Download Pintu App

3 Altcoins That Could Face Significant Liquidations in the Third Week of September

Jakarta, Pintu News – In the second week of September, the Altcoin Season Index recorded its highest level in five years. Positive market sentiment pushed a number of altcoins to all-time record high prices and attracted large amounts of open interest. However, this was also accompanied by the risk of massive liquidation.

According to the BeInCrypto page, some of the following altcoins are showing signs of extreme FOMO (Fear of Missing Out) and are potentially at risk of liquidation in the third week of September.

1. Ethereum (ETH)

By mid-September, Ethereum (ETH) reserves reached a new record of 4.9 million ETH worth about $22.2 billion. This figure does not include the 6.7 million ETH held in Ethereum ETF products, which are worth around $46.3 billion.

Read also: Solana or Ethereum: Which One Dominated Crypto in Q4 2025?

A recent report from BeInCrypto revealed on-chain data indicating that Ethereum’s price could potentially break $5,000 or more. Derivatives traders seem to be in line with this view, increasing their leverage and long positions, meaning their losses will be greater if the ETH price moves against the prediction.

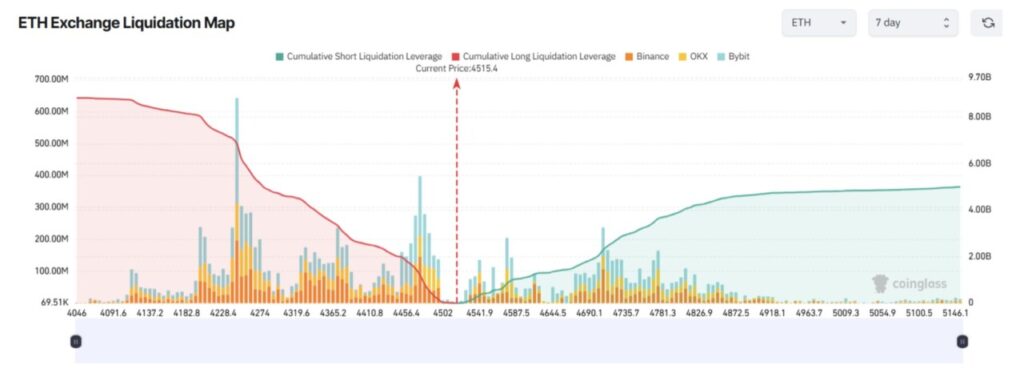

The liquidation map shows that if the ETH price drops to $4,046 within this week, there will be a liquidation of over $8.8 billion worth of long positions. Conversely, if the ETH price rises to $5,000 as many analysts expect, then approximately $4.8 billion in short positions will be liquidated.

Furthermore, recent analysis notes that 99.68% of Ethereum’s current supply is in profit, which could be a signal that holders will start profit-taking.

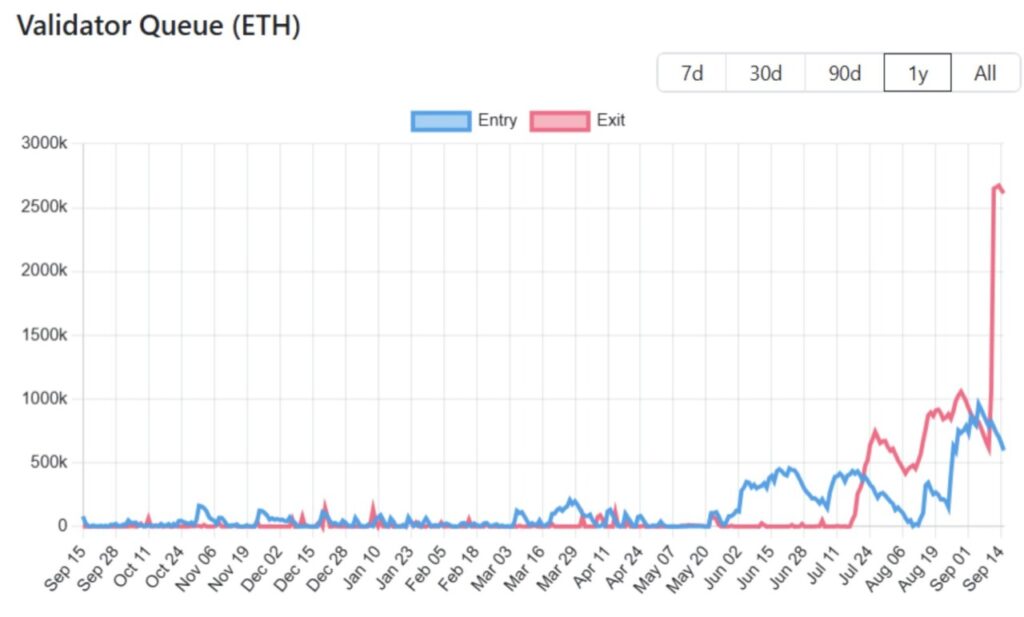

Additionally, more than 2.6 million ETH is currently in the queue to be unstaked. The initial trigger came from Kiln Finance, which unstaked in order to manage risk after the problems associated with SwissBorg.

However, the unstaking queue continues to increase as the price of ETH rises, reflecting the growing interest in realizing profits.

2. Binance Coin (BNB)

Binance Coin (BNB) recorded an all-time high (ATH) of $944 in September. This rise came after the announcement of a partnership between Binance and Franklin Templeton to develop blockchain and crypto-based solutions aimed at institutional adoption.

