Download Pintu App

Dogecoin Price Rises Today as Whale Support Holds — But $0.29 Remains a Struggle

Jakarta, Pintu News – The Dogecoin (DOGE) price has had a very volatile journey throughout the month of September. After rising more than 54% in the last three months, the meme coin saw a drop of almost 5% on September 16.

Traders are starting to worry that the rally is starting to weaken, but a closer look reveals a battle going on behind the scenes. Retail investors’ wallets were selling their assets, while the “whales” (big owners) were quietly stepping in to defend the trend.

The question now is: is this whale support strong enough to push the DOGE price back to the $0.29 level – the decisive point for further movement. Before we go any further, let’s take a look at Dogecoin’s current price movement!

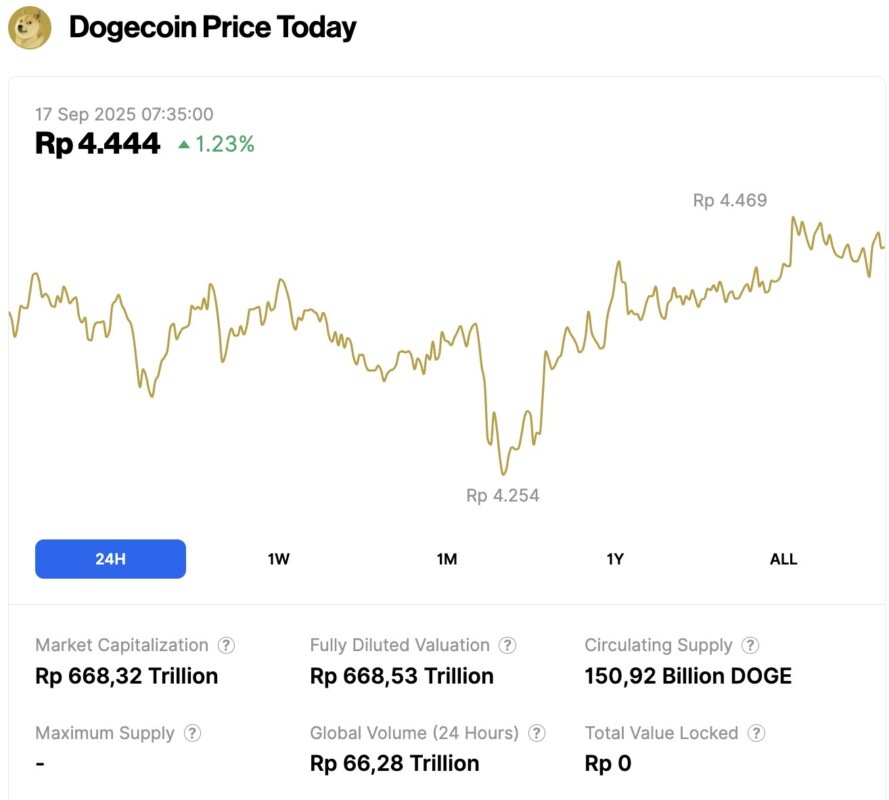

Dogecoin Price Rises 1.23% in 24 Hours

Read also: As DOGE Holders Hold Firm, Could 2025’s High Be Within Reach?

On September 17, 2025, Dogecoin saw a 1.23% gain over the past 24 hours, trading at $0.2711, or approximately IDR 4,444. During this period, the price of DOGE fluctuated between IDR 4,254 and IDR 4,469.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 668.32 trillion, with a 24-hour trading volume of approximately IDR 66.28 trillion.

Sellers and Buyers Move Simultaneously, but One Group Excels

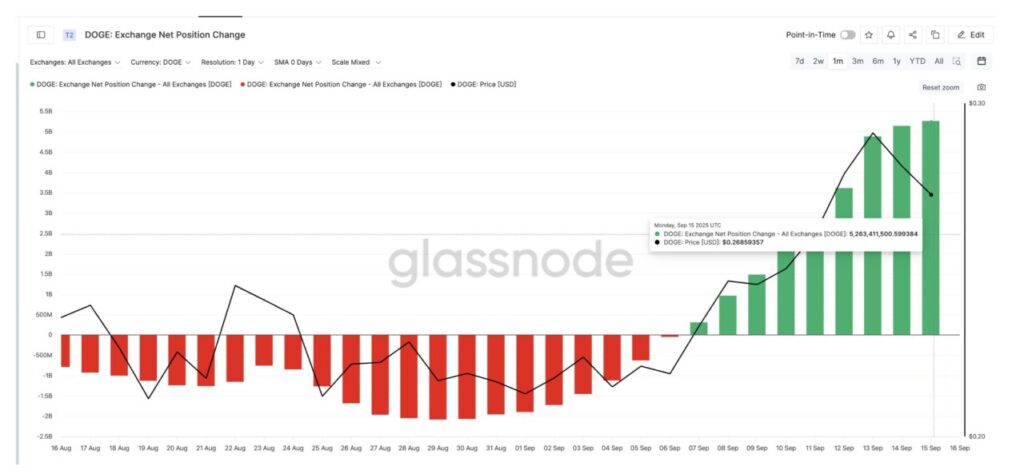

The data shows that net position changes on exchanges – i.e. the flow of coins in and out of trading platforms – have turned strongly positive since September 11, when news broke about the delayed launch of the Dogecoin ETF.

This positive number means that more DOGE was deposited into the exchange than was withdrawn, indicating increased selling pressure. Between September 7 and 15, DOGE balances on exchanges increased by 4.96 billion DOGE (nearly $1.29 billion), the largest inflow in a single month.

At the same time, the whales also started to get active. Owners of more than 1 billion DOGE added 540 million tokens (worth $140 million) between September 13 and 15.

Another group holding between 10 million and 100 million DOGE also increased their holdings by 350 million tokens (about $91 million). Overall, the whales soaked up around 890 million DOGE (worth $231 million) in just a few days.

While this only accounts for around 18% of the retail sell-off at the time of writing, it does show confidence that Dogecoin’s long-term trend could still potentially continue.

But for now, sellers are still in control: their inflows to the exchanges are outpacing the whales’ purchases, and this is the reason for Dogecoin’s recent price drop.

Dogecoin Price Chart Outlook: Can DOGE Return to $0.29?

The 4-hour chart (16/9) shows that the pressure from sellers may be starting to weaken. This chart is used to capture early trend shifts amid larger rallies.

Read also: Crypto Analysts See Bullish Run Ahead for Dogecoin After Open Interest Tops $6 Billion

Despite the correction, DOGE formed a hidden bullish divergence on the RSI (Relative Strength Index) indicator, which measures momentum strength by comparing price gains and losses.

Since September 7, the DOGE price has recorded a higher low, while the RSI has recorded a lower low. This pattern often signals that selling pressure is starting to weaken and the uptrend could potentially resume.

Currently, some important levels are being tested. The support areas are at $0.25 and $0.23. On the upside, if DOGE manages to reclaim the $0.29 level, it could pave the way towards $0.30 or higher.

The $0.29 resistance level shown in the chart is also in line with the analyst’s view of DOGE’s price movement pattern.

For now, Dogecoin is at a crossroads. Retail sellers still dominate, but the whales are the last line of defense. If the selling pressure starts to ease and the confidence of the whales remains strong, DOGE could regain momentum to break $0.29. However, if the price drops below $0.23, then this potential temporary uptrend could be considered nullified.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Whales Prevent Deeper Dogecoin Dip as Price Fights to Reclaim $0.29. Accessed on September 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.