Download Pintu App

Analysts See DOGE Rallying Toward $2 as Dogecoin ETF Approval Odds Skyrocket

Jakarta, Pintu News – Dogecoin (DOGE) price is back in the spotlight as optimism grows regarding the possibility of ETF approval. As of September 8, DOGE was trading at $0.2329, recording a 7% gain.

Dogecoin’s market capitalization has now surpassed $35 billion, while trading volume jumped more than 150% in just one day. With this positive trend, investors’ attention is on whether Dogecoin can continue its upward rally.

Dogecoin Price Action Hints at Potential Surge Towards $2.28

Analyst Javon Marks recently highlighted a price cycle pattern on Dogecoin, with a projected rise of over 860% from current levels. In his analysis, there are three main cycles, with Cycle 3 having the potential to drive a rally towards $2.28 if historical patterns repeat themselves.

Read also: Dogecoin ETF Hype and Retail Interest Drive DOGE’s Bullish Outlook in September

The price movement structure shows that DOGE often forms accumulation zones before finally making a big surge. This view further strengthens Dogecoin’s long-term prospects, especially with market conditions currently favoring risky assets.

Marks believes that this token has the potential to provide returns close to 10 times in the long run. Overall, historical cyclical patterns are still an important reference in forming bullish expectations.

Meanwhile, the daily chart shows that Dogecoin broke out of a long-term symmetrical triangle pattern, which usually signals a big move. The price managed to cross the descending resistance line while still maintaining higher lows, indicating a phase of uptrend continuation.

Important resistance levels are around $0.247 and $0.288. If both are successfully broken, a stronger rally could be confirmed. Above them, medium-term targets are projected to be in the range of $0.42 to $0.54, which is reinforced by the consolidation area from the previous peak.

If DOGE is able to sustain this breakout momentum, buyers could start aiming for higher psychological levels until 2026, cementing Dogecoin’s position as one of the top meme coins in the crypto market.

Dogecoin Leads Altcoin Rally amid High Chance of ETF approval

Dogecoin is now emerging as a major leader in the ongoing altcoin rally, supported by optimism surrounding the potential approval of the Rex-Osprey DOGE ETF. Reports show that DOGE’s daily trading volume surpassed $2.9 billion, jumping more than 150% compared to the previous day.

Read also: Bitcoin Price Stuck at $110,000, These 3 Altcoins Are Starting to Steal the Show

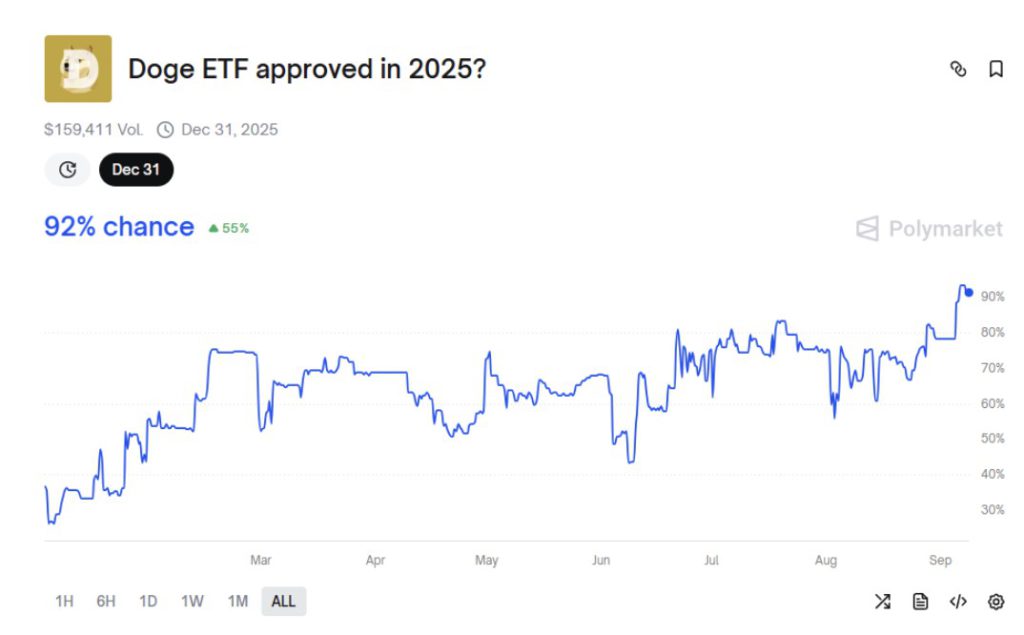

Data from Polymarket recorded a 92% probability of approval for the ETF, further fueling market speculation. Aside from Dogecoin, other altcoins such as XRP (XRP), Solana (SOL), and Hyperliquid (HYPE) also saw gains as hopes of a 50 basis point cut in Fed interest rates increased.

As a result, the Dogecoin price is now the center of attention in the altcoin sector, with expectations that this rally could be the biggest since 2021.

Overall, Dogecoin is in a strong position to lead a major rally. ETF speculation has fueled a surge in market demand, while price cycle patterns reinforced by technical breakouts point directly to higher targets in the months ahead.

With the momentum accelerating, the meme coin is expected to challenge and break important resistance levels towards $1 and beyond.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Dogecoin Price Forecast: Analyst Targets $2 as DOGE Leads Altcoin Market Amid ETF Optimism. Accessed on September 9, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.