Download Pintu App

Ethereum (ETH) Surged in August, Will September Continue to Rise?

Jakarta, Pintu News – Ethereum (ETH) has shown significant gains during August, but traders are reminded to be cautious ahead of September.

History of September Declines

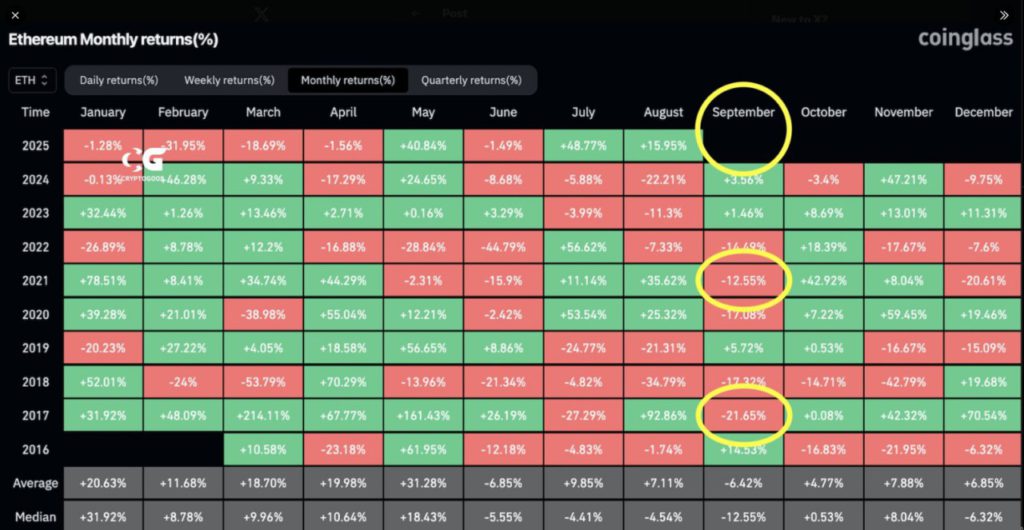

Based on data from CoinGlass, history shows that there have only been three instances since 2016 where Ethereum (ETH) has risen in August and then declined in September. In 2017, Ethereum (ETH) rose 92% in August but fell 20% the following month.

In 2020, a 25% increase in August was followed by a 17% decrease in September. In 2021, a 35% increase in August ended with a 12% decrease in September. A trader on X, CryptoGoos, stated that the seasonality in September in post-halving years tends to be negative. Will this year be different?

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

New Dynamics, New Capital

Inflows into the spot Ethereum (ETH) ETF this month were large enough to attract attention. According to a report from Farside, the spot Ethereum (ETH) ETF saw net inflows of about $2.70 billion in August, while the spot Bitcoin (BTC) ETF saw net outflows of about $1.2 billion during the same period. At the same time, companies that hold crypto on their balance sheets now control a large portion of Ethereum (ETH).

Reports show the total Ethereum (ETH) held by these companies reached a value of $13 billion on August 11. Tom Lee, chairman of BitMine, reportedly bought an additional $45 million worth of Ethereum (ETH), increasing BitMine’s total holdings to $7 billion.

Next Steps for Traders

Traders and portfolio managers will likely continue to monitor macro signals and current data. A softer view on interest rates from Powell is a bullish factor for risk assets, but seasonality and the previous post-August downturn are reasons to remain cautious.

Will Ethereum (ETH) Continue to Rise?

With changing market dynamics and large capital flows, it is possible that Ethereum (ETH) will continue to show strong performance. However, it is important for investors to consider historical and macroeconomic factors that could affect the price in the market.

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ether Soars in August, But Will September Spoil the Party?. Accessed on August 25, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.