Download Pintu App

Bitcoin Drops to $107,000 on September 1 – Is a Rebound to $113,500 Possible?

Jakarta, Pintu News – At the end of August, Bitcoin (BTC) was trading at around $108,700, stagnant for the day but still down more than 6% in the past month and around 5% in the past week.

Bitcoin’s flat price movements reflect broader caution in the market, but beneath the surface, on-chain signals suggest that the recovery narrative is gaining ground.

The resignation of short-term holders, realized price bands, and technical levels together indicate that the market is preparing for the next big move.

Then, how is the current Bitcoin price movement?

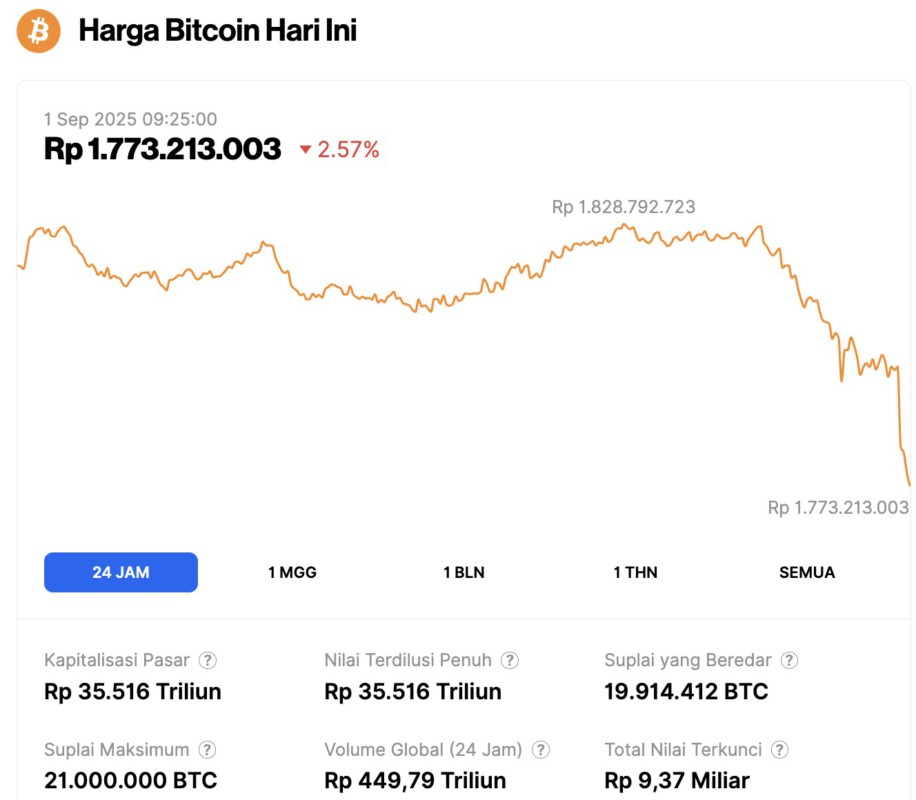

Bitcoin Price Drops 2.57% in 24 Hours

On September 1, 2025, Bitcoin was trading at $107,873, equivalent to IDR 1,773,213,003, marking a 2.57% decline over the past 24 hours. During this period, BTC hit a low of IDR 1,773,213,003 and peaked at IDR 1,828,792,723.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 35,516 trillion, while its 24-hour trading volume has slipped by 0.29% to IDR 449.79 trillion.

Read also: 3 Altcoins that Crypto Whale is Collecting Right Now

SOPR Short-Term Holders Show “Weak Hand” Starting to Exit

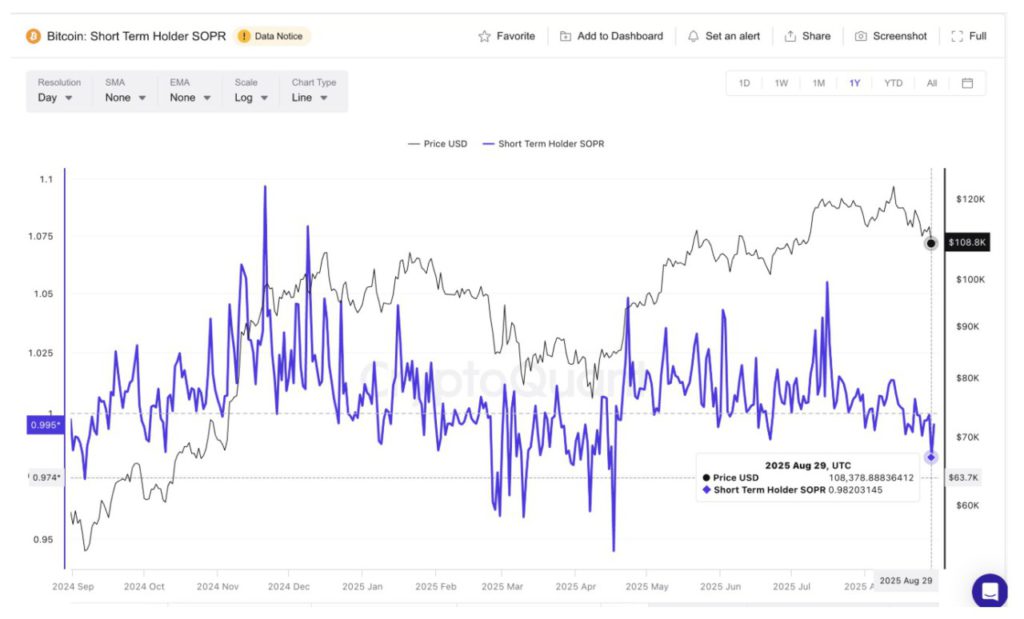

The Spent Output Profit Ratio (SOPR) measures whether coins moved on a blockchain network are sold at a profit or loss. For short-term holders-who are typically the most reactive-this metric becomes a near real-time indicator of market sentiment.

