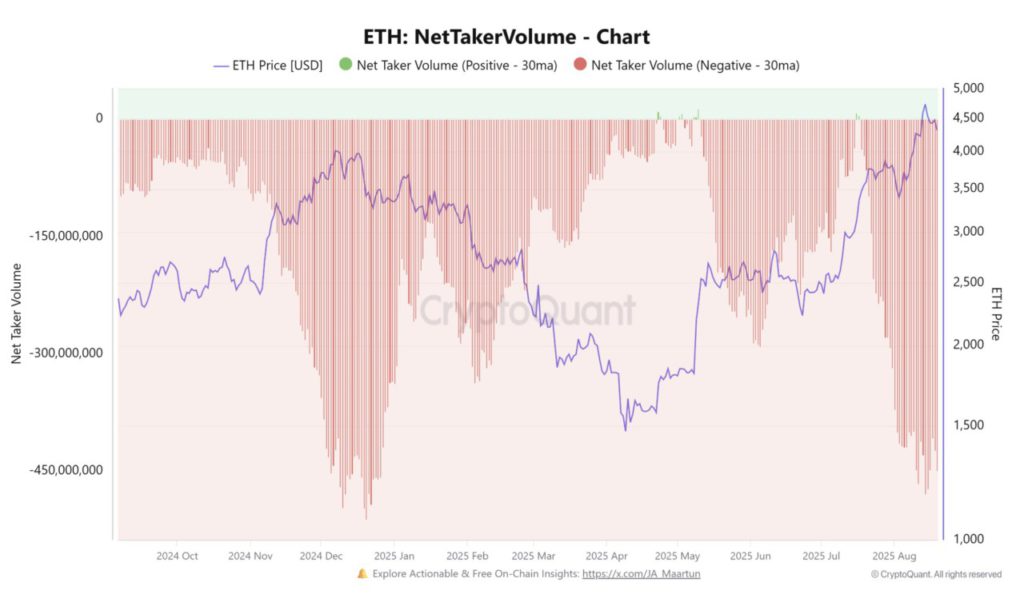

This move follows a large short bias on net taker volume in the Ethereum futures market. Net short volume increased to near highs last seen in December, before ETH plummeted more than 60% in the following months.

While short pressure could weigh on the price of this major altcoin, the trend could also potentially trigger a short squeeze if ETH resumes its medium-term upward trend.

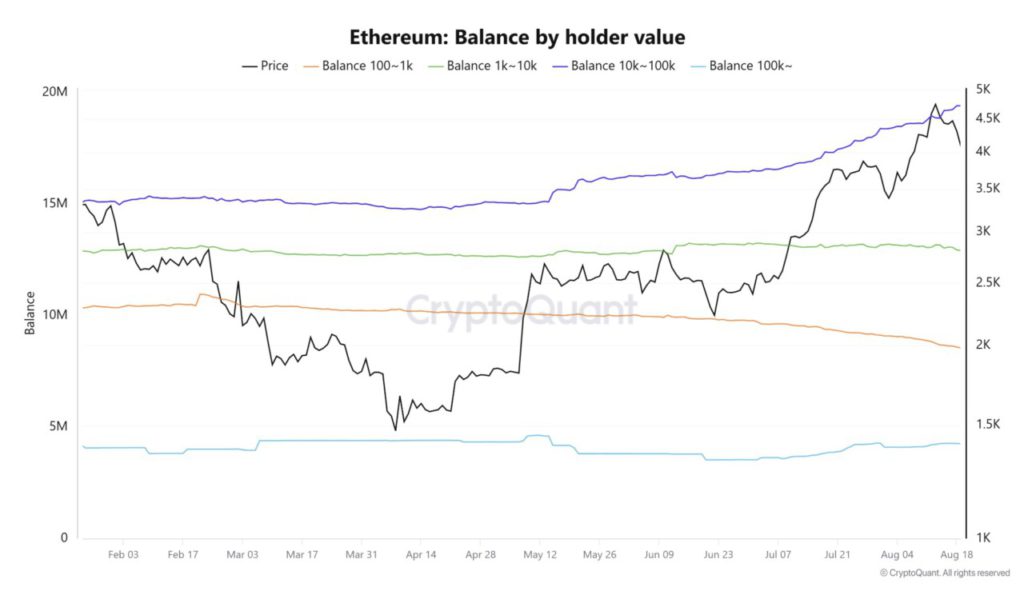

Ethereum’s recovery was also reinforced by the resilience of large investors during the correction phase. Investors with holdings between 10,000 and 100,000 ETH added to their collective 550,000 ETH in the past week, despite the price drop of around 10%.

Instead, small investors were seen panicking and reducing their holdings by around 380,000 ETH.

It was this small group of investors that led over $4 billion worth of profit realization, according to Santiment data, during the ETH correction period. This selling pressure was triggered by higher-than-expected inflation data last week and de-risking ahead of Federal Reserve Chair Jerome Powell’s speech in Jackson Hole.

Read also: Will Dogecoin Rally to $5 by 2030? A Deep Dive Analysis

“After such a big surge, it is natural for the market to look more tired and conservative. So, securing profits before the Fed’s key speech is no surprise. In crypto terms, a 4-5% correction cannot be taken seriously,” Nicolai Sondergaard, Research Analyst at Nansen, told FXStreet via email on Wednesday.

In addition to the buy-the-dip action from the whales, the continued accumulation of digital asset treasuries (DATs) also helped prop up prices during the correction. Companies like BitMine Immersion and SharpLink Gaming collectively bought around 520,000 ETH last week, according to data from StrategicETHReserve.xyz.

Ethereum Price Prediction: ETH Bulls Maintain Support Near $4,100

Ethereum halted its downward trend on Wednesday by recording a 6% gain, as the bulls returned to maintain support in the $4,100 area.

If ETH continues to rise and is able to reclaim the key $4,500 level, the second-largest altcoin could potentially retest the all-time high resistance at $4,868. Reaching a new record could confirm the formation of a bullish pennant pattern that strengthens the uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) indicators are now back above neutral levels, signaling the return of dominant bullish momentum.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Ethereum Price Forecast: ETH bounces off $4,100 as whales show resilience. Accessed on August 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.