Download Pintu App

Binance CEO Reveals Bitcoin’s Role in 3 Catchy Words

Jakarta, Pintu News – Bitcoin (BTC) is now more than just a digital asset. Richard Teng, CEO of Binance, recently described Bitcoin with three words: global macro conversation. According to him, Bitcoin has evolved into a relevant subject in global macroeconomic discussions, moving in tandem with international credit, liquidity and interest rate flows.

Bitcoin: More than a Digital Asset

Bitcoin (BTC) has gone beyond its role as a cryptocurrency. According to Richard Teng, Bitcoin now plays an important role in the global macroeconomic conversation. This signifies a significant shift from being just a digital transaction tool to a factor that influences global financial policy.

Binance, as one of the largest crypto exchanges, has proof of reserves showing ownership of approximately 629,000 Bitcoin (BTC). With this amount, Binance is not only a major player in crypto trading but also in global finance. These large holdings emphasize Bitcoin’s role in the macroeconomy.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

The Changing Way of Looking at Bitcoin

The outlook on Bitcoin (BTC) has changed over time. It is now seen as an important tool in global financing, where liquidity, credit, and refinancing are the main factors affecting the price of Bitcoin. This explains why changes in Bitcoin price often correlate with global macroeconomic conditions.

Traditional financial systems that rely on cash deposits are now less effective. The need for high liquidity and constant pressure on central banks to inject more money into the system has made Bitcoin and gold attractive options as stores of value.

Cycle and Future Predictions

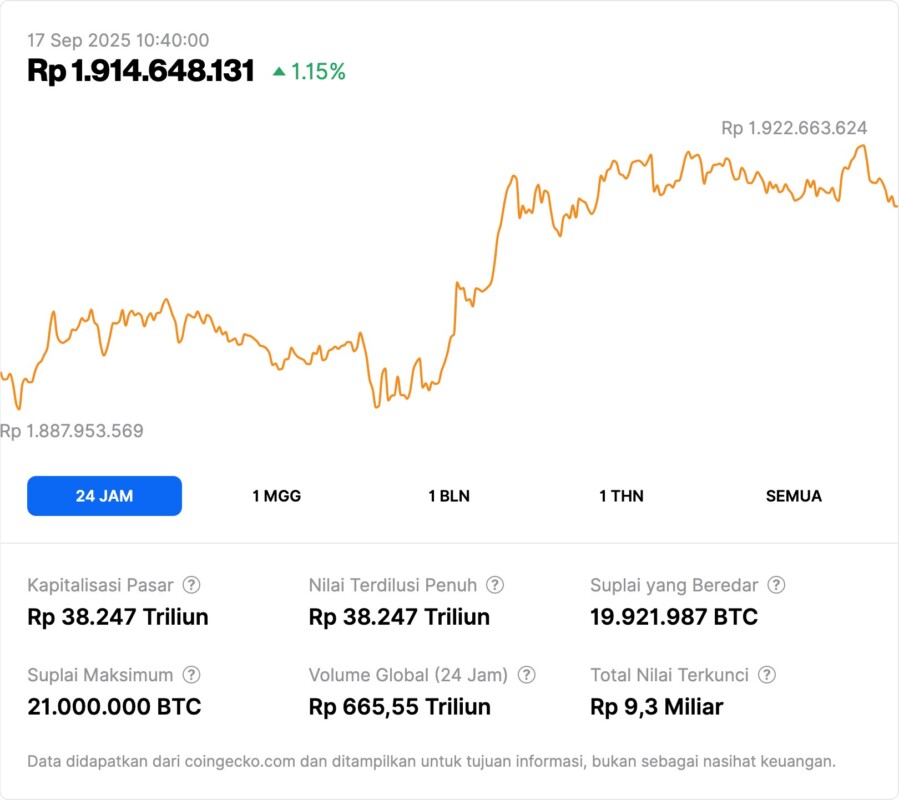

Financial analysts are observing the liquidity cycle that affects the price of Bitcoin (BTC). It is estimated that the five- or six-year cycle will peak in September 2025.

Meanwhile, the 200-day cycle has shown that Bitcoin’s lowest price in 2023 is $16,000, indicating that these two cycles have a significant influence. This understanding helps investors and analysts predict Bitcoin’s price movements. By understanding these cycles, market participants can make more informed and strategic investment decisions, capitalizing on global credit and capital rhythms.

Conclusion

Richard Teng’s commentary on Bitcoin (BTC) as a global macro conversation opens up a new perspective on Bitcoin’s role and influence in the global economy. As the most dominant cryptocurrency, Bitcoin is not only changing the way people transact but also how they view and manage finance on a macro scale.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Binance CEO Redefines Bitcoin in Just 3 Words. Accessed on September 17, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.