Download Pintu App

Solana Soars: What Makes SOL Stand Out Over Bitcoin and Ethereum?

Jakarta, Pintu News – In late August 2025, the cryptocurrency market experienced a steady rise, with total capitalization continuing to increase and Bitcoin (BTC) remaining above $111,000.

However, the spotlight has now shifted to Solana (SOL) which has outperformed Bitcoin (BTC) and Ethereum (ETH), displaying strong fundamentals and worthy of attention by crypto users.

Solana price hits $211 on the back of retail support

On August 29, 2025, Solana prices surged past the $211 mark this week, driven by positive sentiment from retail traders who reached an 11-week high.

Read also: 3 Memecoins to Watch in September 2025 — And Why They’re Gaining Attention

In contrast to previous rallies dominated by whale investors, this time the gains were supported by small traders, reflecting healthier market participation. An influx of retail investors is often an indicator of sustained growth as it reduces reliance on large holders.

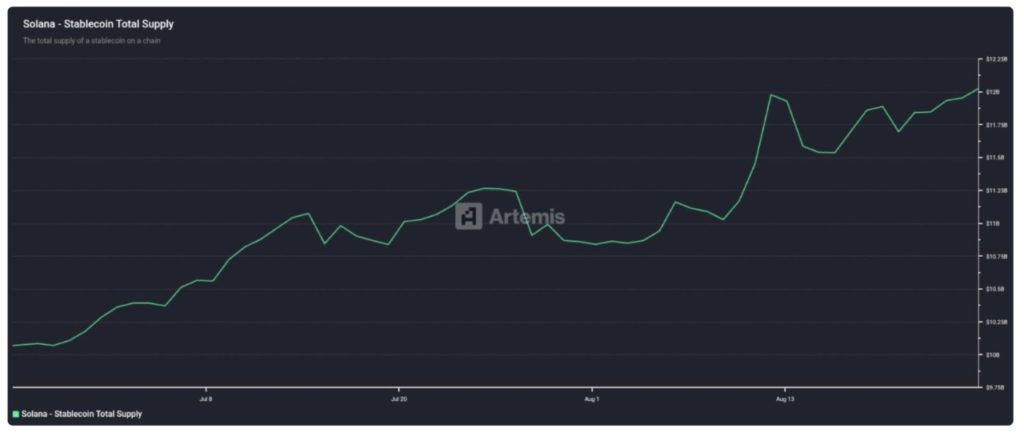

Liquidity on the Solana network also increased rapidly. Stablecoin supply jumped from $10 billion in July to $12 billion in just a few weeks, driving DeFi activity significantly.

This surge in on-chain liquidity provides greater market depth and stronger stability for Solana-based protocols.

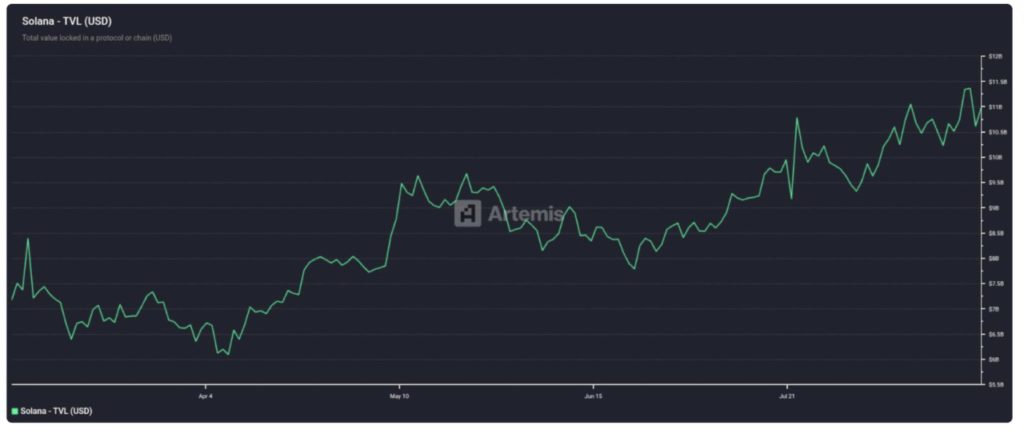

DeFi Solana’s TVL Doubles to $11 Billion

Confidence in the Solana ecosystem is reflected in the total value locked (TVL) which has almost doubled, from $6 billion to $11 billion since the last market correction.

At the same time, Solana also led the trading volume on decentralized exchanges (DEXs), outperforming Ethereum, BNB Chain, and Base in the last 24 hours. This shows that more and more traders are choosing Solana for its faster transactions and cheaper fees.