With Bitcoin prices declining in recent weeks, the SOPR value for short-term holders dropped to 0.982 on August 29, the lowest level in months. This indicates that most short-term holders are selling at a loss, which is often interpreted as a form of resignation from “weak hands.”

Historically, this kind of behavior tends to “cleanse” the market of short-term speculators, creating healthier conditions for stronger market participants to enter.

Similar conditions occurred on April 17, when the SOPR value dropped to 0.94-the lowest in a year. At that time, Bitcoin price bottomed at $84,800 before surging 31.6% to $111,600 when the SOPR rose back above 1.

The current movement shows a similar pattern, hinting that this latest sell-off may mark a market bottom. To date, the short-term holder SOPR value has risen to 0.99, but is still around the lowest level in recent weeks.

URPD Shows Strong Support and Resistance Clusters

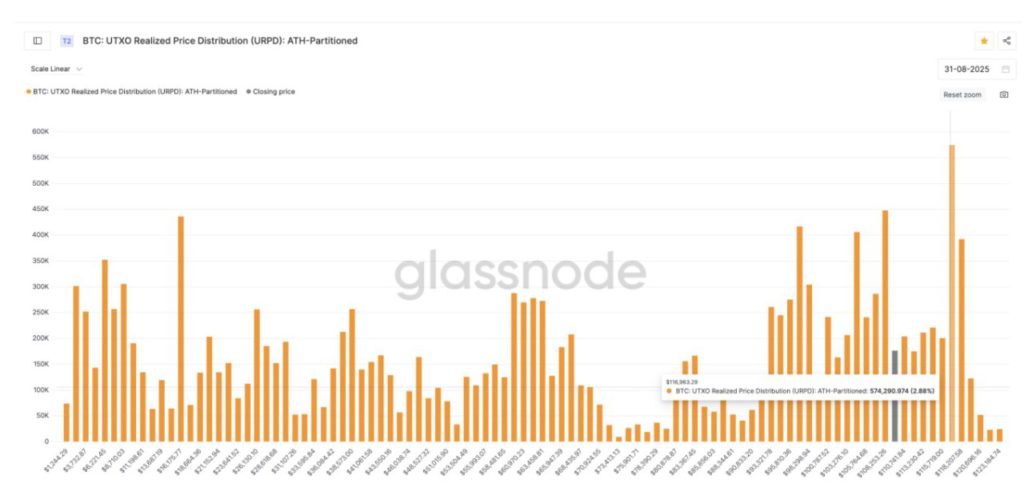

The UTXO Realized Price Distribution (URPD) maps where BTC supply last moved, providing insight into areas of support and resistance. Each cluster shows the price level at which a large amount of Bitcoin was purchased, thus creating a natural barrier in the market.

On the downside, the $107,000 level became a strong anchor point with a cluster of 286,255 BTC (1.44%), while $108,200 (or $108,253.26 on the chart) held 447,544 BTC (2.25%). This large concentration explains why Bitcoin’s price has remained stable around the $108,000 zone despite ongoing selling pressure.

Interestingly, the most recent SOPR downgrade occurred when Bitcoin was trading around $108,300 – almost the same as the URPD cluster at $108,200 – further reinforcing this area as a potential market bottom zone.

Read also: Altcoin Season Approaching? These 3 Crypto Steal the Attention for September 2025

But on the upside, resistance formed quickly. The $113,200 level (close to the key $113,500 area) loaded 210,708 BTC (1.06%), and $114,400 loaded 220,562 BTC (1.11%). The most significant resistance was at $116,900, where 2.88% of the total supply last changed hands – making it the most powerful wall of resistance in this region.

For the bulls, reclaiming this zone is crucial for a sustained price recovery.

Bitcoin Price Levels to Watch

Technically, Bitcoin’s low at $107,300 is a key invalidation level (close to the main URPD anchor at $107,000). If the price closes below this level, it will confirm the continuation of the bearish trend and weaken the argument that the market has bottomed.

On the recovery side, reclaiming the $109,700 level is an early signal of strength. After that, the $112.300 (Fib 0.5) and $113.500 (Fib 0.618) levels are important breakout zones that the bulls need to break.

Visually, the $113,500 level has repeatedly been a rejection zone for the current Bitcoin price and remains the most crucial level to change the direction of the market trend.

For now, the narrative is quite clear: the weak hand is starting to exit (based on SOPR), the strong hand is defending an important price cluster (URPD), and the price is moving near the support area. If Bitcoin price manages to break above $117,400, it could be a confirmation of new strength in the market.

However, if it fails to hold above $107,300, the narrative will lean bearish again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Analysis Reveals Market-Bottom Cues, but $113,500 Remains the Key Test. Accessed on September 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.