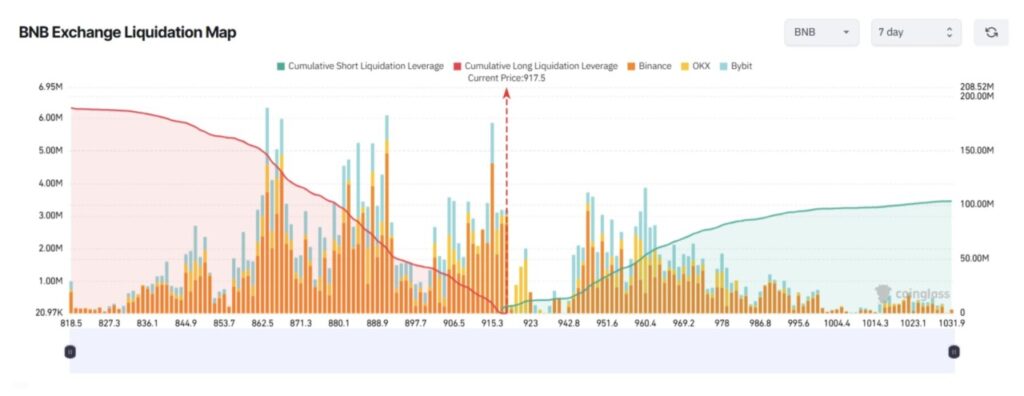

As with ETH, BNB’s 7-day liquidation map shows an imbalance between long and short positions. Long liquidations dominate, indicating that many traders are betting on the continuation of the uptrend.

If the BNB price drops to $818 this week, over $189 million of long positions will be liquidated. Conversely, if BNB rises to $1,031, around $103 million of short positions will vanish.

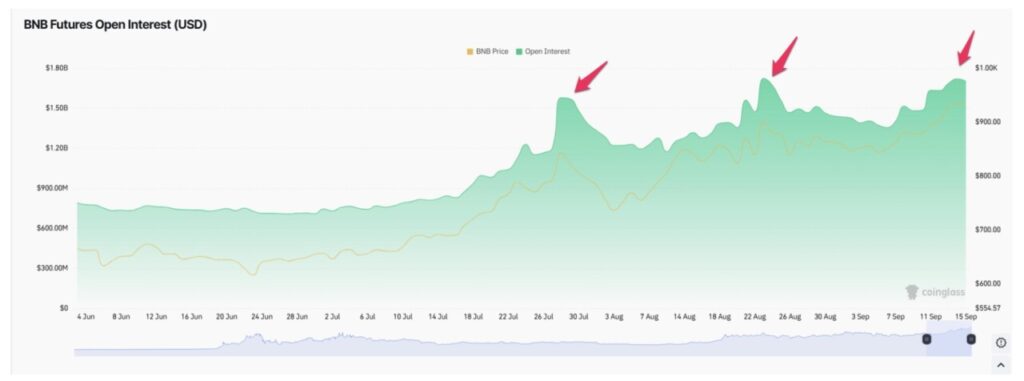

One of the warning signs came from the total open interest (OI). Data from Coinglass as of September 14 shows that the total OI for BNB stood at $1.72 billion.

During the quarter, OI has broken the $1.5 billion mark three times. On the previous two occasions, this triggered price corrections of between 7% and 15%.

Read also: Crypto Whale Buys These 3 Altcoins Ahead of FOMC Meeting

If this pattern repeats itself, this third spike in OI could cause losses for traders holding long positions on BNB.

3. MYX Finance (MYX)

MYX Finance (MYX) recorded one of the most controversial price increases in September. Data from BeInCrypto shows that the token surged by 450% in the past month.

However, MYX has also faced various skepticism, including allegations of Sybil attacks in its airdrop program as well as fears of a potential meltdown like that of Mantra (OM).

Currently, the MYX token has dropped from its highest price of $18.9 to $10.9, or a drop of more than 40%. This correction indicates that the FOMO sentiment is starting to subside.

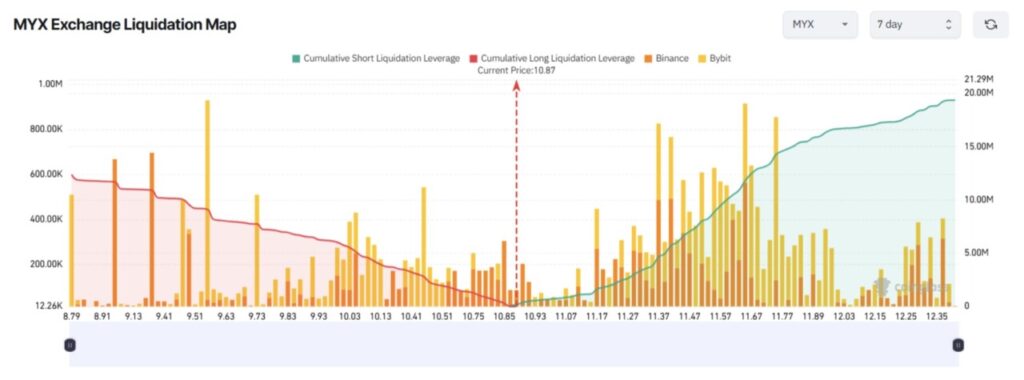

As a result, derivatives traders are now more inclined towards short positions. The 7-day liquidation map shows that short positions will incur greater losses if their predictions are wrong.

If the price of MYX rises back to $12.35, then over $19 million in short positions will be liquidated. Conversely, if MYX falls to $8.79, over $12 million in long positions will be liquidated.

Some technical analysts predict a potential rebound, citing the $10-$11 price range as a strong support zone where investors are likely to buy.

“Beautiful breakout by $MYX and strong bounce from an important support area. Most likely there will be a nice rebound. Targets at 12, 13, 14, 15, 16,” BitcoinHabebe trader predicts.

Recent analysis also suggests that the current price correction is not a trend reversal, but rather a temporary correction within a larger uptrend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins at Liquidations Risk in Mid-September. Accessed on September 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.