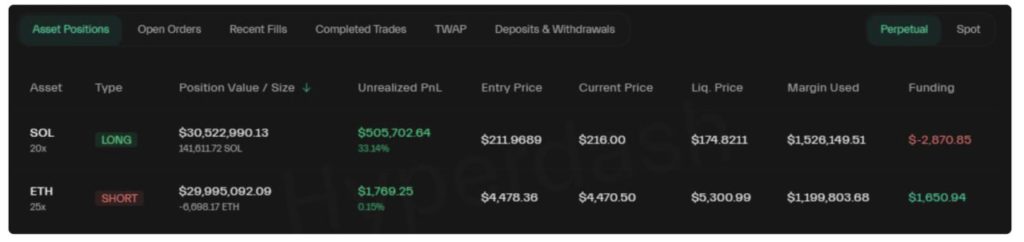

Driving the rally further, the on-chain tracker revealed that Whale 0x9e8b – who had previously realized over $15 million in profits on Hyperliquid – had just opened a large position:

- Long 141,611 $SOL (worth $30.7 million) with 20x leverage

- Short 6,698 $ETH (worth $30 million) with 25x leverage

This move is a classic rotation strategy that indicates a belief that Ethereum’s performance may start to slow down, while Solana still has the potential to excel.

Such aggressive positioning shows the growing confidence of the big players that SOL could be the next market leader.

Read also: Ethereum Price Falls to $4,300 on September 1st: Whales Exit as Spot Market Heats Up!

Institutions Look to Solana as Next Strategic Asset

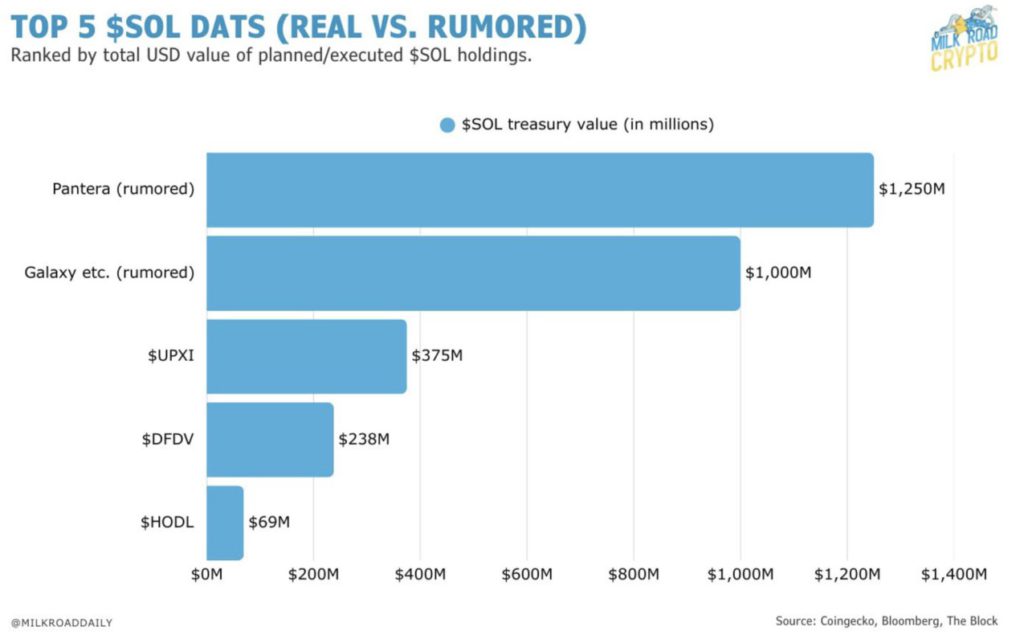

Institutional interest in Solana is growing. Pantera Capital and Galaxy Digital are reportedly preparing to allocate a significant portion of their treasury funds into SOL – potentially securing around 2.2% of the total SOL supply.

This is three times larger than the current largest holder, and supply pressure of this magnitude could push prices higher.

Speculation about a spot ETF for SOL is also growing. If approved, this ETF could open up institutional inflows similar to those of Bitcoin and Ethereum ETFs and push Solana into mainstream investment portfolios.

This is not just a short-term rally. Increased retail adoption, growth in DeFi liquidity, a surge in trading activity on DEXs, as well as a potential influx of institutional funds indicate structural growth.

If the Solana ETF does get approved, it could transform from a high-performing altcoin to a core part of a crypto portfolio in the next market cycle.

While Solana’s price spike is exciting, its true value lies in the long-term adoption and usability of its technology.

Solana, which launched in 2020, is compared to Cardano (ADA) which has been around since 2015 – reflecting Solana’s rapid growth, but still rewarding all blockchains for their contribution to driving innovation in the industry.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Solana is Outperforming Bitcoin and Ethereum – Here’s Why. Accessed on September 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.